Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e empha- 1. What is a value-weighted average? Why does such an average place more e sis on such firms as Microsoft and ExxonMobil

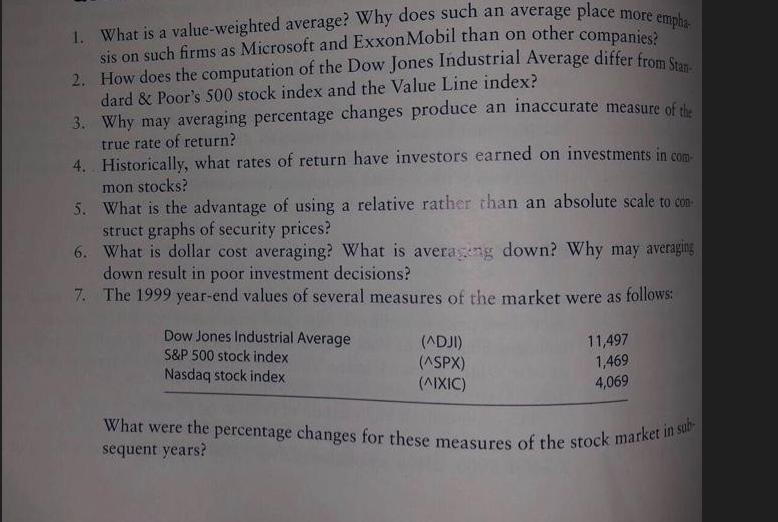

e empha- 1. What is a value-weighted average? Why does such an average place more e sis on such firms as Microsoft and ExxonMobil than on other companies? 2. How does the computation of the Dow Jones Industrial Average differ from Stan- dard & Poor's 500 stock index and the Value Line index? 3. Why may averaging percentage changes produce an inaccurate measure of the true rate of return? 4. Historically, what rates of return have investors earned on investments in com mon stocks? 5. What is the advantage of using a relative rather than an absolute scale to con struct graphs of security prices? 6. What is dollar cost averaging? What is averageng down? Why may averaging down result in poor investment decisions? 7. The 1999 year-end values of several measures of the market were as follows: Dow Jones Industrial Average S&P 500 stock index Nasdaq stock index (^DJI) (^SPX) (^IXIC) 11,497 1,469 4,069 What were the percentage changes for these measures of the stock market in sub- sequent years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 A valueweighted average is a method of calculating an average where each data point is weighted based on its relative value or market capitalization In the context of stock market indices suc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started