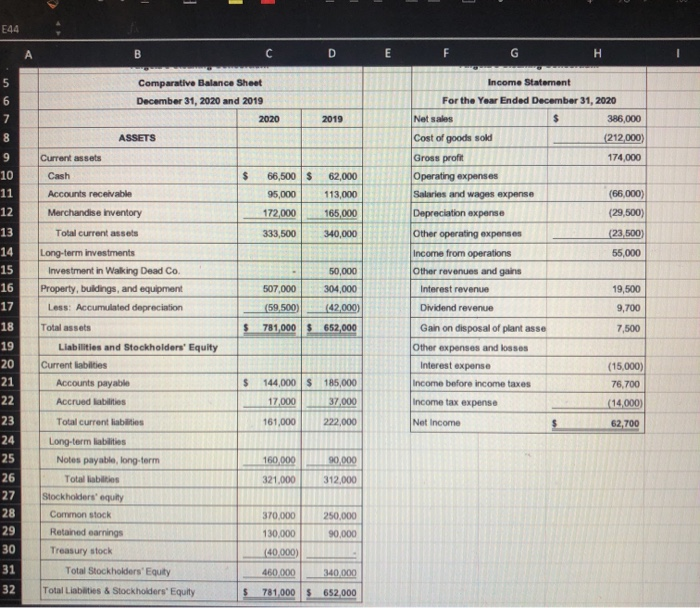

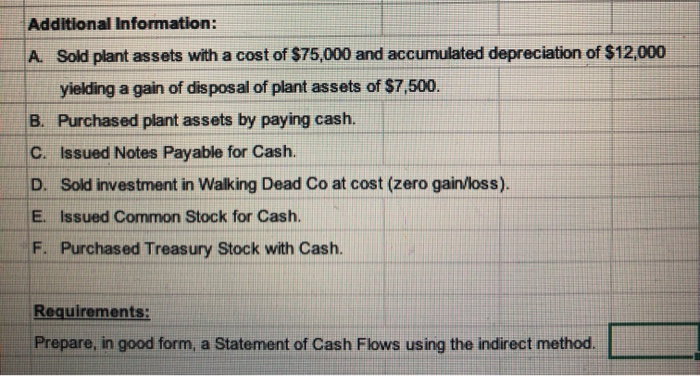

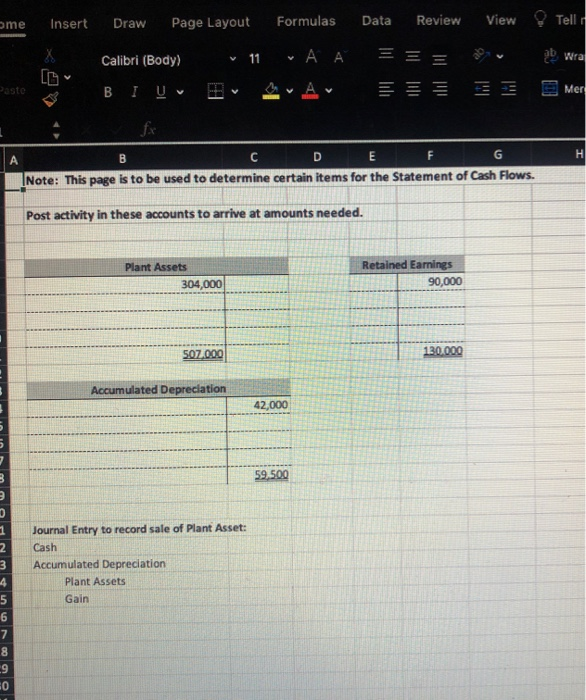

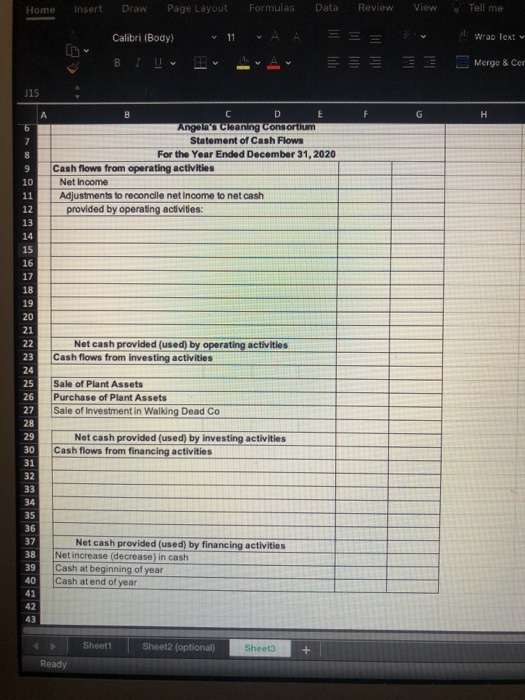

E - E44 A B C DEF G . 5 6 Comparative Balance Sheet December 31, 2020 and 2019 7 2020 2019 8 ASSETS 9 Current assets Cash $ 66,500 $ 62,000 113,000 95,000 172,000 165,000 333,500 340,000 Accounts receivable Merchandise inventory Total current assets Long-term investments Investment in Walking Dead Co. Property, buildings, and equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Accrued abilities 507.000 (59,500) Income Statement For the Year Ended December 31, 2020 Net sales $ 386,000 Cost of goods sold (212 000) Gross profit 174,000 Operating expenses Salaries and wages expense (66,000) Depreciation expense (29,500) Other operating expenses (23,500 Income from operations 55,000 Other revenues and gains Interest revenue 19,500 Dividend revenue 9,700 Gain on disposal of plant asse 7,500 Other expenses and losses Interest expense (15,000) Income before income taxes 76,700 Income tax expense (14,000) Net Income 62.700 50,000 304,000 (42.000) 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 $ 781,000$ 652,000 $ 144,000 $ 185,000 17,000 37,000 161,000 222,000 90,000 160.000 321,000 312,000 Total current liabilities Long-term liabilities Notes payable, long-term Total liabilities Stockholders' equity Common stock Retained earnings Treasury stock Total Stockholders' Equity Total Liabilities & Stockholders' Equity 250,000 370,000 130.000 90,000 (40,000) 31 460.000 340.000 32 7810005 652.000 Additional Information: A. Sold plant assets with a cost of $75,000 and accumulated depreciation of $12,000 yielding a gain of disposal of plant assets of $7,500. B. Purchased plant assets by paying cash. C. Issued Notes Payable for Cash. D. Sold investment in Walking Dead Co at cost (zero gain/loss). E. Issued Common Stock for Cash. F. Purchased Treasury Stock with Cash. Requirements: Prepare, in good form, a Statement of Cash Flows using the indirect method. ome Insert Draw Page Layout Formulas Data Review View Tell 11 Calibri (Body) E = Wral = Pasto BIU Av Mer H B C D E F G Note: This page is to be used to determine certain items for the Statement of Cash Flows. Post activity in these accounts to arrive at amounts needed. Plant Assets 304,000 Retained Earnings 90,000 507.000 130.000 Accumulated Depreciation 42,000 59.500 2 3 Journal Entry to record sale of Plant Asset: Cash Accumulated Depreciation Plant Assets Gain 5 6 7 8 9 50 Home Insert Draw Page Layout Formulas Data Review View Tell me Calibri (Body) 11 > Wrap Text BIL 33 Merge & Cer J15 F G H A B C D E 6 Angela's Cleaning Consortium 7 Statement of Cash Flows 8 For the Year Ended December 31, 2020 9 Cash flows from operating activities 10 Net Income 11 Adjustments to reconcile net income to net cash 12 provided by operating activities: 13 14 15 16 17 18 19 20 21 22 Net cash provided (used) by operating activities 23 Cash flows from investing activities 24 25 Sale of Plant Assets 26 Purchase of Plant Assets 27 Sale of Investment in Walking Dead Co 28 29 Net cash provided (used) by investing activities 30 Cash flows from financing activities 31 32 33 34 35 36 37 Net cash provided (used) by financing activities 38 Net increase (decrease) in cash 39 Cash at beginning of year 40 Cash at end of year 41 42 Sheet1 Sheet2 (optional Sheet3 + Ready