Answered step by step

Verified Expert Solution

Question

1 Approved Answer

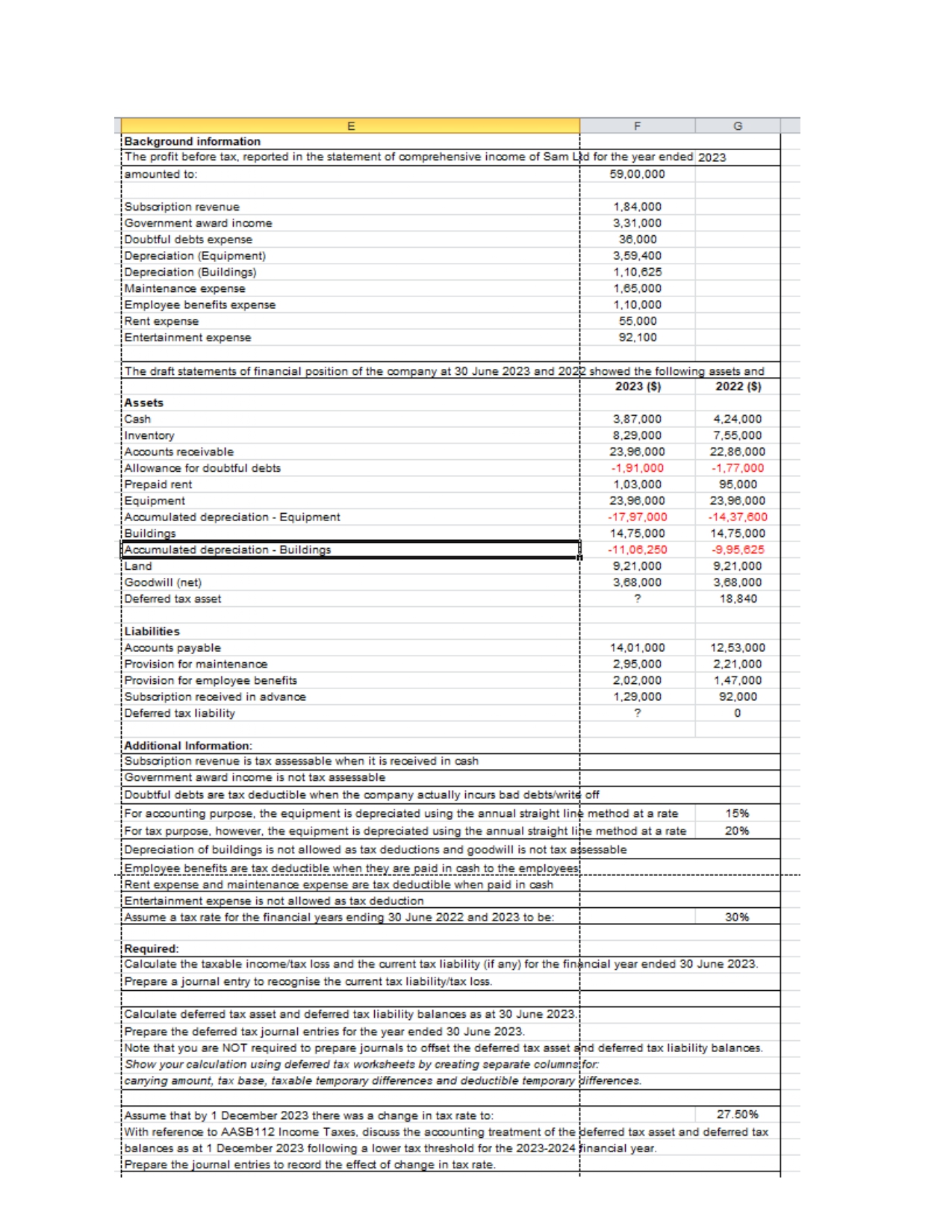

E Background information The profit before tax, reported in the statement of comprehensive income of Sam Ltd for the year ended 2023 amounted to:

E Background information The profit before tax, reported in the statement of comprehensive income of Sam Ltd for the year ended 2023 amounted to: 59,00,000 G Subscription revenue 1,84,000 Government award income Doubtful debts expense Depreciation (Equipment) Depreciation (Buildings) Maintenance expense Employee benefits expense Rent expense Entertainment expense 3,31,000 36,000 3,59,400 1,10,625 1,65,000 1,10,000 55,000 92,100 The draft statements of financial position of the company at 30 June 2023 and 2022 showed the following assets and 2023 ($) 2022 ($) Assets Cash 3,87,000 4,24,000 Inventory 8,29,000 7,55,000 Accounts receivable Allowance for doubtful debts 23,98,000 22,86,000 Prepaid rent Equipment Accumulated depreciation - Equipment Buildings Accumulated depreciation - Buildings Land Goodwill (net) Deferred tax asset Liabilities Accounts payable Provision for maintenance Provision for employee benefits Subscription received in advance Deferred tax liability -1,91,000 1,03,000 23,96,000 -1,77,000 95,000 23,98,000 -17,97,000 -14,37,600 14,75,000 14,75,000 -11,08,250 -9,95,625 9.21,000 9,21,000 3,68,000 3,68,000 ? 18,840 14,01,000 2,95,000 12,53,000 2,21,000 2,02,000 1,47,000 1,29,000 92,000 ? 0 Additional Information: Subscription revenue is tax assessable when it is received in cash Government award income is not tax assessable Doubtful debts are tax deductible when the company actually incurs bad debts/write off For accounting purpose, the equipment is depreciated using the annual straight line method at a rate For tax purpose, however, the equipment is depreciated using the annual straight line method at a rate Depreciation of buildings is not allowed as tax deductions and goodwill is not tax assessable Employee benefits are tax deductible when they are paid in cash to the employees Rent expense and maintenance expense are tax deductible when paid in cash Entertainment expense is not allowed as tax deduction Assume a tax rate for the financial years ending 30 June 2022 and 2023 to be: Required: 15% 20% 30% Calculate the taxable income/tax loss and the current tax liability (if any) for the financial year ended 30 June 2023. Prepare a journal entry to recognise the current tax liability/tax loss. Calculate deferred tax asset and deferred tax liability balances as at 30 June 2023. Prepare the deferred tax journal entries for the year ended 30 June 2023. Note that you are NOT required to prepare journals to offset the deferred tax asset and deferred tax liability balances. Show your calculation using deferred tax worksheets by creating separate columns for: carrying amount, tax base, taxable temporary differences and deductible temporary differences. Assume that by 1 December 2023 there was a change in tax rate to: 27.50% With reference to AASB112 Income Taxes, discuss the accounting treatment of the deferred tax asset and deferred tax balances as at 1 December 2023 following a lower tax threshold for the 2023-2024 financial year. Prepare the journal entries to record the effect of change in tax rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started