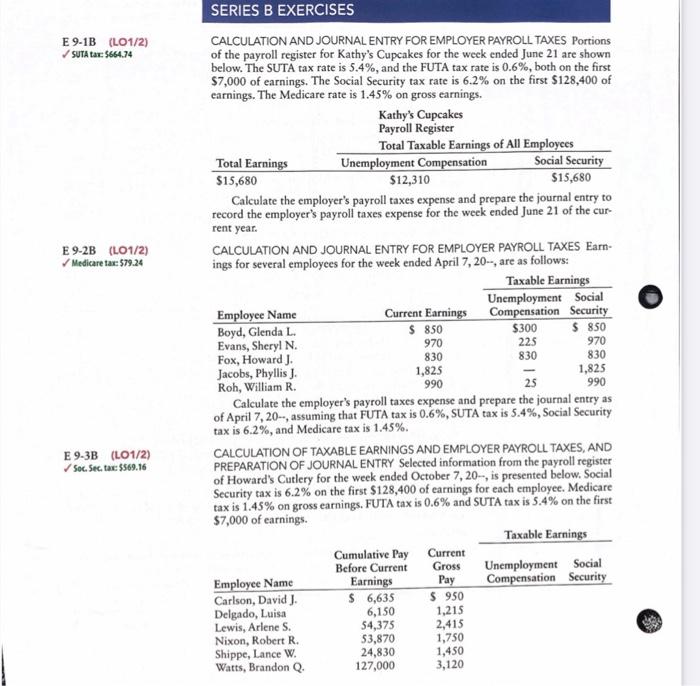

E 9-1B (LO1/2) SUTA: 5664.74 E 9-2B (L01/2) Medicare tax: 579.24 SERIES B EXERCISES CALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL TAXES Portions of the payroll register for Kathy's Cupcakes for the week ended June 21 are shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first $7,000 of earnings. The Social Security tax rate is 6.2% on the first $128,400 of earnings. The Medicare rate is 1.45% on gross earnings. Kathy's Cupcakes Payroll Register Total Taxable Earnings of All Employees Total Earnings Unemployment Compensation Social Security $15,680 $12,310 $15,680 Calculate the employer's payroll taxes expense and prepare the journal entry to record the employer's payroll taxes expense for the week ended June 21 of the cur rent year. CALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL TAXES Earn- ings for several employees for the week ended April 7, 20-, are as follows: Taxable Earnings Unemployment Social Employee Name Current Earnings Compensation Security Boyd, Glenda L. $ 850 $300 $ 850 Evans, Sheryl N. 970 225 970 Fox, Howard J. 830 830 Jacobs, Phyllis J. 1,825 1,825 Roh, William R. 990 25 990 Calculate the employer's payroll taxes expense and prepare the journal entry as of April 7, 20-, assuming that FUTA tax is 0.6%, SUTA tax is 5.4%, Social Security tax is 6.2%, and Medicare tax is 1.45%. CALCULATION OF TAXABLE EARNINGS AND EMPLOYER PAYROLL TAXES, AND PREPARATION OF JOURNAL ENTRY Selected information from the payroll register of Howard's Cutlery for the week ended October 7, 20, is presented below. Social Security tax is 6.2% on the first $128,400 of earnings for each employee. Medicare tax is 1.45% on gross earnings. FUTA tax is 0.6% and SUTA tax is 5.4% on the first $7,000 of earnings Taxable Earnings Cumulative Pay Current Before Current Gross Unemployment Social Employee Name Earnings Pay Compensation Security Carlson, David J. $ 6,635 $ 950 Delgado, Luisa 6,150 1,215 Lewis, Arlene S. 54,375 2,415 Nixon, Robert R. 53,870 1,750 Shippe, Lance W. 24,830 1,450 Watts, Brandon Q. 127,000 3,120 830 E9-3B (L01/2) Soc. Sec. tax: 5569.16