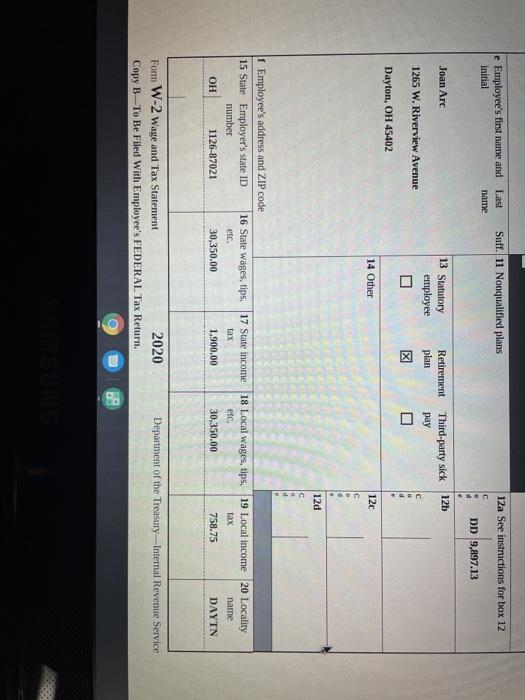

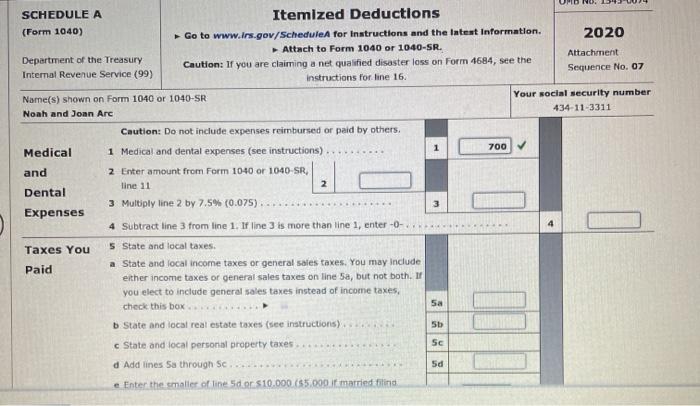

e Employee's first name and Initial 12a See instructions for box 12 Last name Suff. 11 Nonqualified plans C DD 9,897.13 Joan Arc 13 Statutory 12b Retirement plan Third-party sick pay employee 1265 W. Riverview Avenue c Dayton, OH 45402 14 Other 12c c 12d f Employee's address and ZIP code 15 State Employer's state ID 16 State Wages, tips, 17 State income number etc. tax OH 1126-87021 30,350.00 1,900.00 18 Local wages, tips, 19 Local income 20 Locality etc. tax name 30,350.00 758.75 DAYTN Department of the Treasury--Internal Revenue Service Form W-2 Wage and Tax Statement 2020 Copy B-To Be Filed With Employee's FEDERAL Tax Return. UMDRO SCHEDULE A Itemized Deductions (Form 1040) Go to www.lrs.gov/Schedule for instructions and the latest Information 2020 Attach to Form 1040 or 1040-SR. Department of the Treasury Attachment Caution: If you are claiming a net qualified disaster loss on Form 4684, see the Internal Revenue Service (99) Sequence No. 07 Instructions for line 16 Name(s) shown on Form 1040 or 1040-SR Your social security number Noah and Joan Arc 434-11-3311 Caution: Do not include expenses reimbursed or paid by others. 700 Medical and Dental Expenses 4 Taxes You Paid 1 Medical and dental expenses (see instructions) 2 Enter amount from Form 1040 or 1040-SR, line 11 2 3 Multiply line 2 by 7.5% (0.075) 4 Subtract line 3 from line 1. I line 3 is more than line 1, enter-O- State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. I you elect to include general sales taxes instead of income taxes, check this box State and local real estate taxes (see instructions) c State and local personal property taxes d Add lines Sa through sc. 5a Sb Sc 5d e Enter the smaller of line 5d or $10.000 (55.000 if married fiind e Employee's first name and Initial 12a See instructions for box 12 Last name Suff. 11 Nonqualified plans C DD 9,897.13 Joan Arc 13 Statutory 12b Retirement plan Third-party sick pay employee 1265 W. Riverview Avenue c Dayton, OH 45402 14 Other 12c c 12d f Employee's address and ZIP code 15 State Employer's state ID 16 State Wages, tips, 17 State income number etc. tax OH 1126-87021 30,350.00 1,900.00 18 Local wages, tips, 19 Local income 20 Locality etc. tax name 30,350.00 758.75 DAYTN Department of the Treasury--Internal Revenue Service Form W-2 Wage and Tax Statement 2020 Copy B-To Be Filed With Employee's FEDERAL Tax Return. UMDRO SCHEDULE A Itemized Deductions (Form 1040) Go to www.lrs.gov/Schedule for instructions and the latest Information 2020 Attach to Form 1040 or 1040-SR. Department of the Treasury Attachment Caution: If you are claiming a net qualified disaster loss on Form 4684, see the Internal Revenue Service (99) Sequence No. 07 Instructions for line 16 Name(s) shown on Form 1040 or 1040-SR Your social security number Noah and Joan Arc 434-11-3311 Caution: Do not include expenses reimbursed or paid by others. 700 Medical and Dental Expenses 4 Taxes You Paid 1 Medical and dental expenses (see instructions) 2 Enter amount from Form 1040 or 1040-SR, line 11 2 3 Multiply line 2 by 7.5% (0.075) 4 Subtract line 3 from line 1. I line 3 is more than line 1, enter-O- State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. I you elect to include general sales taxes instead of income taxes, check this box State and local real estate taxes (see instructions) c State and local personal property taxes d Add lines Sa through sc. 5a Sb Sc 5d e Enter the smaller of line 5d or $10.000 (55.000 if married fiind