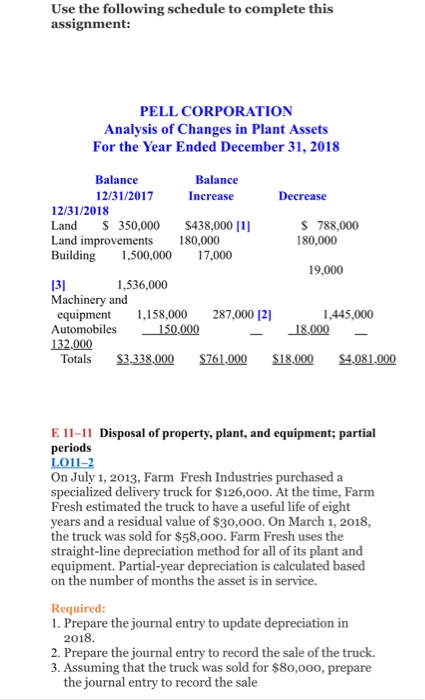

E 11-2 Depreciation methods LO11-2 On January 1, 2018, the Allegheny Corporation purchased machinery for $115,oo0. The estimated service life of the machinery is 10 years and the estimated residual value is s5,000. The machine is expected to produce 220,000 units during its life. Required Calculate depreciation for 2018 and 2019 using each of the following methods. Round all computations to the nearest dollar 1. Straight line 2. Sum-of-the-years-digits 3. Double-declining balance 4. One hundred fifty percent declining balance 5. Units of production (units produced in 2018, 30,000; units produced in 2019, 25,000) P 11-3 Depreciation methods; partial periods Chapters 10 and 11 LO11-2 [This problem is a continuation of Problem 10 3 in Chapter 10 focusing on depreciation.] Required For each asset classification, prepare a schedule showing depreciation for the year ended December 31, 2018, using the following depreciation methods and useful lives: Land improvements-Straight line; 15 years Building-150% declining balance, 20 years Machinery and equipment-Straight line; 10 years Automobiles-150% declining balance; 3 years Depreciation is computed to the nearest month and no residual values are u sed. Use the following schedule to complete this assignment: PEL.CORPORATION Use the following schedule to complete this assignment: PELL CORPORATION Analysis of Changes in Plant Assets For the Year Ended December 31, 2018 Balance Balance Increase 2/31/2017 Decrease 12/31/2018 Land 350,000 $438,000 |1] S 788,000 180,000 d improvements 80,000 Buildig 1,500,000 17,000 19,000 131 Machinery and equipment ,158,000 287,000 12] Automobiles 150.000 1,536,000 1,445,000 18.000 Totals S3.338.000 $761,000 $18,000 $4.081.000 E 11-11 Disposal of property, plant, and equipment; partial periods LO11-2 On July 1, 2013, Farm Fresh Industries purchased a specialized delivery truck for $126,000. At the time, Farm Fresh estimated the truck to have a useful life of eight years and a residual value of $30,000. On March 1, 2018, the truck was sold for $58,00o. Farm Fresh uses the straight-line depreciation method for all of its plant and equipment. Partial-year depreciation is calculated based on the number of months the asset is in service Required 1. Prepare the journal entry to update depreciation in 2018 2. Prepare the journal entry to record the sale of the truck. 3. Assuming that the truck was sold for $8o,o00, prepare the journal entry to record the sale