Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e) Differentiate between cash and carry and reverse cash and carry in CPO futures. f) Why some investors prefer to invest in derivatives market? Elaborate.

-

e) Differentiate between cash and carry and reverse cash and carry in CPO futures.

f) Why some investors prefer to invest in derivatives market? Elaborate.

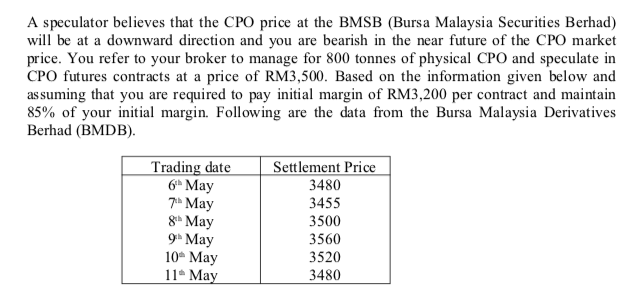

A speculator believes that the CPO price at the BMSB (Bursa Malaysia Securities Berhad) will be at a downward direction and you are bearish in the near future of the CPO market price. You refer to your broker to manage for 800 tonnes of physical CPO and speculate in CPO futures contracts at a price of RM3,500. Based on the information given below and assuming that you are required to pay initial margin of RM3,200 per contract and maintain 85% of your initial margin. Following are the data from the Bursa Malaysia Derivatives Berhad (BMDB)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started