Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e) because of its lower or higher return? and its moderate return and low or high risk? 19. [-/1 Points] DETAILS ASWSBE14 5.E.030. MY NOTES

e) because of its lower or higher return?

e) because of its lower or higher return?

and its moderate return and low or high risk?

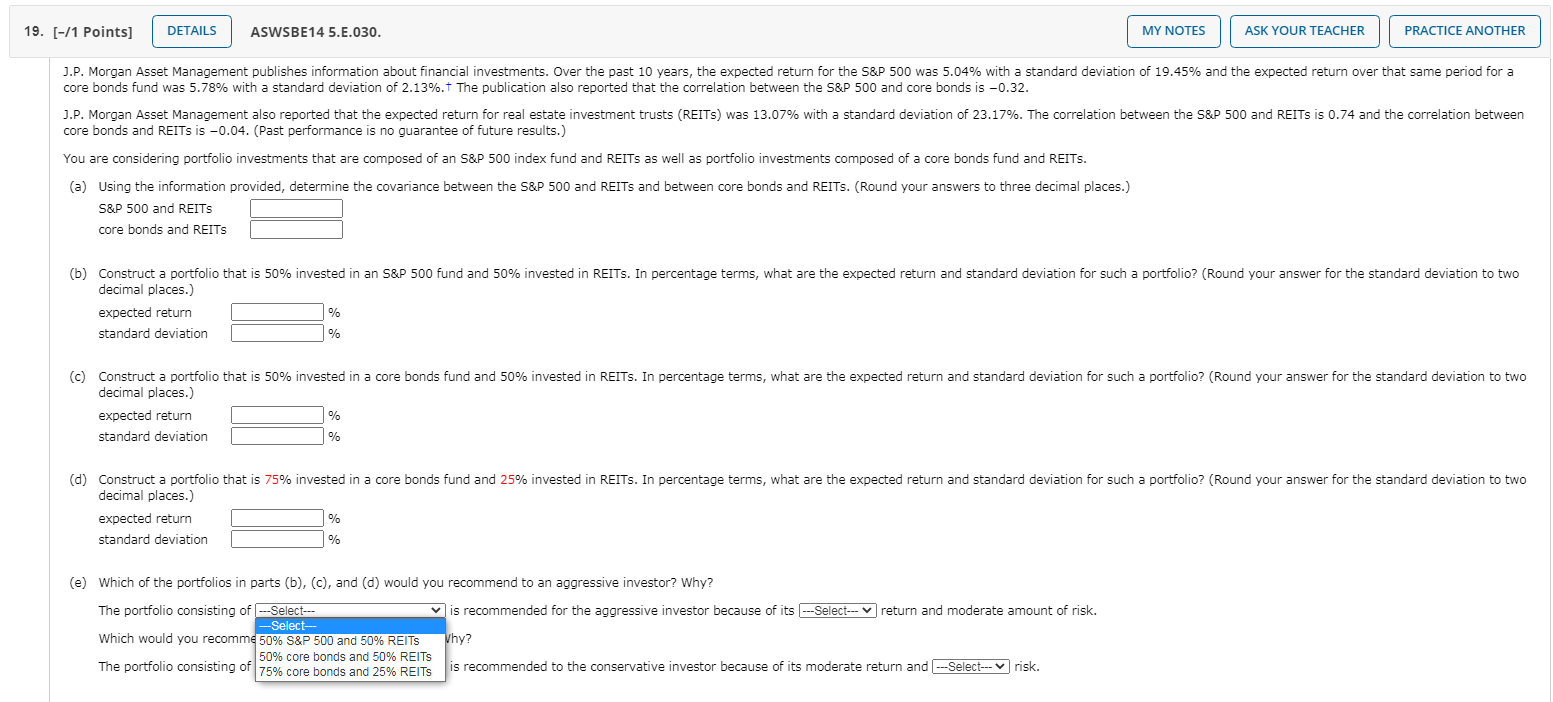

19. [-/1 Points] DETAILS ASWSBE14 5.E.030. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER J.P. Morgan Asset Management publishes information about financial investments. Over the past 10 years, the expected return for the S&P 500 was 5.04% with a standard deviation of 19.45% and the expected return over that same period for a core bonds fund was 5.78% with a standard deviation of 2.13%. The publication also reported that the correlation between the S&P 500 and core bonds is -0.32. J.P. Morgan Asset Management also reported that the expected return for real estate investment trusts (REITS) was 13.07% with a standard deviation of 23.17%. The correlation between the S&P 500 and REITS is 0.74 and the correlation between core bonds and REITs is -0.04. (Past performance is no guarantee of future results.) You are considering portfolio investments that are composed of an S&P 500 index fund and REITs as well as portfolio investments composed of a core bonds fund and REITS. (a) Using the information provided, determine the covariance between the S&P 500 and REITs and between core bonds and REITS. (Round your answers to three decimal places.) S&P 500 and REITS core bonds and REITS (b) Construct a portfolio that is 50% invested in an S&P 500 fund and 50% invested in REITs. In percentage terms, what are the expected return and standard deviation for such a portfolio? (Round your answer for the standard deviation to two decimal places.) expected return % standard deviation % (c) Construct a portfolio that is 50% invested in a core bonds fund and 50% invested in REITs. In percentage terms, what are the expected return and standard deviation for such a portfolio? (Round your answer for the standard deviation to two decimal places.) expected return % standard deviation % (d) Construct a portfolio that is 75% invested in a core bonds fund and 25% invested in REITs. In percentage terms, what are the expected return and standard deviation for such a portfolio? (Round your answer for the standard deviation to two decimal places.) expected return % standard deviation % (e) Which of the portfolios in parts (b), (c), and (d) would you recommend to an aggressive investor? Why? The portfolio consisting of --Select--- is recommended for the aggressive investor because of its ---Select-- return and moderate amount of risk. ---Select- Which would you recomme 50% S&P 500 and 50% REITS Vhy? The portfolio consisting of 75% core bonds and 25% REITS is recommended to the conservative investor because of its moderate return and ---Select--- VriskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started