Question

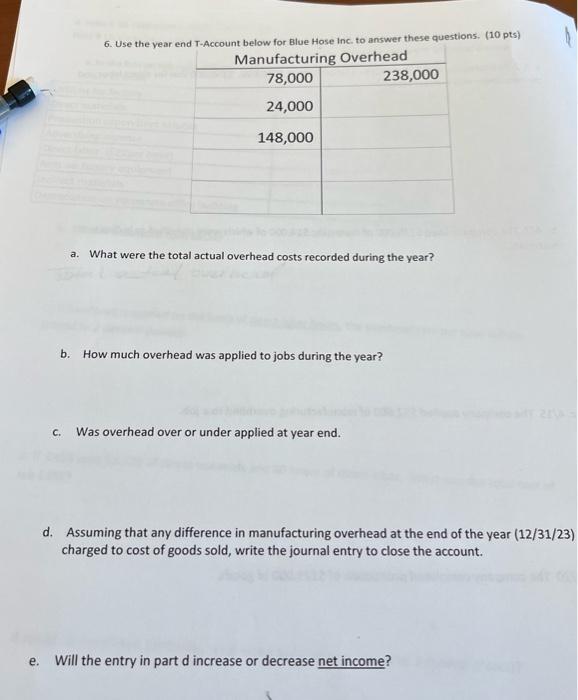

e. 6. Use the year end T-Account below for Blue Hose Inc. to answer these questions. (10 pts) Manufacturing Overhead 78,000 24,000 148,000 238,000

e. 6. Use the year end T-Account below for Blue Hose Inc. to answer these questions. (10 pts) Manufacturing Overhead 78,000 24,000 148,000 238,000 a. What were the total actual overhead costs recorded during the year? b. How much overhead was applied to jobs during the year? C. Was overhead over or under applied at year end. d. Assuming that any difference in manufacturing overhead at the end of the year (12/31/23) charged to cost of goods sold, write the journal entry to close the account. Will the entry in part d increase or decrease net income?

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Actual overhead costs recorded during the year 2400078000148000 250000 as the manuf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App