Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e) For the loan in part (a), assume you are allowed to prepay 10% of the loan balance at the end of Year 2, without

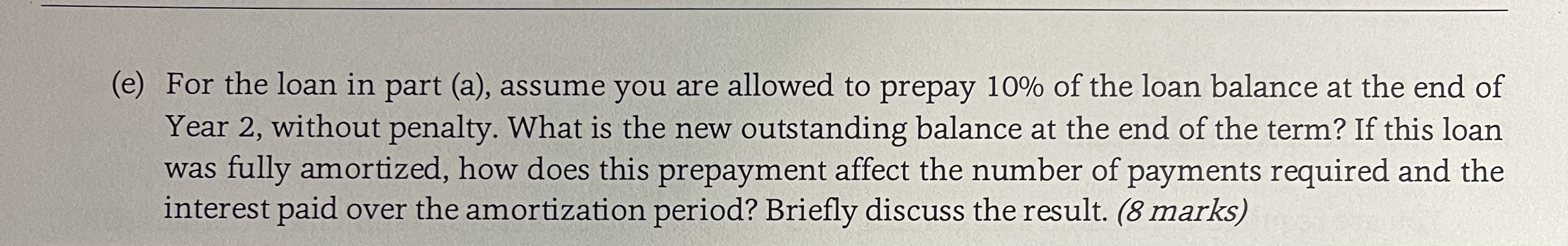

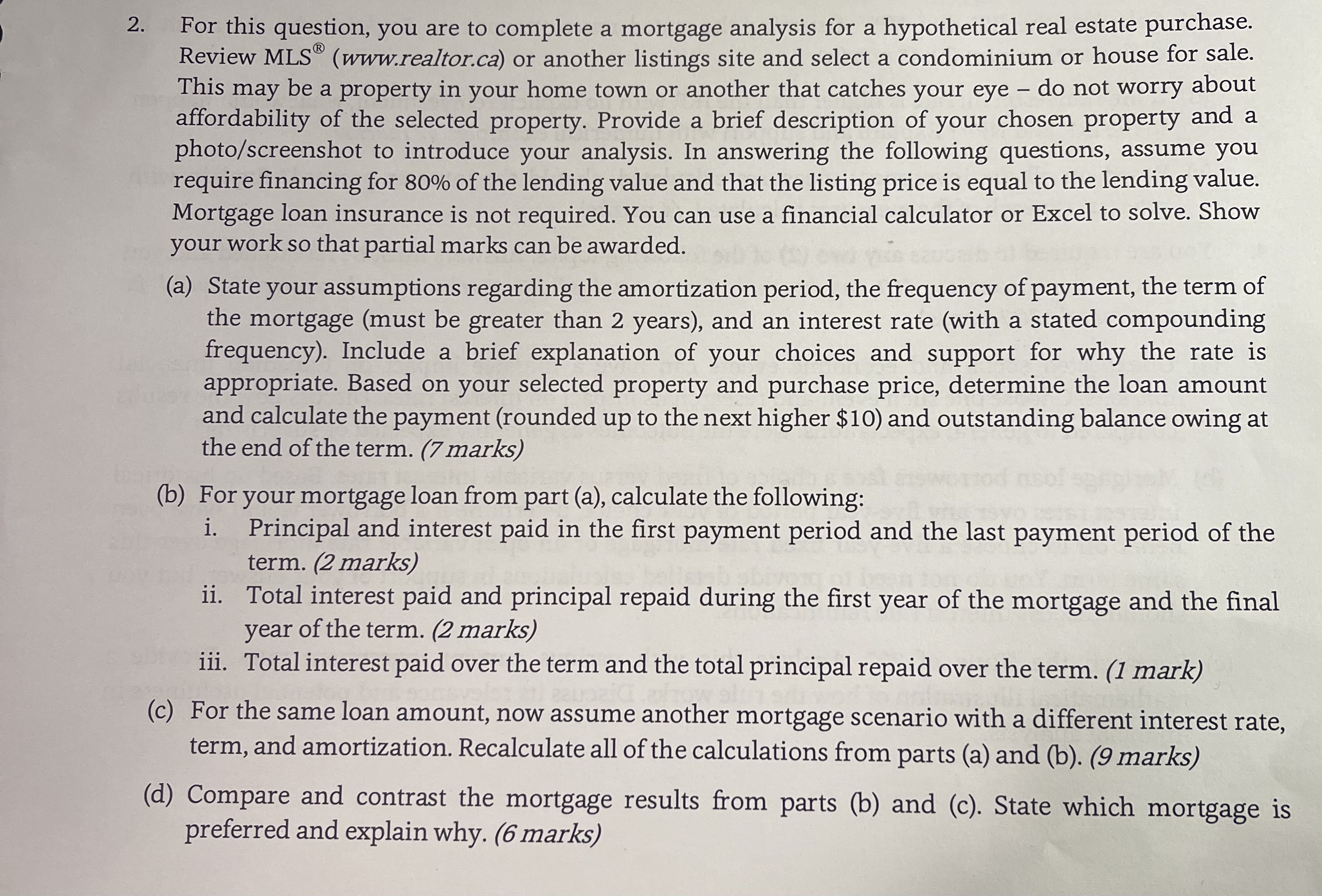

e) For the loan in part (a), assume you are allowed to prepay 10% of the loan balance at the end of Year 2, without penalty. What is the new outstanding balance at the end of the term? If this loan was fully amortized, how does this prepayment affect the number of payments required and the interest paid over the amortization period? Briefly discuss the result. ( 8 marks) 2. For this question, you are to complete a mortgage analysis for a hypothetical real estate purchase. Review MLS (www.realtor.ca) or another listings site and select a condominium or house for sale. This may be a property in your home town or another that catches your eye - do not worry about affordability of the selected property. Provide a brief description of your chosen property and a photo/screenshot to introduce your analysis. In answering the following questions, assume you require financing for 80% of the lending value and that the listing price is equal to the lending value. Mortgage loan insurance is not required. You can use a financial calculator or Excel to solve. Show your work so that partial marks can be awarded. (a) State your assumptions regarding the amortization period, the frequency of payment, the term of the mortgage (must be greater than 2 years), and an interest rate (with a stated compounding frequency). Include a brief explanation of your choices and support for why the rate is appropriate. Based on your selected property and purchase price, determine the loan amount and calculate the payment (rounded up to the next higher \$10) and outstanding balance owing at the end of the term. ( 7 marks) (b) For your mortgage loan from part (a), calculate the following: i. Principal and interest paid in the first payment period and the last payment period of the term. (2 marks) ii. Total interest paid and principal repaid during the first year of the mortgage and the final year of the term. ( 2 marks) iii. Total interest paid over the term and the total principal repaid over the term. (1 mark) (c) For the same loan amount, now assume another mortgage scenario with a different interest rate, term, and amortization. Recalculate all of the calculations from parts (a) and (b). (9 marks) (d) Compare and contrast the mortgage results from parts (b) and (c). State which mortgage is preferred and explain why. (6 marks)

e) For the loan in part (a), assume you are allowed to prepay 10% of the loan balance at the end of Year 2, without penalty. What is the new outstanding balance at the end of the term? If this loan was fully amortized, how does this prepayment affect the number of payments required and the interest paid over the amortization period? Briefly discuss the result. ( 8 marks) 2. For this question, you are to complete a mortgage analysis for a hypothetical real estate purchase. Review MLS (www.realtor.ca) or another listings site and select a condominium or house for sale. This may be a property in your home town or another that catches your eye - do not worry about affordability of the selected property. Provide a brief description of your chosen property and a photo/screenshot to introduce your analysis. In answering the following questions, assume you require financing for 80% of the lending value and that the listing price is equal to the lending value. Mortgage loan insurance is not required. You can use a financial calculator or Excel to solve. Show your work so that partial marks can be awarded. (a) State your assumptions regarding the amortization period, the frequency of payment, the term of the mortgage (must be greater than 2 years), and an interest rate (with a stated compounding frequency). Include a brief explanation of your choices and support for why the rate is appropriate. Based on your selected property and purchase price, determine the loan amount and calculate the payment (rounded up to the next higher \$10) and outstanding balance owing at the end of the term. ( 7 marks) (b) For your mortgage loan from part (a), calculate the following: i. Principal and interest paid in the first payment period and the last payment period of the term. (2 marks) ii. Total interest paid and principal repaid during the first year of the mortgage and the final year of the term. ( 2 marks) iii. Total interest paid over the term and the total principal repaid over the term. (1 mark) (c) For the same loan amount, now assume another mortgage scenario with a different interest rate, term, and amortization. Recalculate all of the calculations from parts (a) and (b). (9 marks) (d) Compare and contrast the mortgage results from parts (b) and (c). State which mortgage is preferred and explain why. (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started