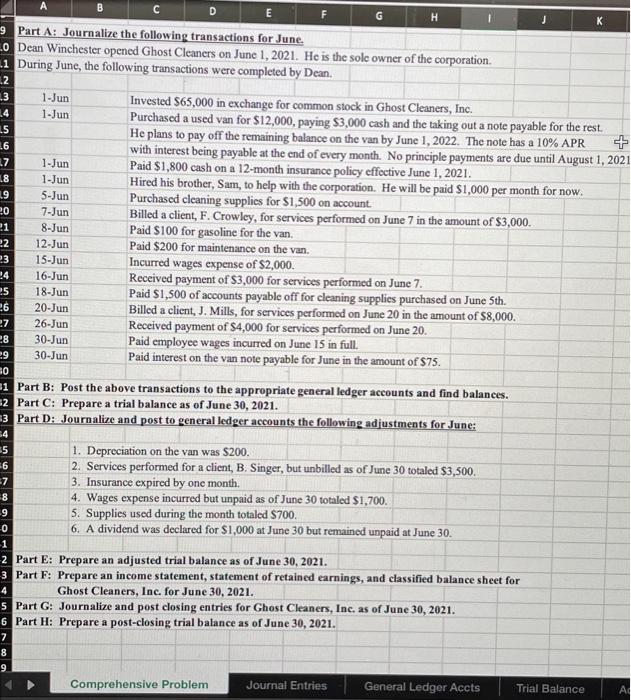

E F H K W No 060 Vouw N O 17 18 19 20 23 24 25 0 G 9 Part A: Journalize the following transactions for June. 20 Dean Winchester opened Ghost Cleaners on June 1, 2021. He is the sole owner of the corporation. 1 During June, the following transactions were completed by Dean. 1.3 1-Jun Invested $65,000 in exchange for common stock in Ghost Cleaners, Inc. 14 1-Jun Purchased a used van for $12,000, paying $3,000 cash and the taking out a note payable for the rest. 25 He plans to pay off the remaining balance on the van by June 1, 2022. The note has a 10% APR 16 with interest being payable at the end of every month. No principle payments are due until August 1, 2021 1-Jun Paid $1,800 cash on a 12-month insurance policy effective June 1, 2021. 1-Jun Hired his brother, Sam, to help with the corporation. He will be paid $1,000 per month for now. 5-Jun Purchased cleaning supplies for $1,500 on account 7-Jun Billed a client, F. Crowley, for services performed on June 7 in the amount of $3,000. 8-Jun Paid $100 for gasoline for the van. 12-Jun Paid $200 for maintenance on the van. 15-Jun Incurred wages expense of $2,000. 16-Jun Received payment of $3,000 for services performed on June 7. 18-Jun Paid $1,500 of accounts payable off for cleaning supplies purchased on June 5th. 26 20-Jun Billed a client, J. Mills, for services performed on June 20 in the amount of $8,000. 26-Jun Received payment of $4,000 for services performed on June 20. 30-Jun Paid employee wages incurred on June 15 in full. 29 30-Jun Paid interest on the van note payable for June in the amount of $75. 30 =1 Part B: Post the above transactions to the appropriate general ledger accounts and find balances. 32 Part C: Prepare a trial balance as of June 30, 2021. 3 Part D: Journalize and post to general ledger accounts the following adjustments for June 1. Depreciation on the van was $200. 2. Services performed for a client, B. Singer, but unbilled as of June 30 totaled $3,500. 3. Insurance expired by one month. 4. Wages expense incurred but unpaid as of June 30 totaled $1,700. 5. Supplies used during the month totaled $700. 6. A dividend was declared for $1,000 at June 30 but remained unpaid at June 30. 2 Part E: Prepare an adjusted trial balance as of June 30, 2021. 3 Part F: Prepare an income statement, statement of retained earnings, and classified balance sheet for Ghost Cleaners, Inc. for June 30, 2021. 5 Part G: Journalize and post closing entries for Ghost Cleaners, Inc. as of June 30, 2021. 6 Part H: Prepare a post-closing trial balance as of June 30, 2021. 27 28 54 35 6 7 8 9 0 1 00 O o 4 7 8 9 Comprehensive Problem Journal Entries General Ledger Accts Trial Balance AL