Question

Dylex Corporation sold machinery on December 31, 2023. The accounts showed adjusted balances on December 31, 2023 as follows: Machinery... Accumulated Depreciation, Machinery $143,000

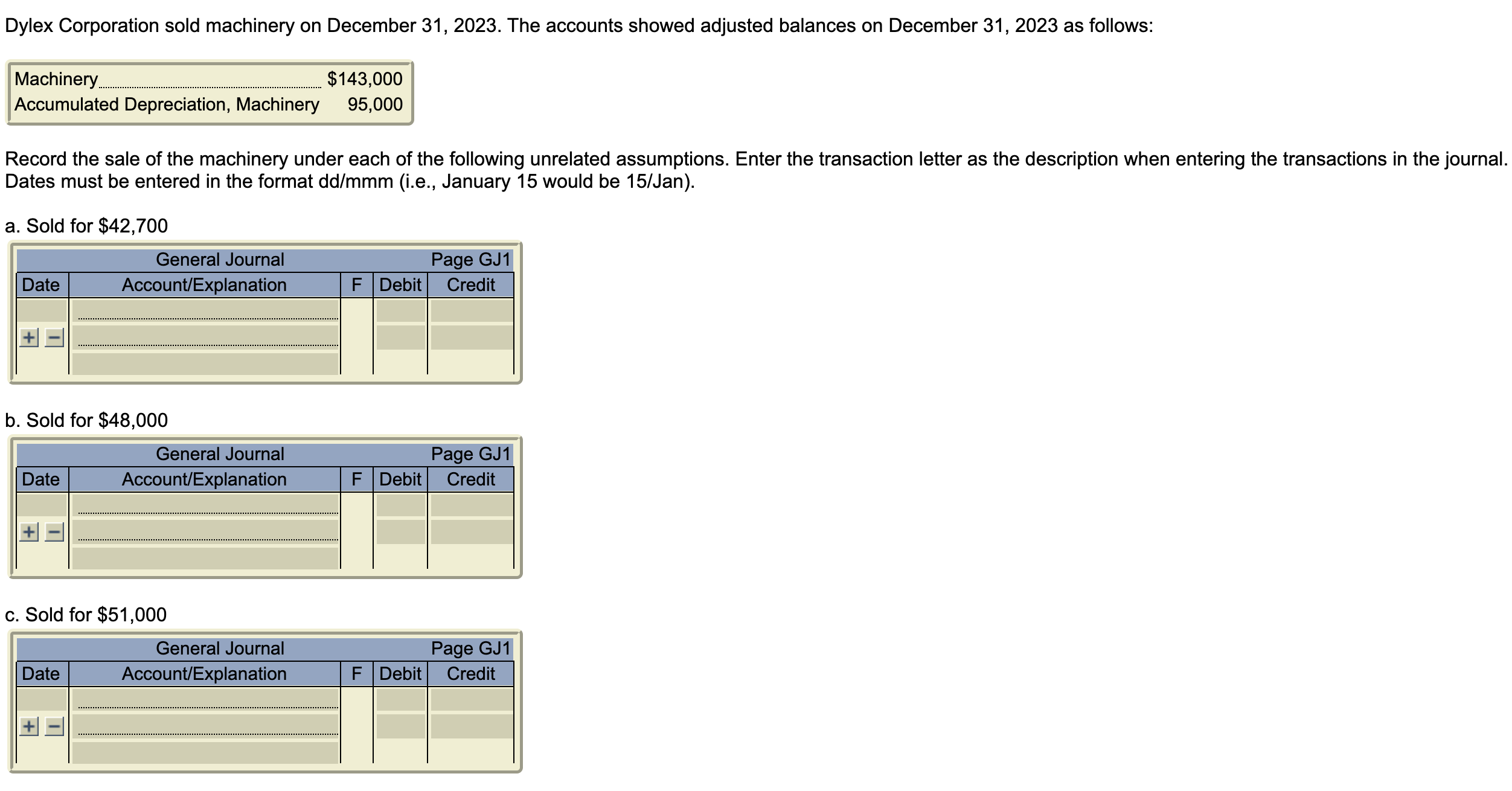

Dylex Corporation sold machinery on December 31, 2023. The accounts showed adjusted balances on December 31, 2023 as follows: Machinery... Accumulated Depreciation, Machinery $143,000 95,000 Record the sale of the machinery under each of the following unrelated assumptions. Enter the transaction letter as the description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (i.e., January 15 would be 15/Jan). a. Sold for $42,700 Date General Journal Account/Explanation F Debit Page GJ1 Credit b. Sold for $48,000 Date General Journal Account/Explanation c. Sold for $51,000 Date Page GJ1 F Debit Credit General Journal Page GJ1 Account/Explanation F Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume 2

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris

17th Canadian Edition

1260881334, 9781260881332

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App