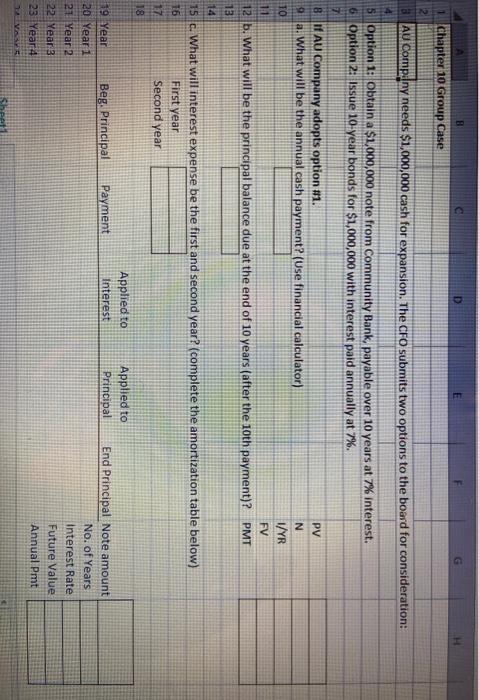

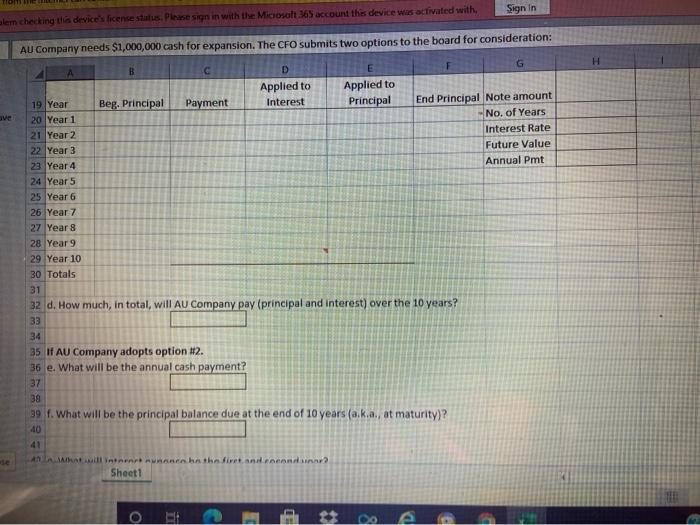

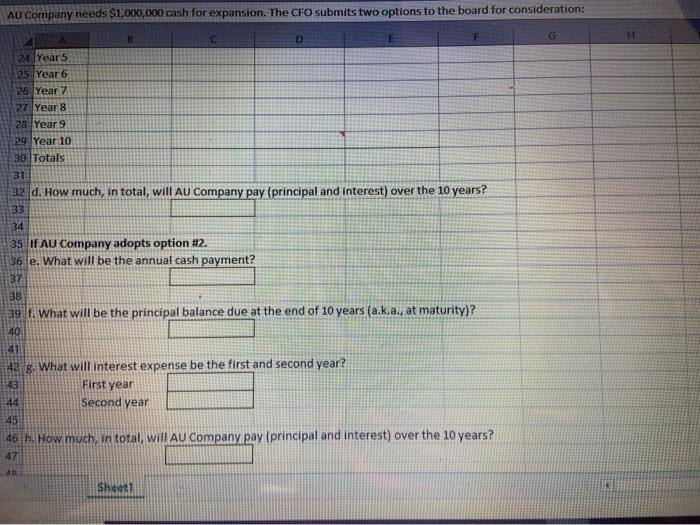

E Chapter 10 Group Case AU Company needs $1,000,000 cash for expansion. The CFO submits two options to the board for consideration: Option 1: Obtain a $1,000,000 note from Community Bank, payable over 10 years at 7% interest. Option 2: Issue 10-year bonds for $1,000,000 with interest paid annually at 7%. 8 AU Company adopts option #1. PV 9. a. What will be the annual cash payment? (Use financial calculator) N TO 1/YR 11 FV 12 b. What will be the principal balance due at the end of 10 years (after the 10th payment)? PMT 13 14 15 c. What will interest expense be the first and second year? (complete the amortization table below) 16 First year 17 Second year 118 Applied to Applied to 19 Year Beg. Principal Payment Interest Principal End Principal Note amount 20 Year 1 No. of Years 21 Year 2 Interest Rate 22. Year 3 Future Value 23 Yeart4 Annual Pmt VA TO Sign In blem checking this device's licensestas. Please sign in with the Microsoft 365 account the device was activated with AU Company needs $1,000,000 cash for expansion. The CFO submits two options to the board for consideration: H ve A B C D G Applied to Applied to 19 Year Beg. Principal Payment Interest Principal End Principal Note amount 20 Year 1 No. of Years 21 Year 2 Interest Rate 22 Year 3 Future Value 23 Year 4 Annual Pmt 24 Year 5 25 Year 6 26 Year 7 27 Year 8 28 Year 9 29 Year 10 30 Totals 31 32 d. How much, in total, Will AU Company pay (principal and interest) over the 10 years? 33 34 35 If AU Company adopts option 12. 36 e. What will be the annual cash payment? 37 38 39 f. What will be the principal balance due at the end of 10 years (ak.a., at maturity)? 40 AN Antent Cathefire and recondiner Sheet1 AU Company needs $1,000,000 cash for expansion. The CFO submits two options to the board for consideration: B D 24 Years 25 Year 6 26 Year 7 27 Year 8 28 Year 9 29 Year 10 30 Totals 31 32 d. How much, in total, will AU Company pay (principal and interest) over the 10 years? 33 34 35 IF AU Company adopts option #2. 36 e. What will be the annual cash payment? 37 88 39. What will be the principal balance due at the end of 10 years (a.k.a., at maturity)? 40 41 42 g. What will interest expense be the first and second year? 43 First year 44 Second year 45 46 h. How much in total, will AU Company pay (principal and interest) over the 10 years? 47 Sheet1