Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dynamic Industrial is a relatively young company, with an unsophisticated accounting system. Dynamic Industrial manufactures two products, X370A, and Z410B. Each of the products

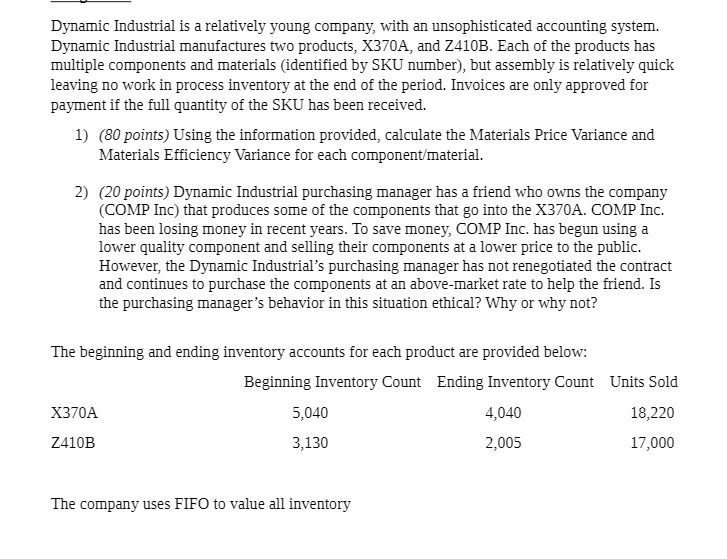

Dynamic Industrial is a relatively young company, with an unsophisticated accounting system. Dynamic Industrial manufactures two products, X370A, and Z410B. Each of the products has multiple components and materials (identified by SKU number), but assembly is relatively quick leaving no work in process inventory at the end of the period. Invoices are only approved for payment if the full quantity of the SKU has been received. 1) (80 points) Using the information provided, calculate the Materials Price Variance and Materials Efficiency Variance for each component/material. 2) (20 points) Dynamic Industrial purchasing manager has a friend who owns the company (COMP Inc) that produces some of the components that go into the X370A. COMP Inc. has been losing money in recent years. To save money, COMP Inc. has begun using a lower quality component and selling their components at a lower price to the public. However, the Dynamic Industrial's purchasing manager has not renegotiated the contract and continues to purchase the components at an above-market rate to help the friend. Is the purchasing manager's behavior in this situation ethical? Why or why not? The beginning and ending inventory accounts for each product are provided below: Beginning Inventory Count Ending Inventory Count Units Sold X370A Z410B 5,040 3,130 The company uses FIFO to value all inventory 4,040 2,005 18,220 17,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started