Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e. Can IIT inventory Explain your answer. 16.8. Describe the three major sources of short-term 16.9. a. What is the difference between free trade

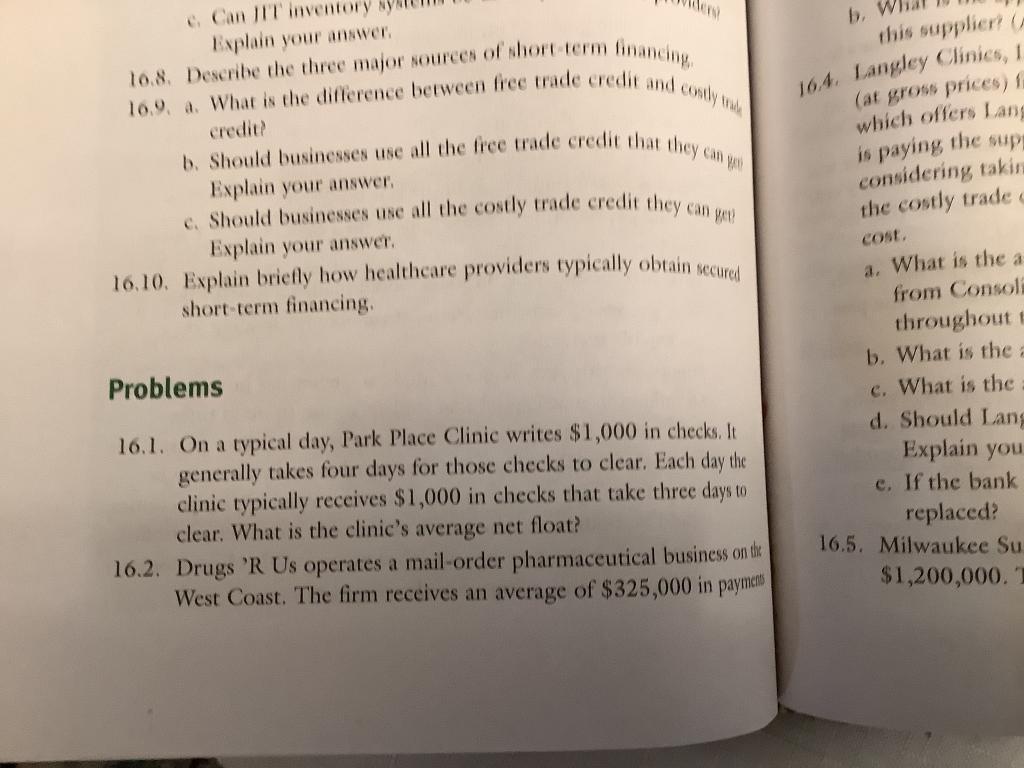

e. Can IIT inventory Explain your answer. 16.8. Describe the three major sources of short-term 16.9. a. What is the difference between free trade credit and costly tra b. Should businesses use all the free trade credit that they can ge credit? Explain your answer. c. Should businesses use all the costly trade credit they can get! Explain your answer. 16.10. Explain briefly how healthcare providers typically obtain secured short-term financing. Problems 16.1. On a typical day, Park Place Clinic writes $1,000 in checks. It generally takes four days for those checks to clear. Each day the clinic typically receives $1,000 in checks that take three days to clear. What is the clinic's average net float? 16.2. Drugs 'R Us operates a mail-order pharmaceutical business on the West Coast. The firm receives an average of $325,000 in payments this supplier? (A 16.4. Langley Clinics, I (at gross prices) f which offers Lang is paying the supe considering takin the costly trade c cost. a. What is the a from Consoli throughout t b. What is the a e. What is the d. Should Lang Explain you e. If the bank replaced? 16.5. Milwaukee Su $1,200,000. T

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

161 The clinics average net float is 2000 This figure is calculated as follows There is a float of 1000 on the checks written by the clinic as it will take four days for them to clear Additionally the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started