Answered step by step

Verified Expert Solution

Question

1 Approved Answer

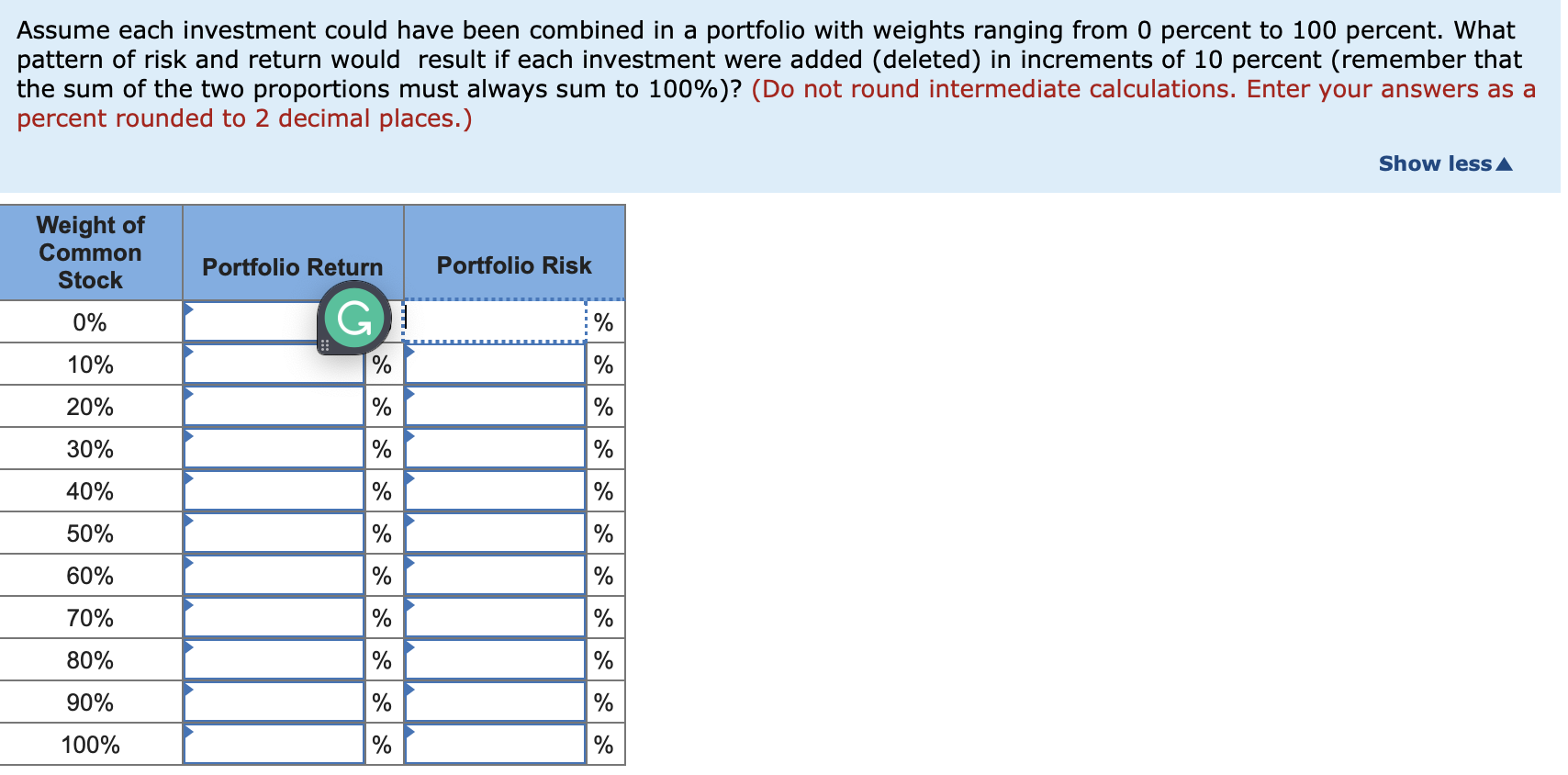

e. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattern of risk and

e. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattern of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100%)?

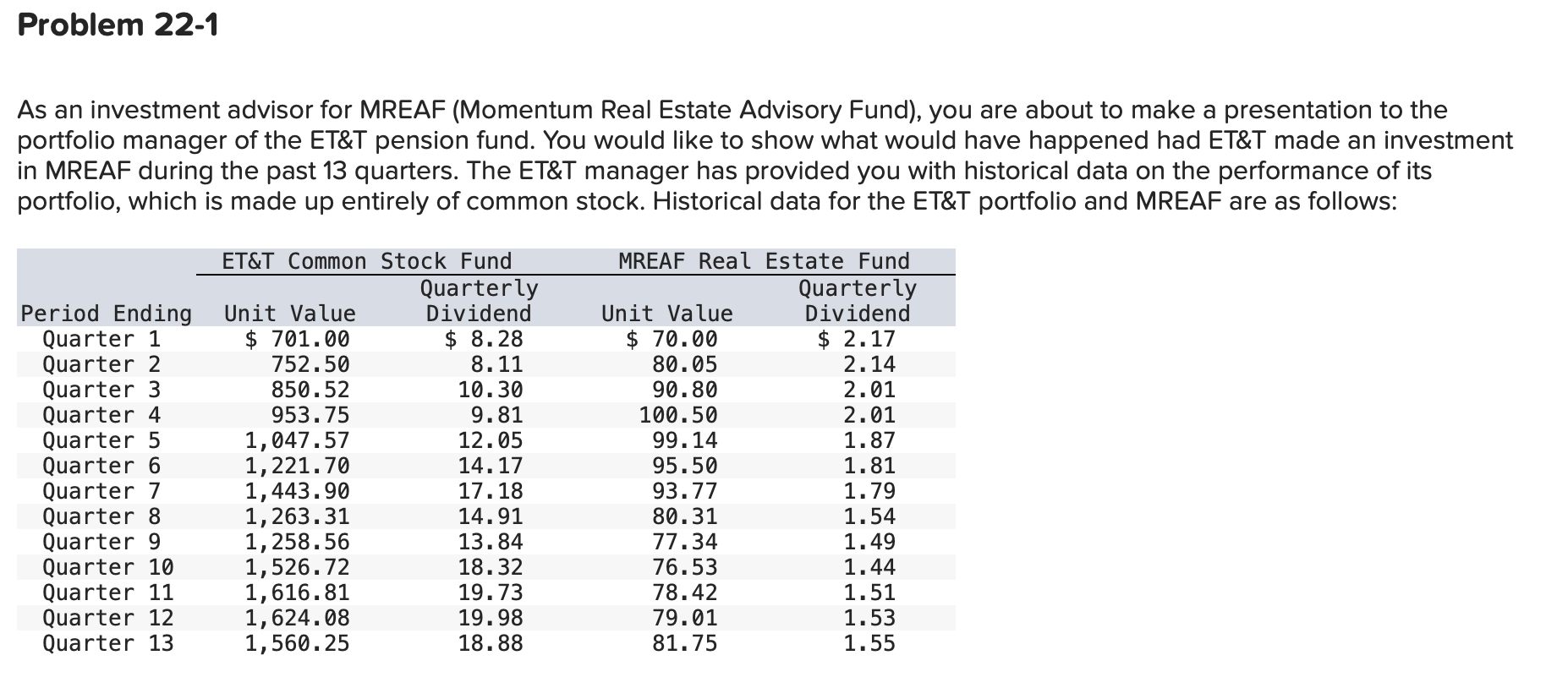

Problem 22-1 As an investment advisor for MREAF (Momentum Real Estate Advisory Fund), you are about to make a presentation to the portfolio manager of the ET&T pension fund. You would like to show what would have happened had ET&T made an investment in MREAF during the past 13 quarters. The ET&T manager has provided you with historical data on the performance of its portfolio, which is made up entirely of common stock. Historical data for the ET&T portfolio and MREAF are as follows: Period Ending Quarter 1 Quarter 2 Quarter 3 Quarter 4 Quarter 5 Quarter 6 Quarter 7 Quarter 8 Quarter 9 Quarter 10 Quarter 11 Quarter 12 Quarter 13 ET&T Common Stock Fund Quarterly Unit Value Dividend $ 701.00 $ 8.28 752.50 8.11 850.52 10.30 953.75 9.81 1,047.57 12.05 1,221.70 14.17 1,443.90 17.18 1,263.31 14.91 1,258.56 13.84 1,526.72 18.32 1,616.81 19.73 1,624.08 19.98 1,560.25 18.88 MREAF Real Estate Fund Quarterly Unit Value Dividend $ 70.00 $ 2.17 80.05 2.14 90.80 2.01 100.50 2.01 99.14 1.87 95.50 1.81 93.77 1.79 80.31 1.54 77.34 1.49 76.53 1.44 78.42 1.51 79.01 1.53 81.75 1.55 Assume each investment could have been combined in a portfolio with weights ranging from O percent to 100 percent. What pattern of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100%)? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Show less A Weight of Common Stock Portfolio Return Portfolio Risk 0% G % 10% % % % 20% % % 30% % % 40% % % 50% % 60% % % 70% % % 80% % % % 90% 100% % %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started