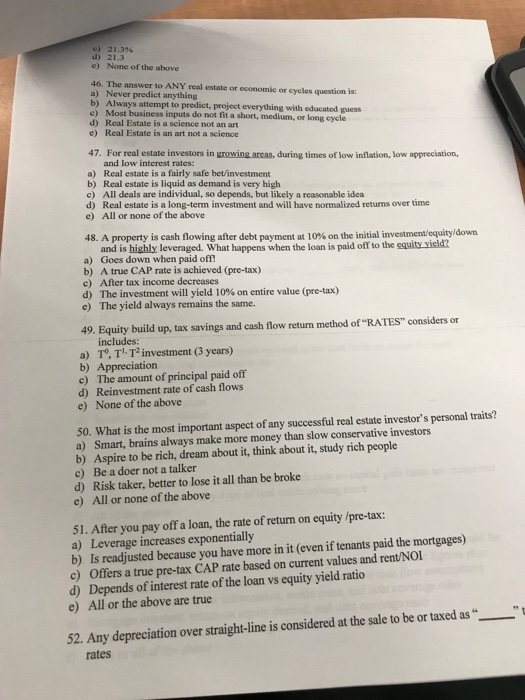

e) 21.3% d) 21.3 e) None of the above 46. The answer to ANY real estate or economic or cycles question is: a) Never predict anything Always attempt to predict, project everything with educated guess Most business inputs do not fit a short, medium, or long cycle b) c) d) Real Estate is a science not an art e) Real Estate is an art not a science 47. For real estate investors in growing areas, during times of low inflation, low appreciation, and low interest rates: a) Real estate is a fairly safe bet/investment b) Real estate is liquid as demand is very high c) All deals are individual, so depends, but likely a reasonable idea d) Real estate is a long-term investment and will have normalized returns over time e) All or none of the above 48 A propertyis cash flowing after debt payment t 10% onthe initial investment equity/down and is highly leveraged. What happens when the loan is paid off to the equity vield? a) Goes down when paid off! b) A true CAP rate is achieved (pre-tax) c) After tax income decreases d) The investment will yield 10% on entire value (pre-tax) e) The yield always remains the same. 49. Equity build up, tax savings and cash flow return method of "RATES" considers or includes a) T. T. T investment (3 years) b) Appreciation c) The amount of principal paid off d) Reinvestment rate of cash flows e) None of the above 50. What is the most important aspect of any successful real estate investor's personal traits? a) Smart, brains always make more money than slow conservative investors b) Aspire to be rich, dream about it, think about it, study rich people c) Be a doer not a talker d) Risk taker, better to lose it all than be broke e) All or none of the above 51. After you pay off a loan, the rate of return on equity /pre-tax a) Leverage increases exponentially b) Is readjusted because you have more in it (even if tenants paid the mortgages) c) Offers a true pre-tax CAP rate based on current values and rent/NOI d) Depends of interest rate of the loan vs equity yield ratio e) All or the above are true 52. Any depreciation over straight-line is considered at the sale to be or taxed as rates