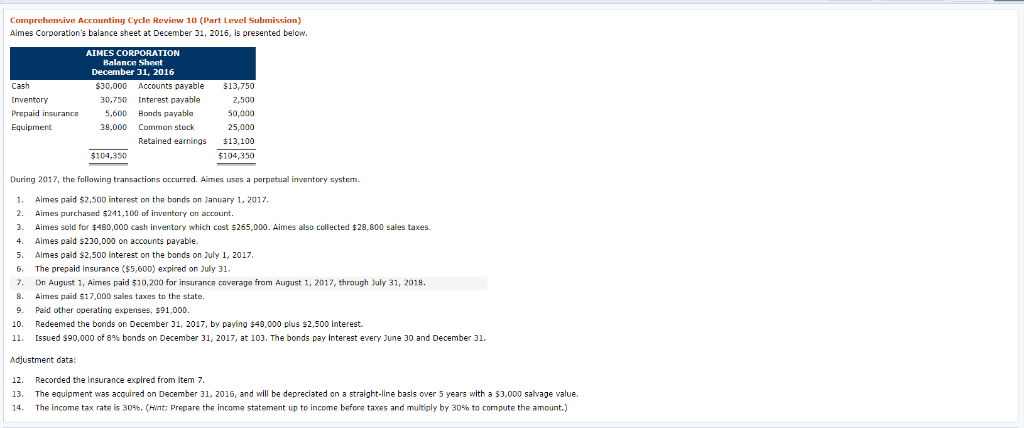

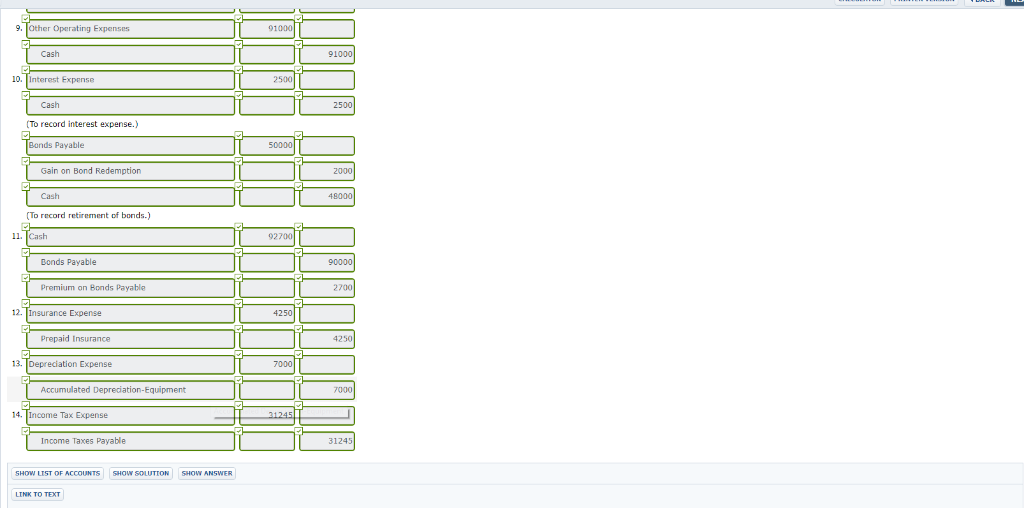

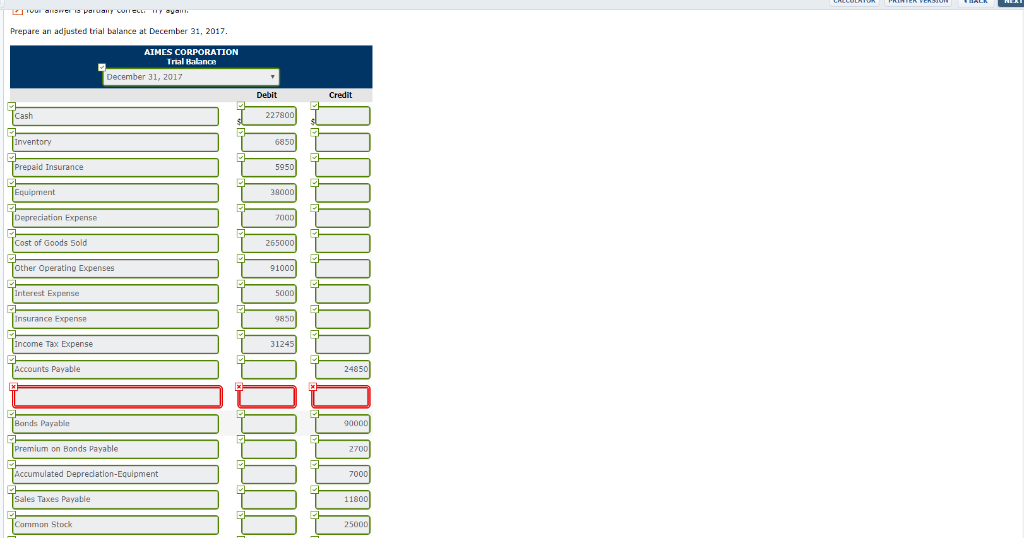

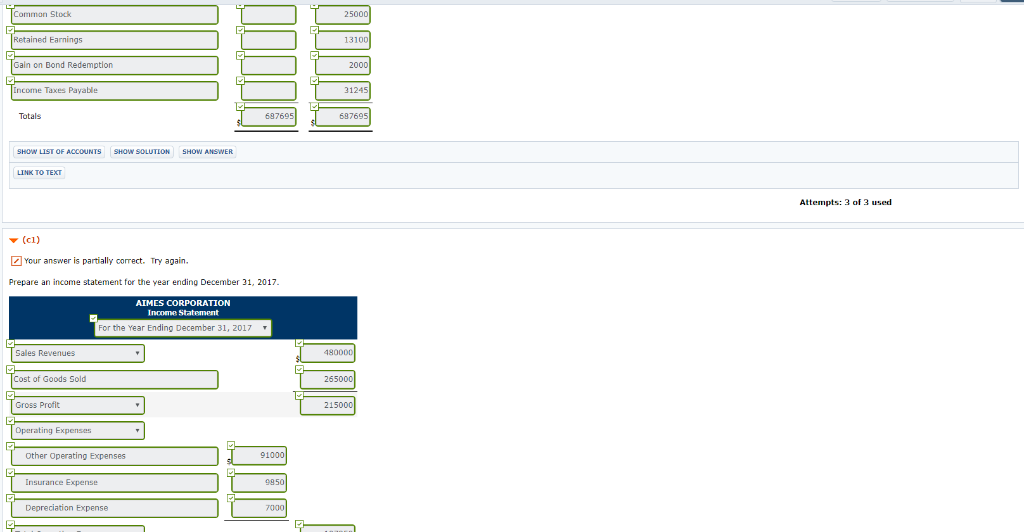

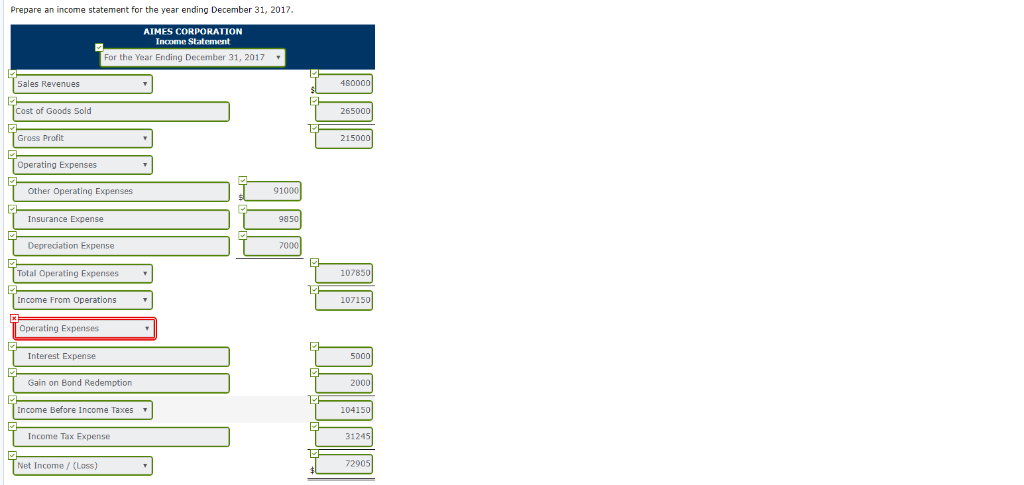

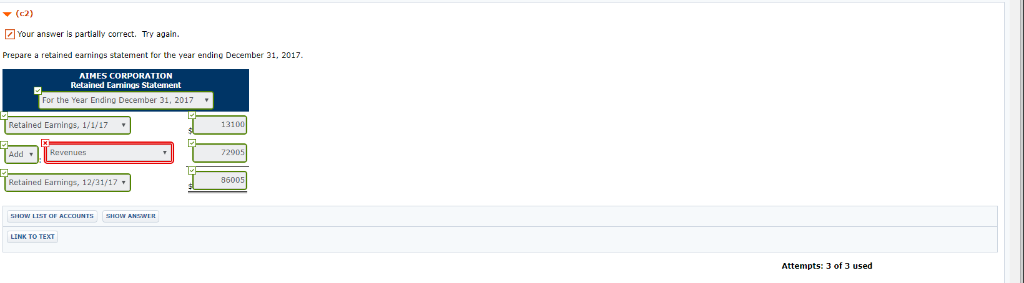

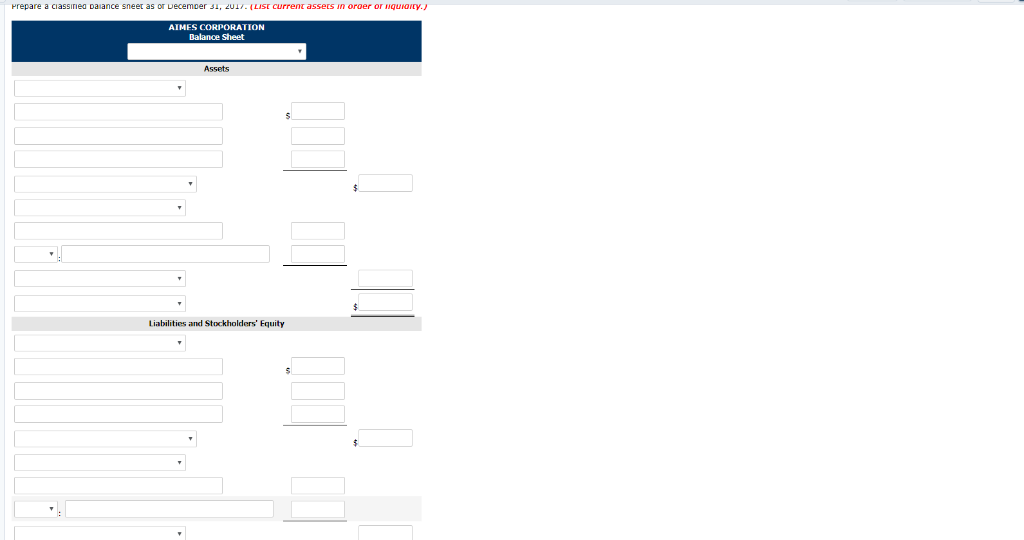

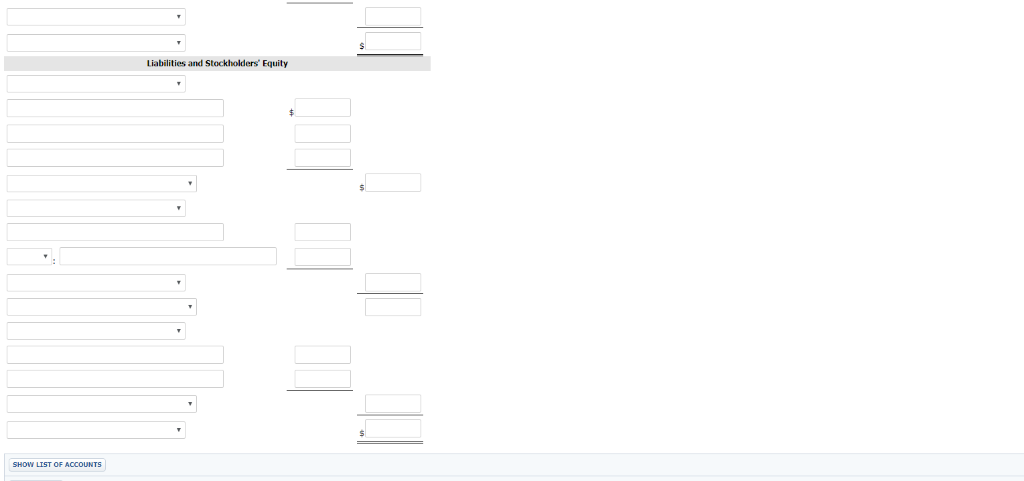

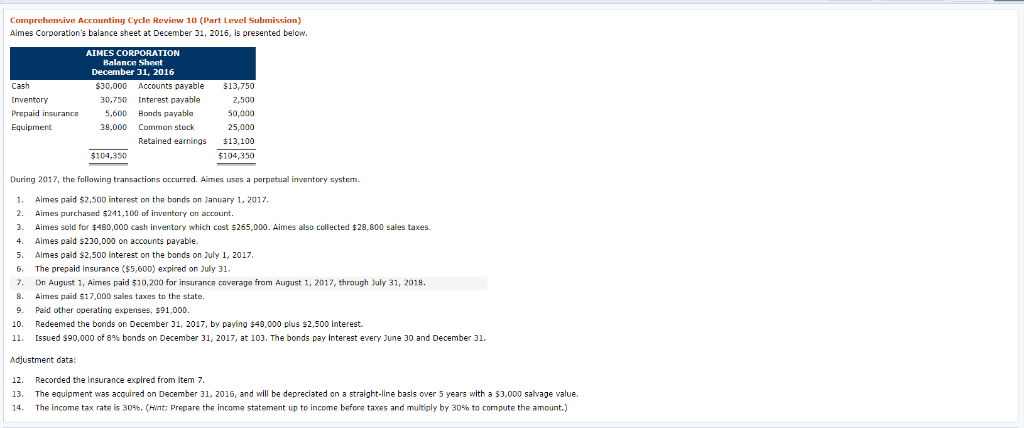

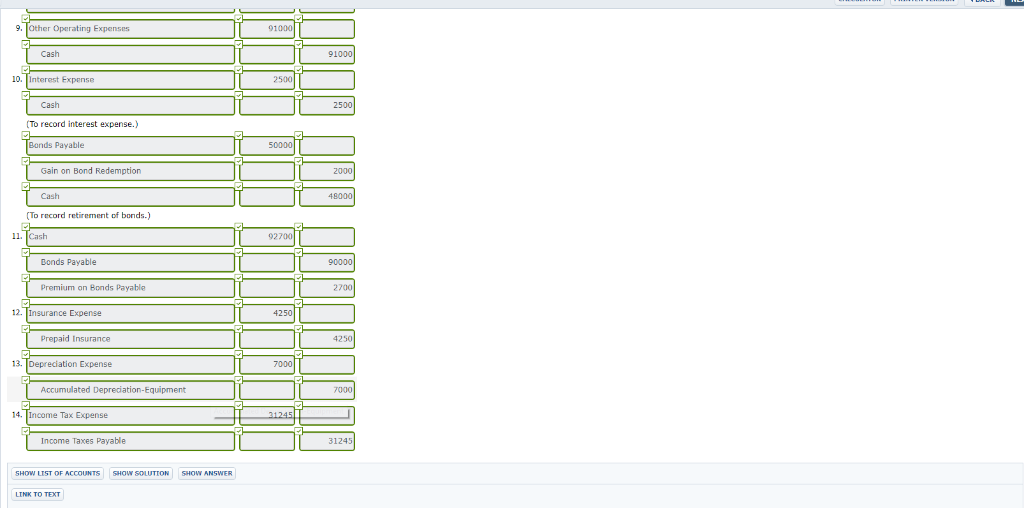

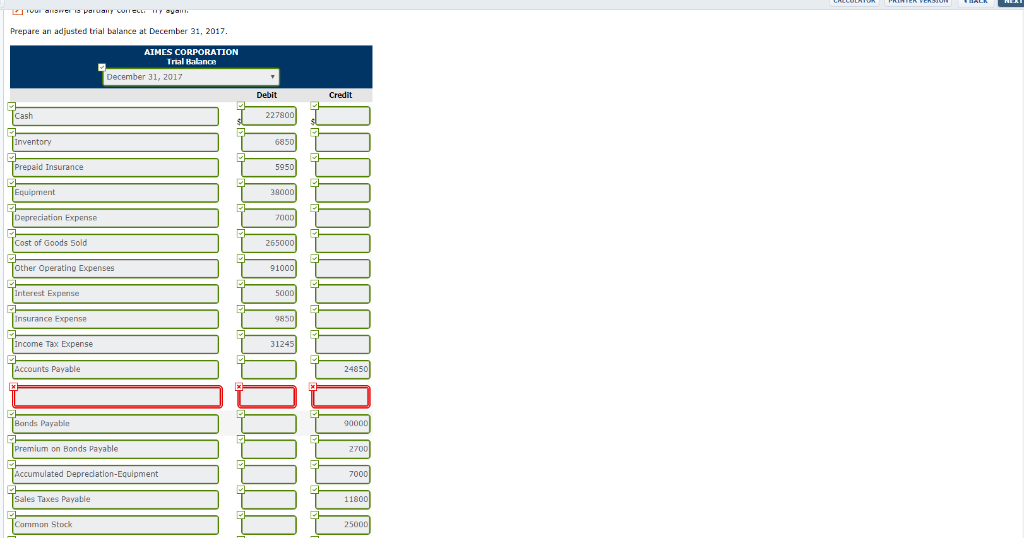

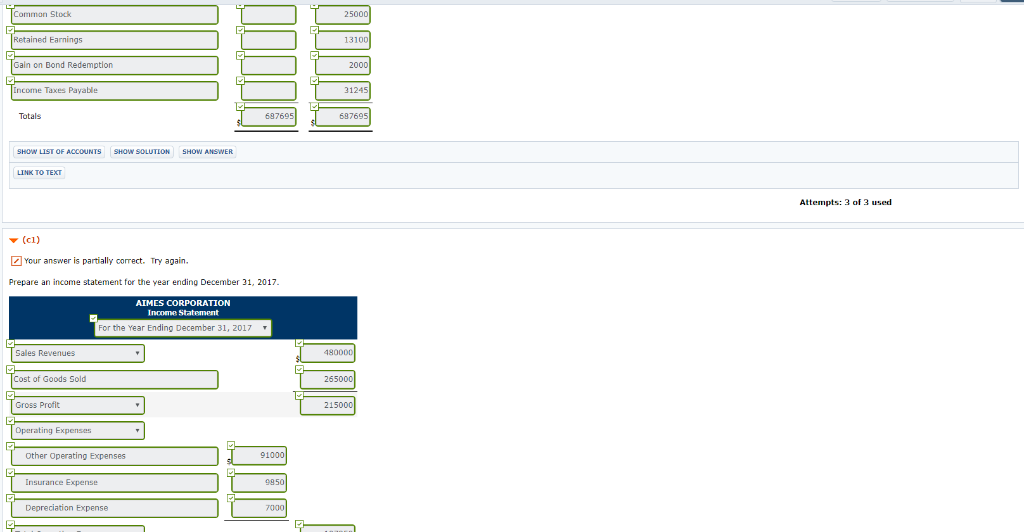

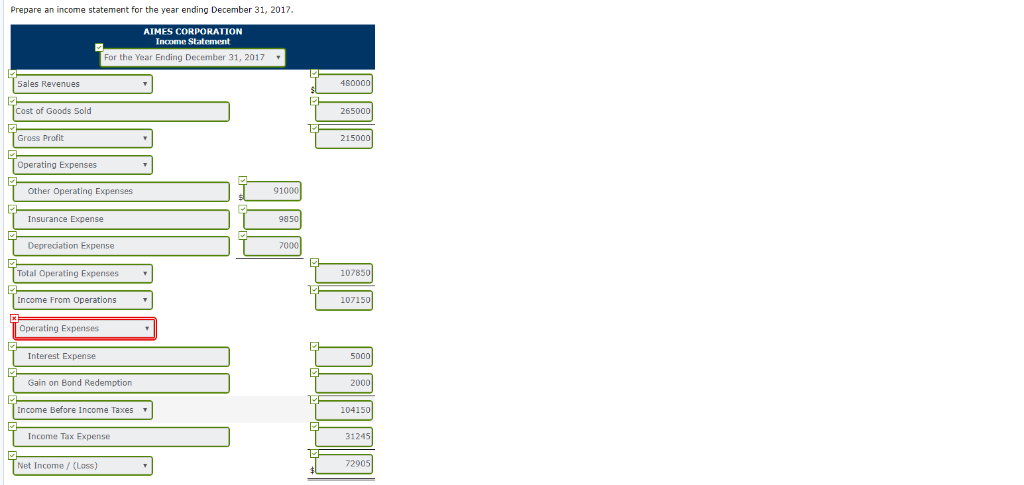

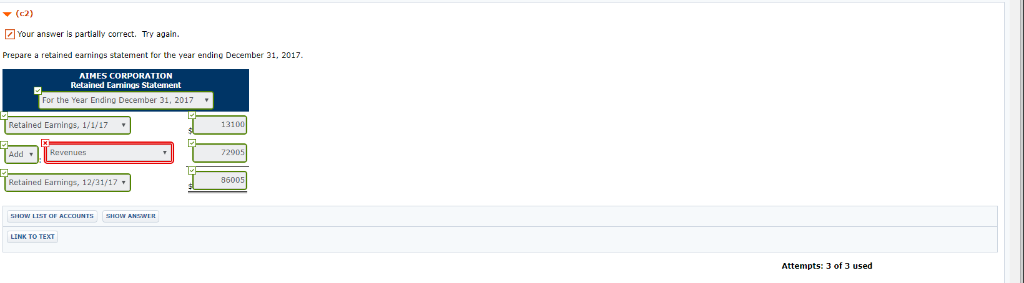

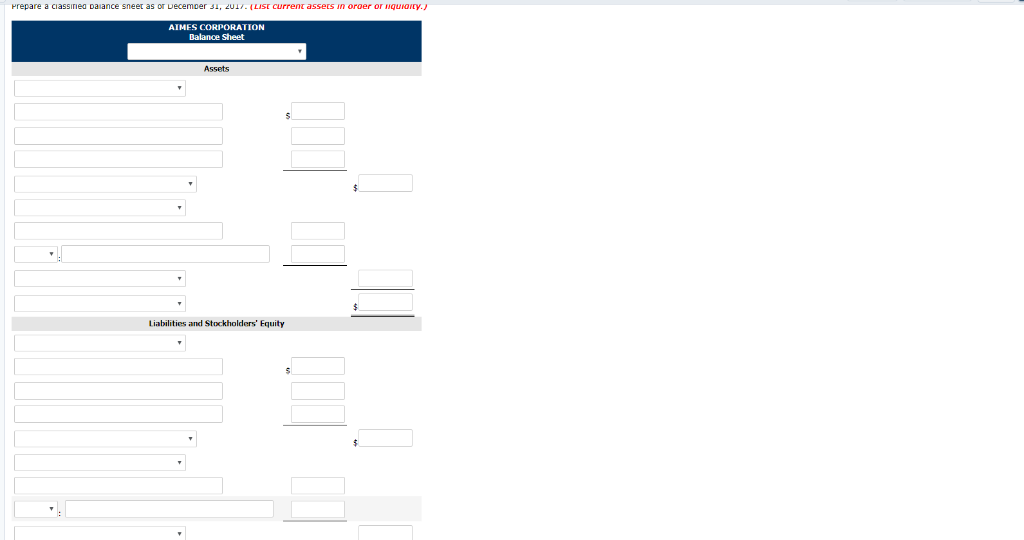

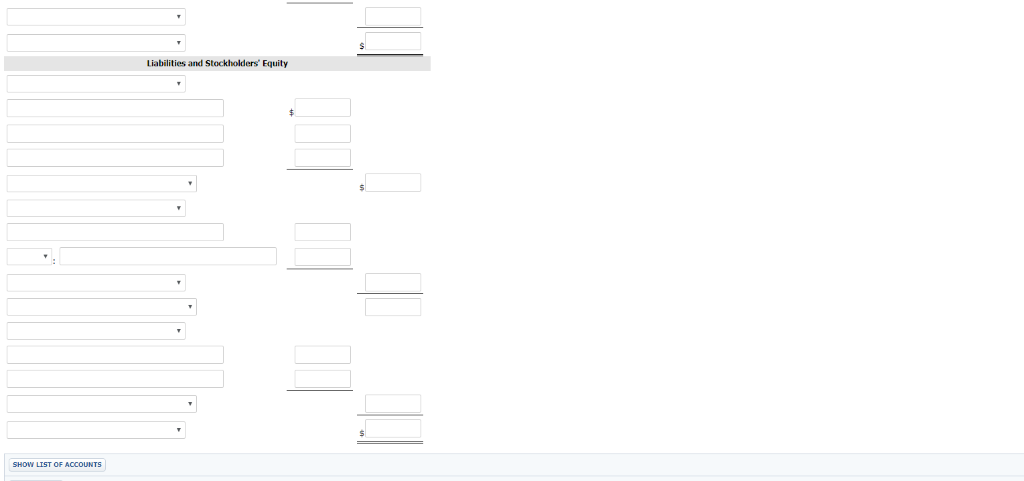

e Accounting Cycle Review 10 (Part Level Submission) Aimes Corporation's balance sheet at December 31, 2016, is presented below. AIMES CORPORATION Balance Sheet December 31, 2016 Cash $30,000 Accounts payable $13,750 2,500 50,000 25,000 Retained earnings 13,100 $104350 Propaid insurance Equipment 30,750 Interest payable 5,600 Bonds payable 39,000 Common stock $104,354 During 2017, the following transactions occurred. Aimes uses a perpetual inventory system 1. Aimes paid $2,50D interest on the bonds on January 1, 2017 2. Aimes purchased $241,100 of inventory on account 3. Aimes sold for 480,000 cash inventory which cost $265,000. Aimes also collected $28,800 sales taxes. 4. Aimes paid $230,000 on accounts payable 5. Almes pald $2,500 interest on the bonds on July 1, 2017 6. The prepaid insurance ($5,600) expired on July 31 . On August 1, Aimes paid $10,200 for insurance coverage from August 1, 2017, through July 31, 2018 . Aimes paid $17,000 sales taxes to the state 9. Paid other operating expenses, $91,000 10. Redeemed the bonds on December 31, 2017, by paying $48,000 plus $2,500 interest 11, Issued $90,000 of 8% bonds on December 31, 2017, at 103. The bonds pay interest every June 30 and December 31. Adjustment data: 12. Recorded the insurance expired from item 7 13. The equipment was acquired on December 31, 2016, and will be depreciated on a straight-line basis over 5 years with a $3,000 salvage value 14. The income tax rate is 30%. (Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute the amount.) our answer is correct. prepare )auma entries for the transactions listed above and adjusting entnes. Credit account titles are automatically indented when mount es entered. Do not indent manually. No. Account Titles and Explanation Debit Credit 1. Interest Payable Cash 2500 2. Inventony 241100 Accounts Payable 2411 508800 Sales Revenue Sales Taxes Payable (To record sales revenue.) of Goods Sold 265000 (To record cost of goods sold) 4. ts Payable 230000 Cash 5. Interest Expense 2500 Cash 6. Insurance Expense 5G0D Prepaid Insurance Cash 9. Other Operating Expenses Cash 91 10. Interest Expense 2500 Cash To record interest expense.) Bonds Payable Gain on Bond Redemption Cash To record retirement of bonds.) 927 Bonds Payable Premium on Bonds Payable 12. Insurance Expense 4250 Prepaid Insurance 13. Deprediation Expense 7000 14. Income Tax Expense Income Taxes Payable 31245 LTST OF ACCOUNTS SHOW SOLUTION Prepare an adjusted trial balance at December 31, 2017 AIMES CORPORATION Trtal Halance December 31, 2017 Debit Credit Cash 227800 Inventory 6850 Prepaid Insurance 9000 Depreciation Expense 00D of Goods Sold 265000 Other Operating Expenses Interest Expense 5000 Insurance Expense 9850 Income Tax Expense 31245 Payable 24850 Bonds Payable Premium on Bonds Payable ulated Depreciation-Equipment Sales Taxes Payable Cormmon Stock Prepare an income statement for the year ending December 31, 2017 AIMES CORPORATION For the Year Ending December 31, 2017 Sales Revenues 460000 Cost of Goods Sold 265000 Gross Profit 215000 Operating Expenses Other Operating Expenses 91000 Insurance Expense 9850 7000 Total Operating Expenses 107850 Income From Operations 107150 Operating Expenses Interest Expense Gain on Bond Redemption 2000 Income Before Income Taxes 104150 Income Tax Expense 31245 Net Income/ (Laoss) 72905 (c2) Your answer is partially correct. Try again. Prepare a retained earnings statement for the year ending December 31, 2017. AIMES CORPORATION For the Year Ending December 31, 2017 Retained Eamings, 1/1/17 131 Add Revenues 290 36005 Retained Earnings, 12/11/17 LINK TO TEXT Attempts: 3 of 3 used prepare a ciassnea Dalance sneet as or Decemoer jl, 2U1/.( LS Currer assets 1n 0roer or liquiary.) AIMES CORPORATION Balance Sheet Assets Liabilities and Stockholders' Equity Liabilities and Stockholders' Equity LTST OF ACCOUNTS