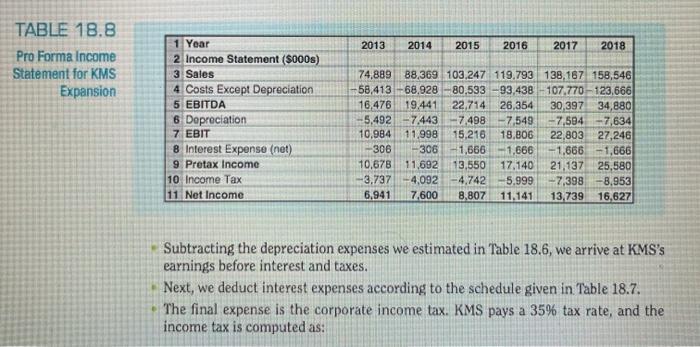

E Aalbredt cbr AaBbccbd Heading 1 Heading 2 Title Subtitle Normal No Spacing Subtle 16. Using the information in the following table, calculate this company's: a. Internal growth rate. b. Sustainable growth rate. c. Sustainable growth rate if it pays out 40% of its net income as a dividend. Using the information in the following table, calculate this company's: A. Internal growth rate. = 14.3% B. Sustainable growth rate. = 25% C. Sustainable growth rate if it pays out 40% of its net income as a dividend = 13.6% 17. Did KMS's expansion plan call for it to grow slower or faster than its sustainable growth rate? 21. Calculate the continuation value of KMS using your reproduction of Table 18.8 from Problem 14, and assuming an EBITDA multiple of 8.5. 2013 2014 2015 2016 2017 2018 TABLE 18.8 Pro Forma Income Statement for KMS Expansion 1 Year 2 Income Statement ($000s) 3 Sales 4 Costs Except Depreciation 5 EBITDA 6 Depreciation 7 EBIT 8 Interest Expense (net) 9 Pretax Income 10 Income Tax 11 Net Income 74,889 88,369. 103,247 119.793 138,167 158,546 58,413 68.928 -80.533 -93,438 -107.770 -123,666 16,476 19.441 22,714 26,354 30,397 34,880 -5,492 -- 7.443 7.498 -7.549 -7,594 -7,634 10,984 11,998 15,216 19.306 22,803 27,246 -306 -306 -1,666 -1,666 -1.666 1,666 10,678 11.692 13,550 17,140 21,137 25,580 3,737 -4,092 -4.742 -5,999 -7,398 -8,953 6.941 7,600 8,807 11,141 13,739 16,627 Subtracting the depreciation expenses we estimated in Table 18.6, we arrive at KMS's earnings before interest and taxes. Next, we deduct interest expenses according to the schedule given in Table 18.7. The final expense is the corporate income tax. KMS pays a 35% tax rate, and the income tax is computed as: E Aalbredt cbr AaBbccbd Heading 1 Heading 2 Title Subtitle Normal No Spacing Subtle 16. Using the information in the following table, calculate this company's: a. Internal growth rate. b. Sustainable growth rate. c. Sustainable growth rate if it pays out 40% of its net income as a dividend. Using the information in the following table, calculate this company's: A. Internal growth rate. = 14.3% B. Sustainable growth rate. = 25% C. Sustainable growth rate if it pays out 40% of its net income as a dividend = 13.6% 17. Did KMS's expansion plan call for it to grow slower or faster than its sustainable growth rate? 21. Calculate the continuation value of KMS using your reproduction of Table 18.8 from Problem 14, and assuming an EBITDA multiple of 8.5. 2013 2014 2015 2016 2017 2018 TABLE 18.8 Pro Forma Income Statement for KMS Expansion 1 Year 2 Income Statement ($000s) 3 Sales 4 Costs Except Depreciation 5 EBITDA 6 Depreciation 7 EBIT 8 Interest Expense (net) 9 Pretax Income 10 Income Tax 11 Net Income 74,889 88,369. 103,247 119.793 138,167 158,546 58,413 68.928 -80.533 -93,438 -107.770 -123,666 16,476 19.441 22,714 26,354 30,397 34,880 -5,492 -- 7.443 7.498 -7.549 -7,594 -7,634 10,984 11,998 15,216 19.306 22,803 27,246 -306 -306 -1,666 -1,666 -1.666 1,666 10,678 11.692 13,550 17,140 21,137 25,580 3,737 -4,092 -4.742 -5,999 -7,398 -8,953 6.941 7,600 8,807 11,141 13,739 16,627 Subtracting the depreciation expenses we estimated in Table 18.6, we arrive at KMS's earnings before interest and taxes. Next, we deduct interest expenses according to the schedule given in Table 18.7. The final expense is the corporate income tax. KMS pays a 35% tax rate, and the income tax is computed as