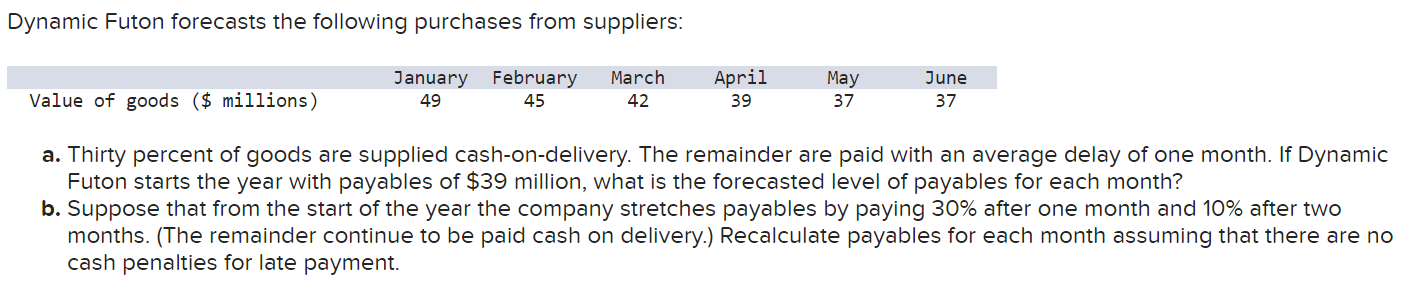

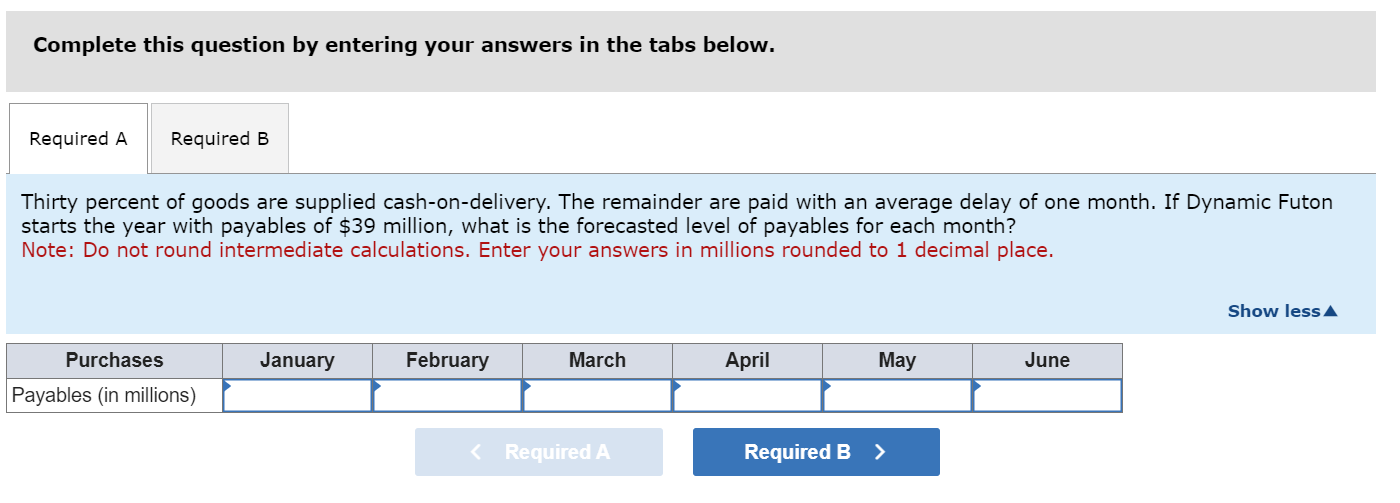

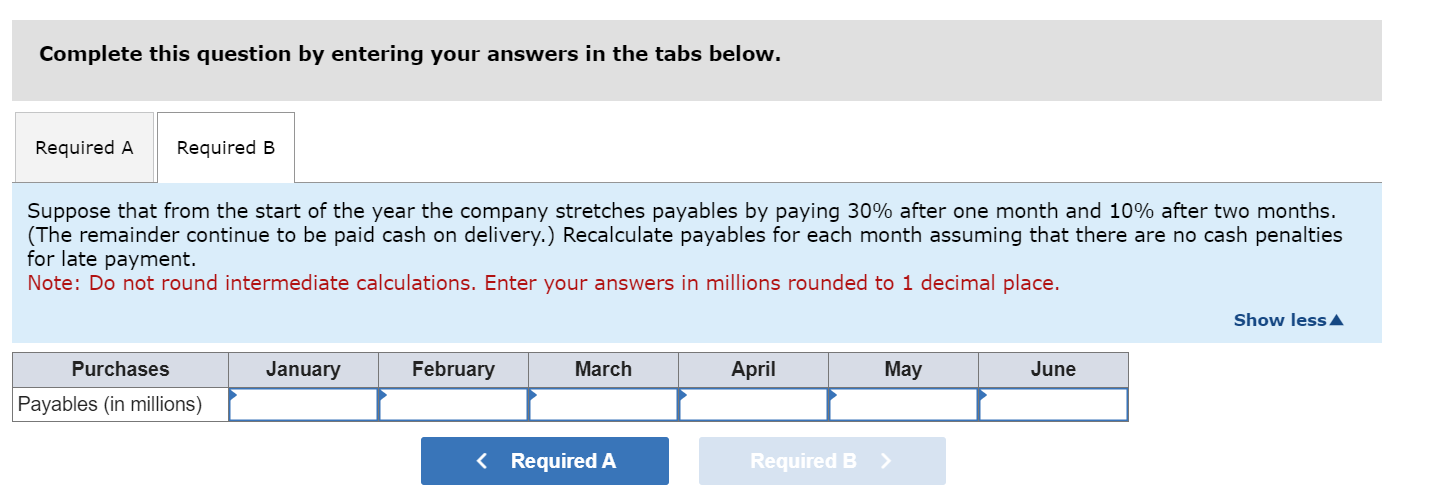

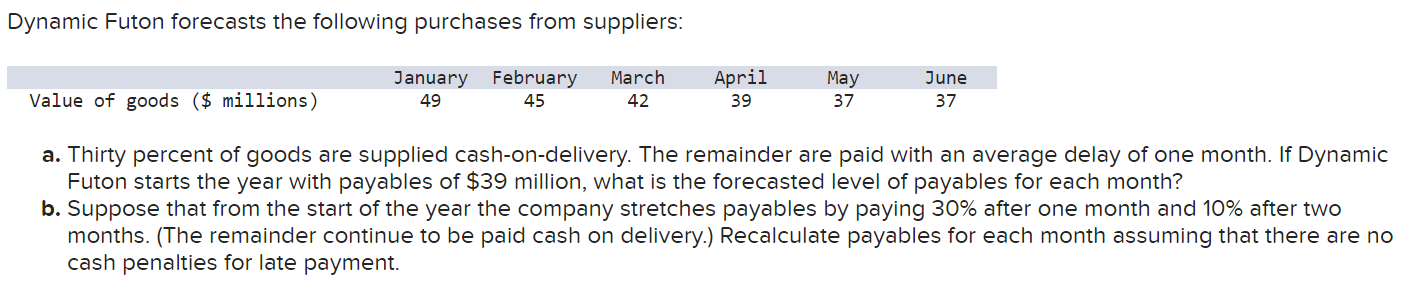

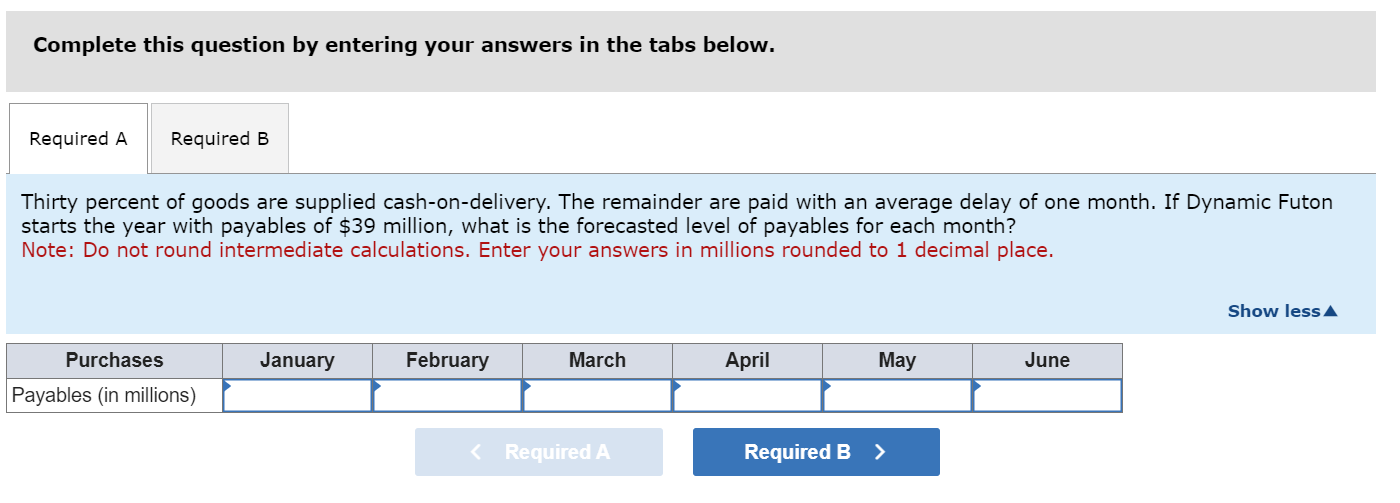

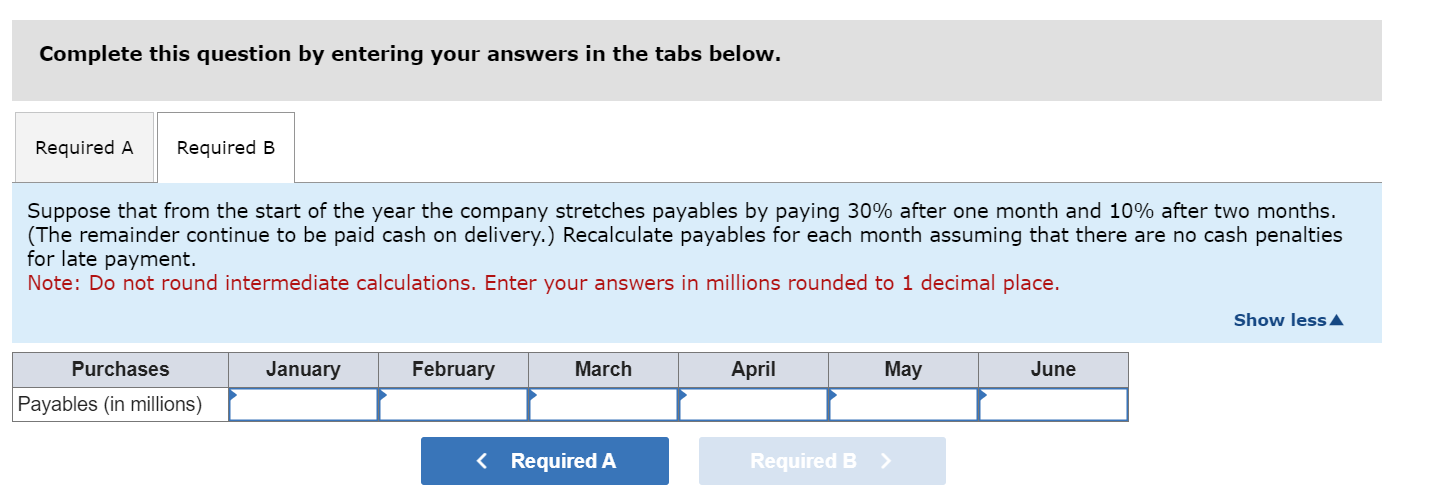

Dynamic Futon forecasts the following purchases from suppliers: a. Thirty percent of goods are supplied cash-on-delivery. The remainder are paid with an average delay of one month. If Dynamic Futon starts the year with payables of $39 million, what is the forecasted level of payables for each month? b. Suppose that from the start of the year the company stretches payables by paying 30% after one month and 10% after two months. (The remainder continue to be paid cash on delivery.) Recalculate payables for each month assuming that there are no cash penalties for late payment. Complete this question by entering your answers in the tabs below. Thirty percent of goods are supplied cash-on-delivery. The remainder are paid with an average delay of one month. If Dynamic Futon starts the year with payables of $39 million, what is the forecasted level of payables for each month? Note: Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place. Complete this question by entering your answers in the tabs below. Suppose that from the start of the year the company stretches payables by paying 30% after one month and 10% after two months. (The remainder continue to be paid cash on delivery.) Recalculate payables for each month assuming that there are no cash penalties for late payment. Note: Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place. Dynamic Futon forecasts the following purchases from suppliers: a. Thirty percent of goods are supplied cash-on-delivery. The remainder are paid with an average delay of one month. If Dynamic Futon starts the year with payables of $39 million, what is the forecasted level of payables for each month? b. Suppose that from the start of the year the company stretches payables by paying 30% after one month and 10% after two months. (The remainder continue to be paid cash on delivery.) Recalculate payables for each month assuming that there are no cash penalties for late payment. Complete this question by entering your answers in the tabs below. Thirty percent of goods are supplied cash-on-delivery. The remainder are paid with an average delay of one month. If Dynamic Futon starts the year with payables of $39 million, what is the forecasted level of payables for each month? Note: Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place. Complete this question by entering your answers in the tabs below. Suppose that from the start of the year the company stretches payables by paying 30% after one month and 10% after two months. (The remainder continue to be paid cash on delivery.) Recalculate payables for each month assuming that there are no cash penalties for late payment. Note: Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place