Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E 1 9 - 2 B ( LO 3 ) 4 . clark: $ 3 5 , 5 0 0 ENTRIES FOR ALLOCATION OF NET

E B LO

clark: $

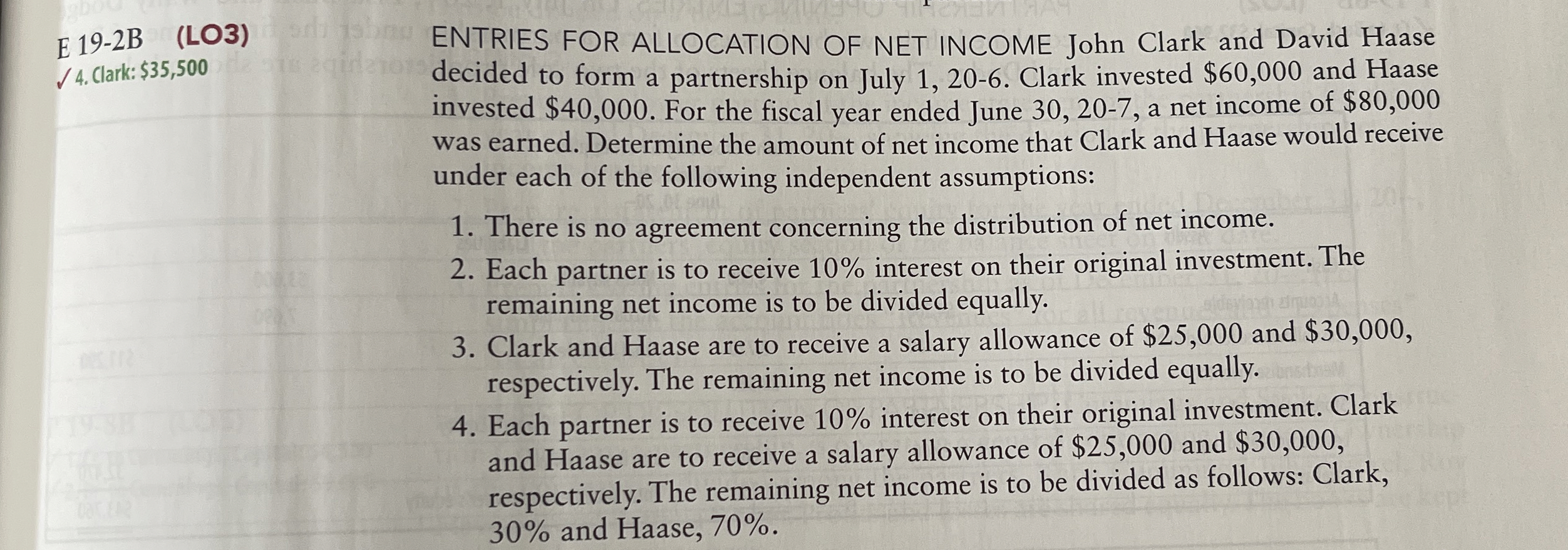

ENTRIES FOR ALLOCATION OF NET INCOME John Clark and David Haase

decided to form a partnership on July Clark invested $ and Haase

invested $ For the fiscal year ended June a net income of $

was earned. Determine the amount of net income that Clark and Haase would receive

under each of the following independent assumptions:

There is no agreement concerning the distribution of net income.

Each partner is to receive interest on their original investment. The

remaining net income is to be divided equally.

Clark and Haase are to receive a salary allowance of $ and $

respectively. The remaining net income is to be divided equally.

Each partner is to receive interest on their original investment. Clark

and Haase are to receive a salary allowance of $ and $

respectively. The remaining net income is to be divided as follows: Clark,

and Haase,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started