Answered step by step

Verified Expert Solution

Question

1 Approved Answer

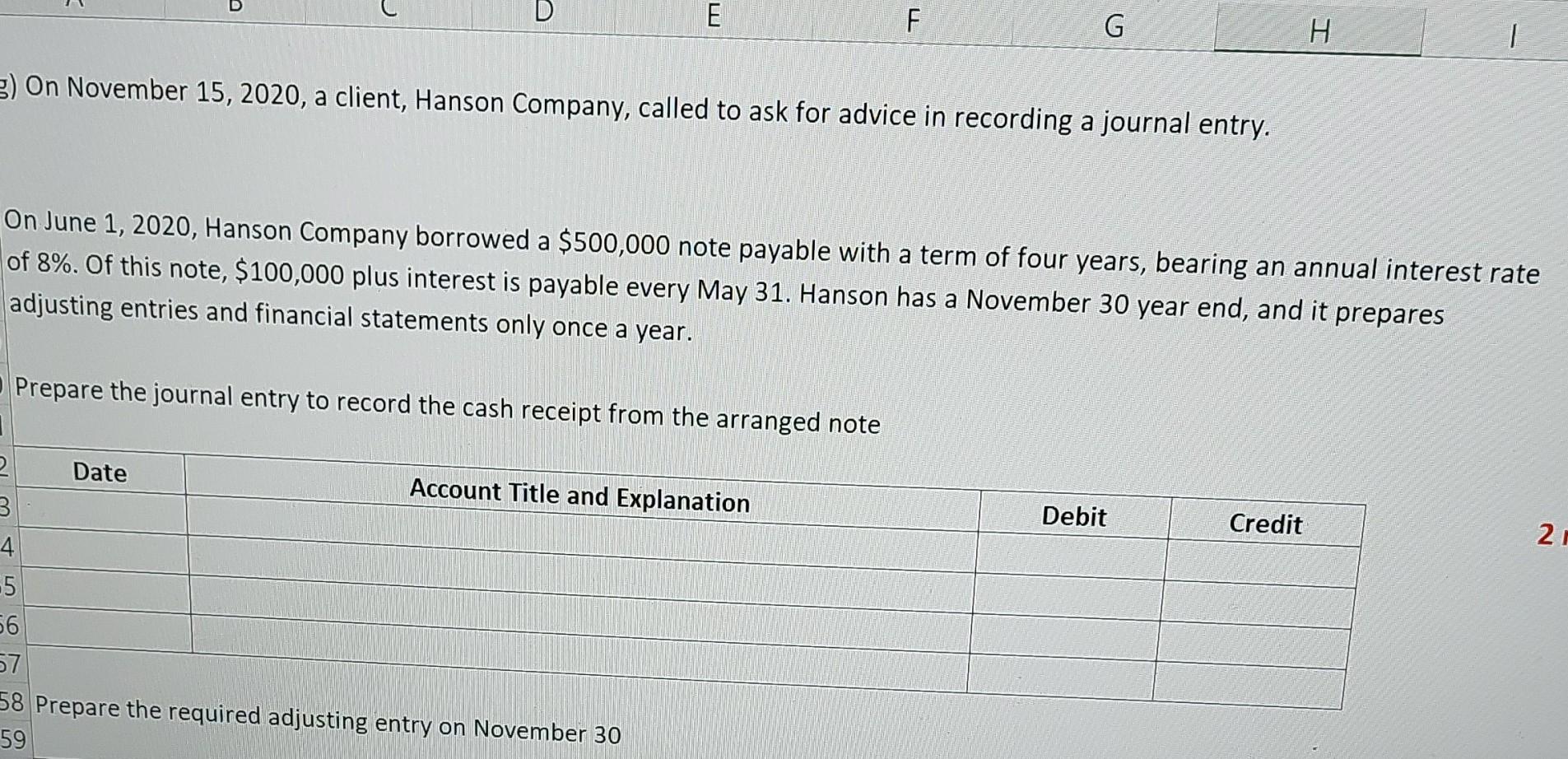

E F G H 4 I 3) On November 15, 2020, a client, Hanson Company, called to ask for advice in recording a journal entry.

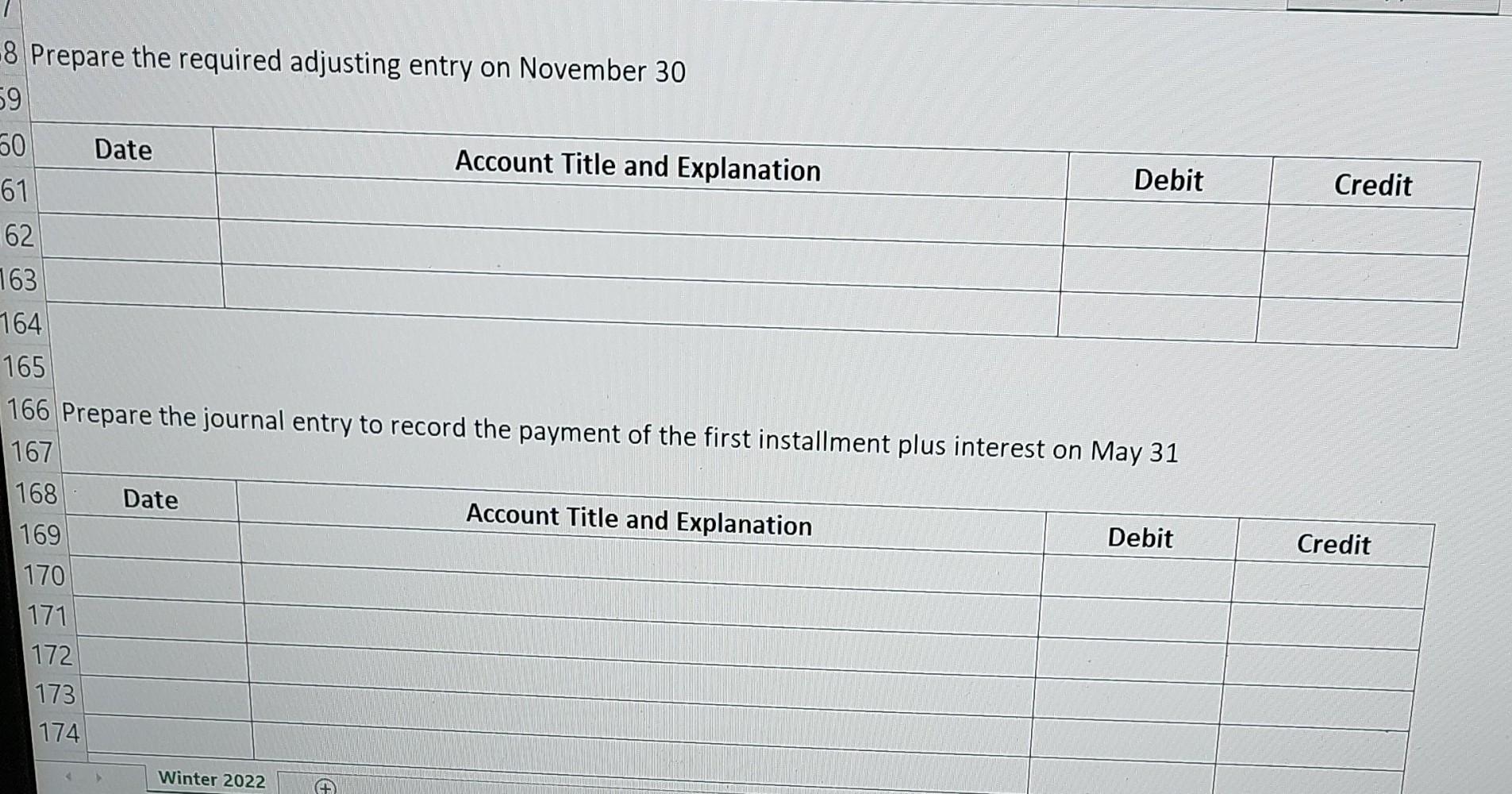

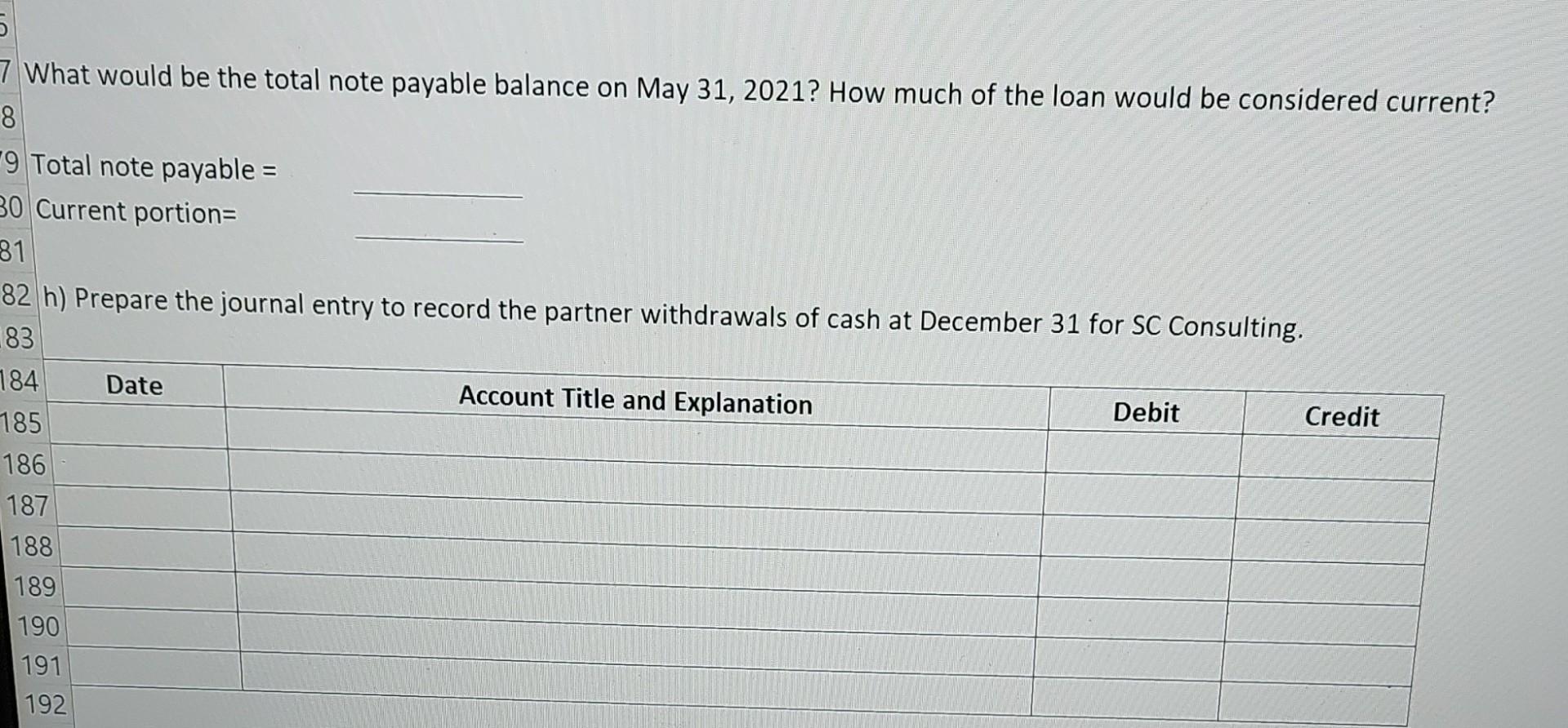

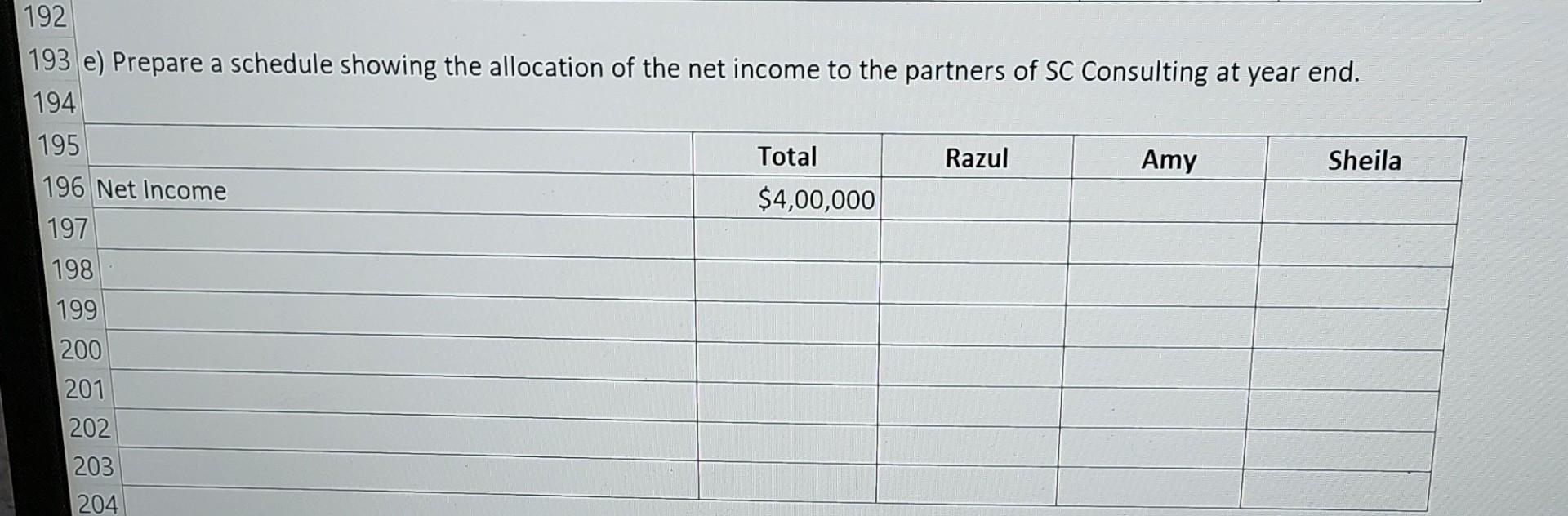

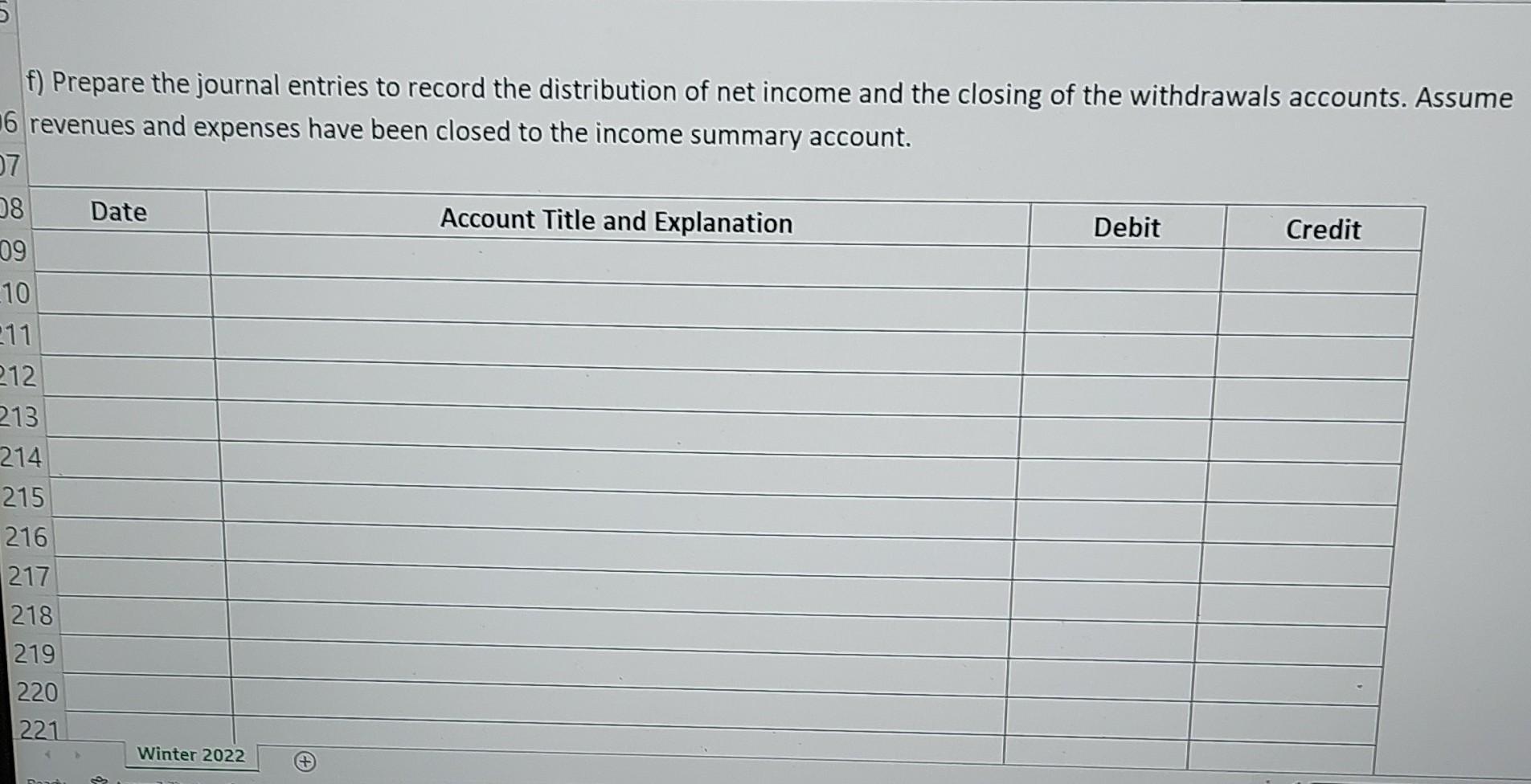

E F G H 4 I 3) On November 15, 2020, a client, Hanson Company, called to ask for advice in recording a journal entry. On June 1, 2020, Hanson Company borrowed a $500,000 note payable with a term of four years, bearing an annual interest rate of 8%. Of this note, $100,000 plus interest is payable every May 31. Hanson has a November 30 year end, and it prepares adjusting entries and financial statements only once a year. Prepare the journal entry to record the cash receipt from the arranged note 2 Date Account Title and Explanation Debit 3 4 Credit 21 -5 66 57 58 Prepare the required adjusting entry on November 30 59 Z o Credit -8 Prepare the required adjusting entry on November 30 59 50 Date Account Title and Explanation Debit 61 62 163 764 165 166 Prepare the journal entry to record the payment of the first installment plus interest on May 31 167 168 Date Account Title and Explanation Debit 169 170 171 172 173 Credit (174 Winter 2022 7 What would be the total note payable balance on May 31, 2021? How much of the loan would be considered current? 8 -9 Total note payable = 30 Current portion= 81 82 h) Prepare the journal entry to record the partner withdrawals of cash at December 31 for SC Consulting, 83 184 Date Account Title and Explanation Debit Credit 185 186 187 188 189 190 191 192 192 193 e) Prepare a schedule showing the allocation of the net income to the partners of SC Consulting at year end. 194 195 Total Razul Amy Sheila 196 Net Income $4,00,000 197 198 199 200 201 202 203 204 f) Prepare the journal entries to record the distribution of net income and the closing of the withdrawals accounts. Assume 16 revenues and expenses have been closed to the income summary account. 07 28 Date Account Title and Explanation Debit Credit 09 -10 -11 212 213 214 215 216 217 218 219 220 221 Winter 2022 +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started