Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e default application for reading PDF files? + ? 1. Record the sale of Cousin Company 2. Record all equity method entries on Mimi's

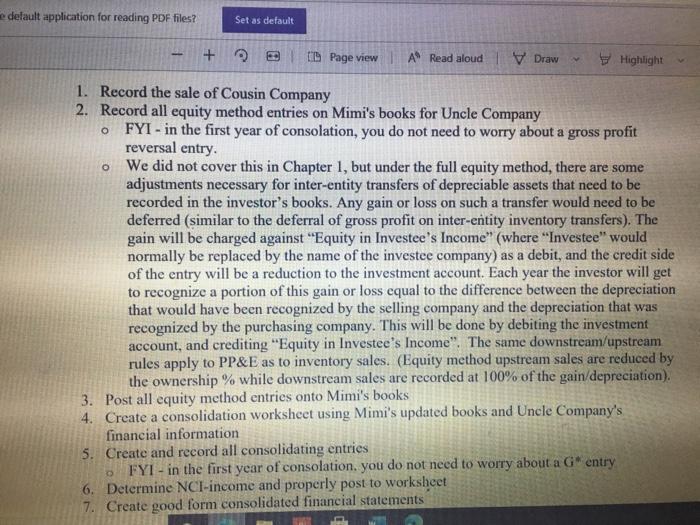

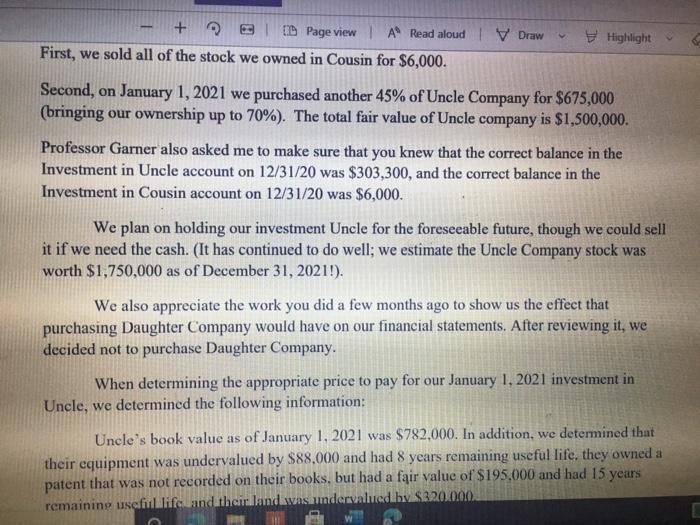

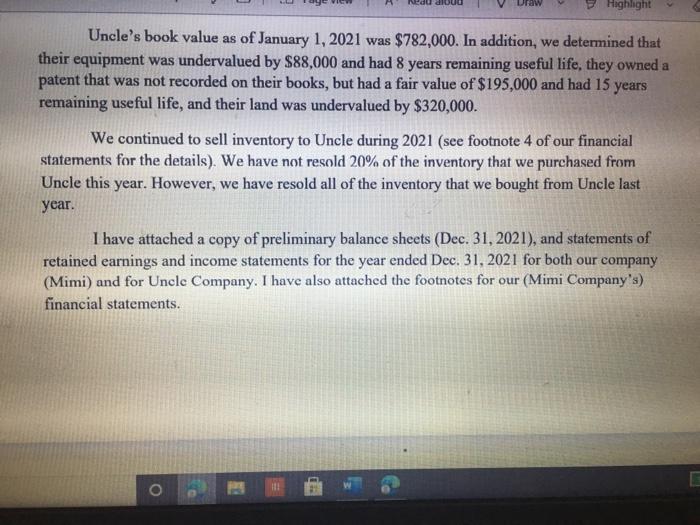

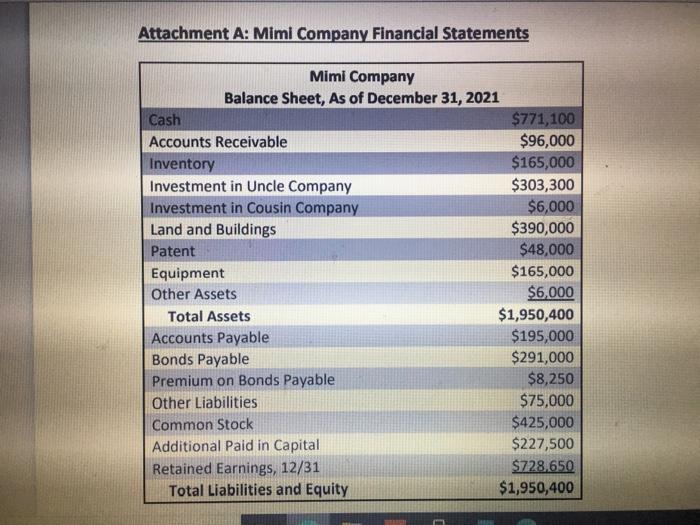

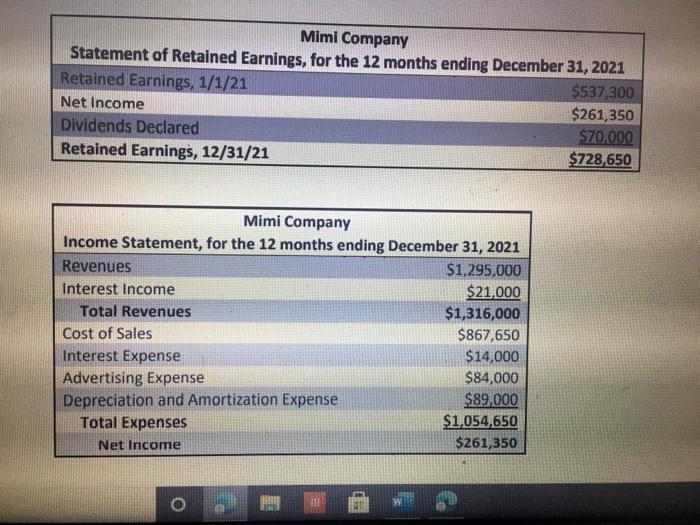

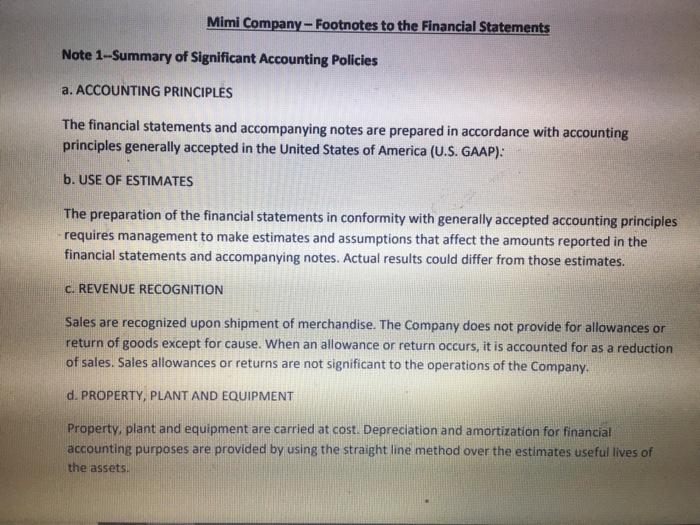

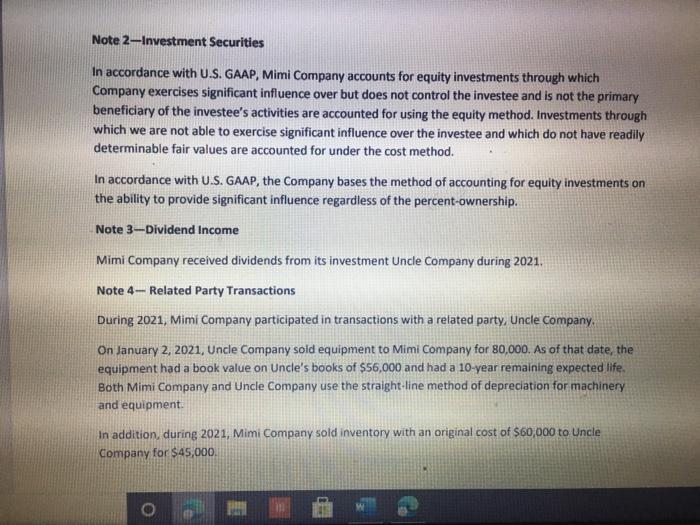

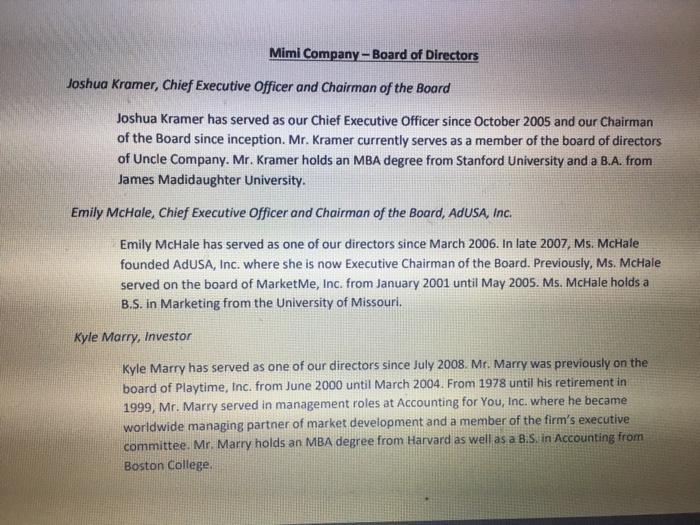

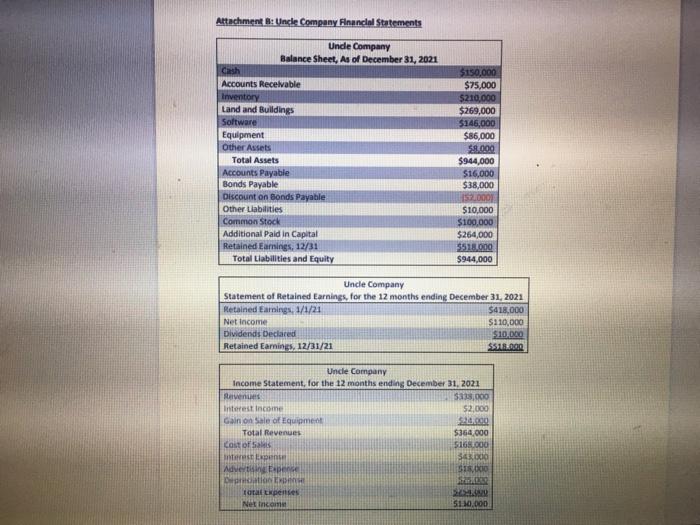

e default application for reading PDF files? + ? 1. Record the sale of Cousin Company 2. Record all equity method entries on Mimi's books for Uncle Company FYI - in the first year of consolation, you do not need to worry about a gross profit reversal entry. O Set as default - O Page view A Read aloud Draw N We did not cover this in Chapter 1, but under the full equity method, there are some adjustments necessary for inter-entity transfers of depreciable assets that need to be recorded in the investor's books. Any gain or loss on such a transfer would need to be deferred (similar to the deferral of gross profit on inter-entity inventory transfers). The gain will be charged against "Equity in Investee's Income" (where "Investee" would normally be replaced by the name of the investee company) as a debit, and the credit side of the entry will be a reduction to the investment account. Each year the investor will get to recognize a portion of this gain or loss equal to the difference between the depreciation that would have been recognized by the selling company and the depreciation that was recognized by the purchasing company. This will be done by debiting the investment account, and crediting "Equity in Investee's Income". The same downstream/upstream rules apply to PP&E as to inventory sales. (Equity method upstream sales are reduced by the ownership % while downstream sales are recorded at 100% of the gain/depreciation). Post all equity method entries onto Mimi's books Create a consolidation worksheet using Mimi's updated books and Uncle Company's financial information Highlight 3. 4. 5. Create and record all consolidating entries FYI - in the first year of consolation, you do not need to worry about a G* entry 6. Determine NCI-income and properly post to worksheet 7. Create good form consolidated financial statements +8 Page view A Read aloud First, we sold all of the stock we owned in Cousin for $6,000. - Draw V Highlight Second, on January 1, 2021 we purchased another 45% of Uncle Company for $675,000 (bringing our ownership up to 70%). The total fair value of Uncle company is $1,500,000. Professor Garner also asked me to make sure that you knew that the correct balance in the Investment in Uncle account on 12/31/20 was $303,300, and the correct balance in the Investment in Cousin account on 12/31/20 was $6,000. We plan on holding our investment Uncle for the foreseeable future, though we could sell it if we need the cash. (It has continued to do well; we estimate the Uncle Company stock was worth $1,750,000 as of December 31, 2021!). We also appreciate the work you did a few months ago to show us the effect that purchasing Daughter Company would have on our financial statements. After reviewing it, we decided not to purchase Daughter Company. When determining the appropriate price to pay for our January 1, 2021 investment in Uncle, we determined the following information: Uncle's book value as of January 1, 2021 was $782,000. In addition, we determined that their equipment was undervalued by $88,000 and had 8 years remaining useful life, they owned a patent that was not recorded on their books, but had a fair value of $195,000 and had 15 years remaining useful life and their land was undervalued by $320.000. Uncle's book value as of January 1, 2021 was $782,000. In addition, we determined that their equipment was undervalued by $88,000 and had 8 years remaining useful life, they owned a patent that was not recorded on their books, but had a fair value of $195,000 and had 15 years remaining useful life, and their land was undervalued by $320,000. Highlight We continued to sell inventory to Uncle during 2021 (see footnote 4 of our financial statements for the details). We have not resold 20% of the inventory that we purchased from Uncle this year. However, we have resold all of the inventory that we bought from Uncle last year. I have attached a copy of preliminary balance sheets (Dec. 31, 2021), and statements of retained earnings and income statements for the year ended Dec. 31, 2021 for both our company (Mimi) and for Uncle Company. I have also attached the footnotes for our (Mimi Company's) financial statements. O 111 Attachment A: Mimi Company Financial Statements Mimi Company Balance Sheet, As of December 31, 2021 Cash Accounts Receivable Inventory Investment in Uncle Company Investment in Cousin Company Land and Buildings Patent Equipment Other Assets Total Assets Accounts Payable Bonds Payable Premium on Bonds Payable Other Liabilities Common Stock Additional Paid in Capital Retained Earnings, 12/31 Total Liabilities and Equity $771,100 $96,000 $165,000 $303,300 $6,000 $390,000 $48,000 $165,000 $6,000 $1,950,400 $195,000 $291,000 $8,250 $75,000 $425,000 $227,500 $728,650 $1,950,400 Mimi Company Statement of Retained Earnings, for the 12 months ending December 31, 2021 Retained Earnings, 1/1/21 $537,300 Net Income $261,350 $70,000 $728,650 Dividends Declared Retained Earnings, 12/31/21 Mimi Company Income Statement, for the 12 months ending December 31, 2021 Revenues $1,295,000 Interest Income $21,000 $1,316,000 $867,650 $14,000 $84,000 $89,000 Total Revenues Cost of Sales Interest Expense Advertising Expense Depreciation and Amortization Expense Total Expenses Net Income 111 $1,054,650 $261,350 Mimi Company-Footnotes to the Financial Statements Note 1-Summary of Significant Accounting Policies a. ACCOUNTING PRINCIPLES The financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP): b. USE OF ESTIMATES The preparation of the financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates. c. REVENUE RECOGNITION Sales are recognized upon shipment of merchandise. The Company does not provide for allowances or return of goods except for cause. When an allowance or return occurs, it is accounted for as a reduction of sales. Sales allowances or returns are not significant to the operations of the Company. d. PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment are carried at cost. Depreciation and amortization for financial accounting purposes are provided by using the straight line method over the estimates useful lives of the assets. Note 2-Investment Securities In accordance with U.S. GAAP, Mimi Company accounts for equity investments through which Company exercises significant influence over but does not control the investee and is not the primary beneficiary of the investee's activities are accounted for using the equity method. Investments through which we are not able to exercise significant influence over the investee and which do not have readily determinable fair values are accounted for under the cost method. In accordance with U.S. GAAP, the Company bases the method of accounting for equity investments on the ability to provide significant influence regardless of the percent-ownership. Note 3-Dividend Income Mimi Company received dividends from its investment Uncle Company during 2021. Note 4- Related Party Transactions During 2021, Mimi Company participated in transactions with a related party, Uncle Company. On January 2, 2021, Uncle Company sold equipment to Mimi Company for 80,000. As of that date, the equipment had a book value on Uncle's books of $56,000 and had a 10-year remaining expected life. Both Mimi Company and Uncle Company use the straight-line method of depreciation for machinery and equipment. In addition, during 2021, Mimi Company sold inventory with an original cost of $60,000 to Uncle Company for $45,000. P Mimi Company-Board of Directors Joshua Kramer, Chief Executive Officer and Chairman of the Board Joshua Kramer has served as our Chief Executive Officer since October 2005 and our Chairman of the Board since inception. Mr. Kramer currently serves as a member of the board of directors of Uncle Company. Mr. Kramer holds an MBA degree from Stanford University and a B.A. from James Madidaughter University. Emily McHale, Chief Executive Officer and Chairman of the Board, AdUSA, Inc. Emily McHale has served as one of our directors since March 2006. In late 2007, Ms. McHale founded AdUSA, Inc. where she is now Executive Chairman of the Board. Previously, Ms. McHale served on the board of MarketMe, Inc. from January 2001 until May 2005. Ms. McHale holds a B.S. in Marketing from the University of Missouri. Kyle Marry, Investor Kyle Marry has served as one of our directors since July 2008. Mr. Marry was previously on the board of Playtime, Inc. from June 2000 until March 2004. From 1978 until his retirement in 1999, Mr. Marry served in management roles at Accounting for You, Inc. where he became worldwide managing partner of market development and a member of the firm's executive committee. Mr. Marry holds an MBA degree from Harvard as well as a B.S. in Accounting from Boston College. Attachment B: Uncle Company Financial Statements Uncle Company Balance Sheet, As of December 31, 2021 Cash Accounts Receivable Inventory Land and Buildings Software Equipment Other Assets Total Assets Accounts Payable Bonds Payable Discount on Bonds Payable Other Liabilities Common Stock Additional Paid in Capital Retained Earnings, 12/31 Total Liabilities and Equity Dividends Declared Retained Earnings, 12/31/21 $150,000 $75,000 $210,000 $269,000 $146,000 $86,000 $8.000 Cost of Sales Interest Expense Advertising Expense Depreciation Expe $944,000 $16,000 $38,000 Uncle Company Statement of Retained Earnings, for the 12 months ending December 31, 2021 Retained Earnings, 1/1/21 Net Income total expenses Net Income 152.000 $10,000 $100,000 $264,000 $518,000 $944,000 Uncle Company Income Statement, for the 12 months ending December 31, 2021 Revenues $338,000 Interest Income $2,000 Gain on Sale of Equipment $24.000 Total Revenues $364,000 5168,000 $43,000 1518,000 5241000 $418,000 $110,000 $10,000 $518.000 2624999 5130.000

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The process of recording equity method entries on the investor s books is as follows 1 Record the sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started