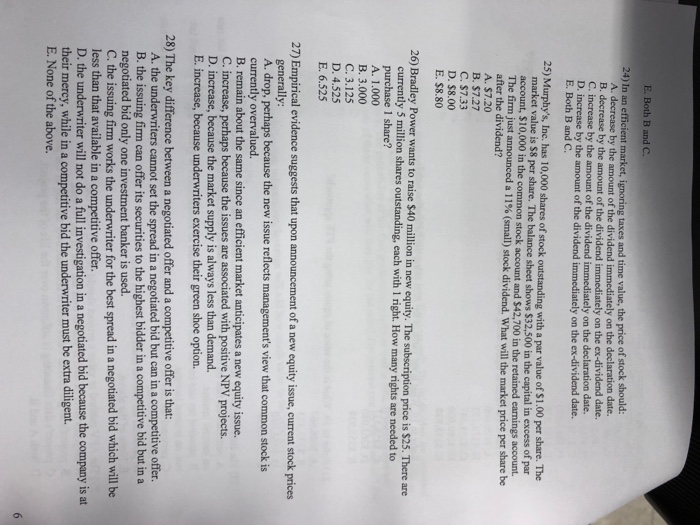

E. Both B and C. 24) In an efficient market, ignoring taxes and time value, the price of stock should: A. decrease by the amount of the dividend immediately on the declaration date. B. decrease by the amount of the dividend immediately on the ex-dividend date. C. increase by the amount of the dividend immediately on the declaration date. D. increase by the amount of the dividend immediately on the ex-dividend date. E. Both B and C 25) Murphy's, Inc. has 10,000 shares of stock outstandin g with a par value of $1.00 per share. The market value is $8 per share. The balance sheet shows S32,500 in the capital in excess of par account, $10,000 in the common stock account and $42,700 in the retained earnings account. The firm just announced a 1 1% (small) stock dividend, what will the market price per share be after the dividend? A. $7.20 B. $7.27 C. $7.33 D. $8.00 E. $8.80 26) Bradley Power wants to raise $40 million in new equity. The subscription price is $25. There are currently 5 million shares outstanding, each with 1 right. How many rights are needed to purchase 1 share? A. 1.000 B. 3.000 C. 3.125 D. 4.525 E. 6.525 27) Empirical evidence suggests that upon announcement of a new equity issue, current stock prices generally A. drop, perhaps because the new issue reflects management's view that common stock is currently overvalued. B. remain about the same since an efficient market anticipates a new equity issue. C. increase, perhaps because the issues are associated with positive NPV projects. D. increase, because the market supply is always less than demand. E. increase, because underwriters exercise their green shoe option. 28) The key difference between a negotiated offer and a competitive offer is that A. the underwriters cannot set the spread in a negotiated bid but can in a competitive offer. B. the issuing firm can offer its securities to the highest bidder in a competitive bid but in a negotiated bid only one investment banker is used. C. the issuing firm works the underwriter for the best spread in a negotiated bid which will be less than that available in a competitive offer D, the underwriter will not do a full investigation in a negotiated bid because the company is at their mercy, while in a competitive bid the underwriter must be extra diligent. E. None of the above