Answered step by step

Verified Expert Solution

Question

1 Approved Answer

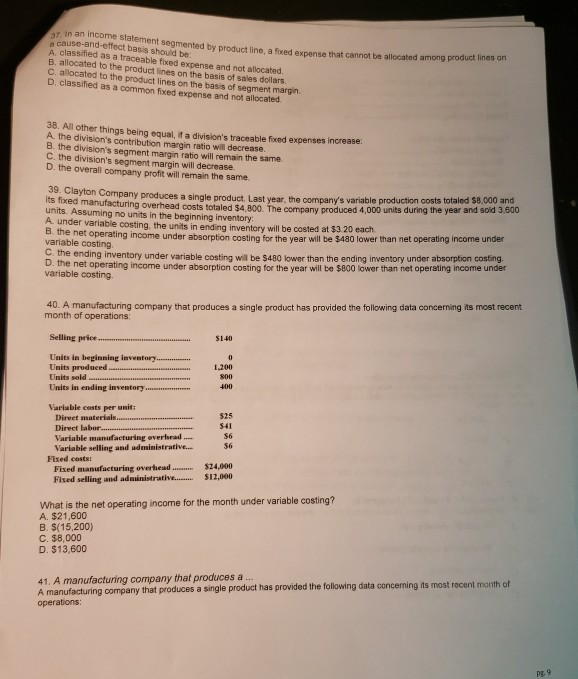

e cause-and-effect basis should be: A classified as a traceable fixed expense and not allocated. B. allocated to the product lines on the basis of

e cause-and-effect basis should be: A classified as a traceable fixed expense and not allocated. B. allocated to the product lines on the basis of sales dollars. C. allocated to the product lines on the basis of segment margn. D. classified as a common fixed expense and not allocated segmented by product line, a fived expense that cannot be allocated among product lines on 38. All other things being equal, if a division's traceable fixed expenses increase A the division's contribution margin ratio will decrease B. the division's segment margin ratio will remain the same. .me division's segment margin will decrease D. the overall company profit will remain the same. uces a single product. Last year, the company's variable production costs totaled $8,000 and its fixed manufacturing overhead costs units. Assuming no units in the beginning inventory A under variable costing, the units in ending inventory will be costed at $3 20 each. totaled $4,800. The company produced 4,000 units during the year and sold 3,800 operating income under absorption costing for the year wll be $480 lower than net operating income under variable costing C. the ending inventory under variable costing will be $480 lower than the ending inventory under absorption costing net operating income under absorption costing for the year will be $800 lower than net operating income under variable costing. 40. A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations: Selling price $140 Units in beginning inventory Units produced Units sold Units in ending inventory 1.200 Variable costs per unit: $25 S41 S6 56 Direet materials Direct labor Variable manufacturing overbead Variable selling and administrative... Fixed costs: Fixed manufacturing overiead $24,000 What is the net operating income for the month under variable costing? A. $21,600 B $(15,200) C. $8,000 D. $13,600 41. A manufacturing company that produces a A manufacturing company that produces a single operations: PE 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started