Question

(e) Forecast Cisco's sales, NOPAT, and NOA for years 2017 through 2020 and the terminal period. Note, the forecasted sales growth rates are available in

(e) Forecast Cisco's sales, NOPAT, and NOA for years 2017 through 2020 and the terminal period. Note, the forecasted sales growth rates are available in the case

(f) Estimate the value of a share of Cisco common stock as of July 30, 2016 using the discounted cash flow (DCF) model and sales, NOPAT and NOA forecast in (e); Describe the DCF model, and explain the computations and results

(g) Cisco stock closed at $31.47 on September 8, 2016, the date the Form 10-K was filed with the SEC. How does your DCF valuation estimates compare with this closing price? What do you believe are some reasons for the difference? What investment decision is suggested from your results?

(h) Assume that Ciscos weighted average cost of capital (WACC) increased to 15% due to the high inflation. Estimate the value of a share of Cisco common stock as of July 30, 2016, using the discounted cash flow (DCF) model and the forecast in (e); Describe the computations, and discuss how the increase in WACC affects Ciscos stock price.

(i) Discuss how inflation, federal monetary policy, credit ratings, and sales growth opportunities affect Ciscos equity valuation based on the DCF and CAPM models

(j) Are there other equity valuation models? Please discuss the advantages and disadvantages of different equity valuation models

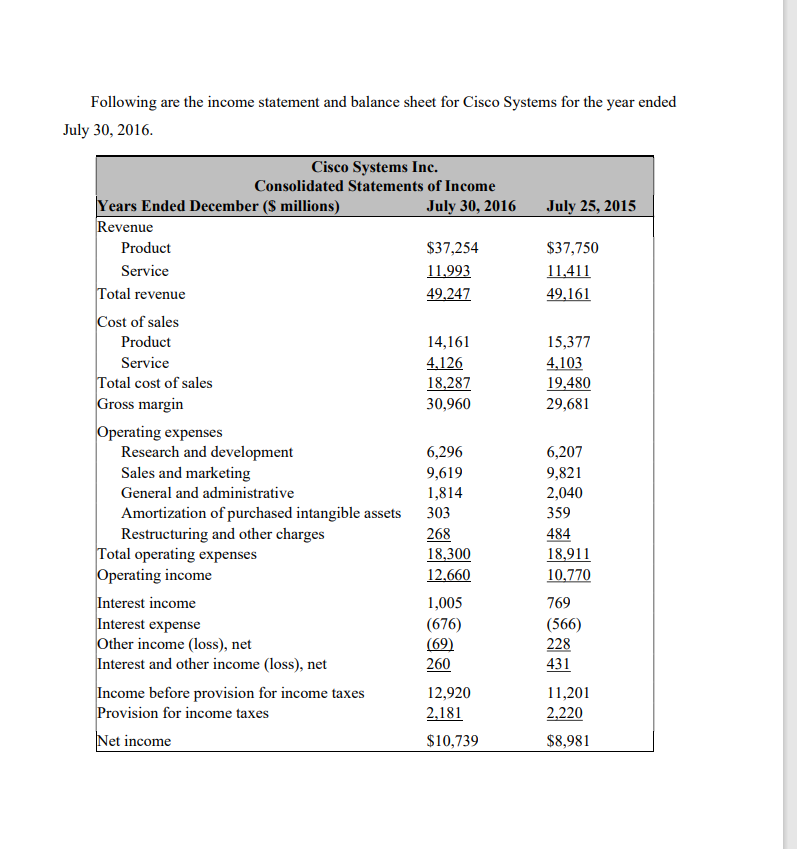

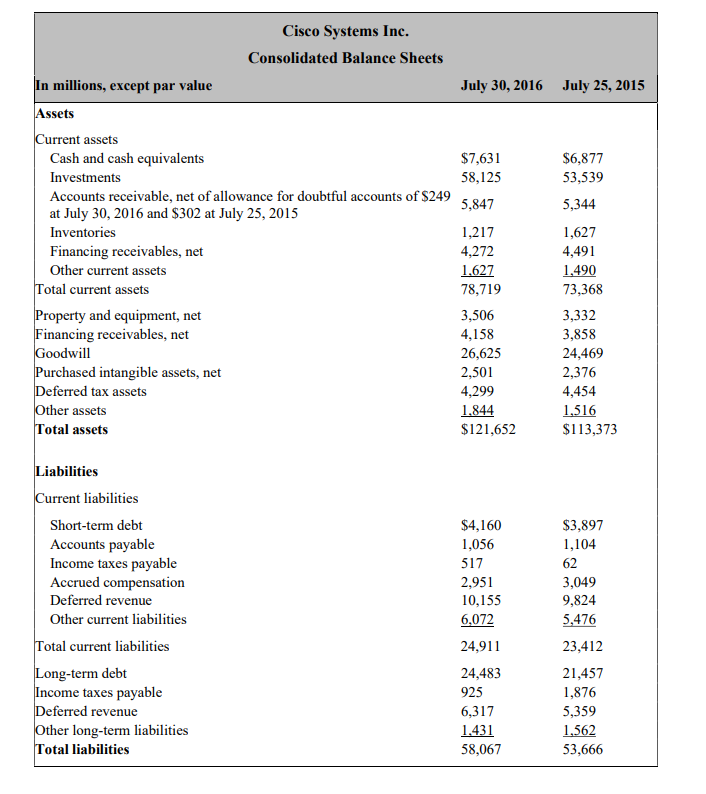

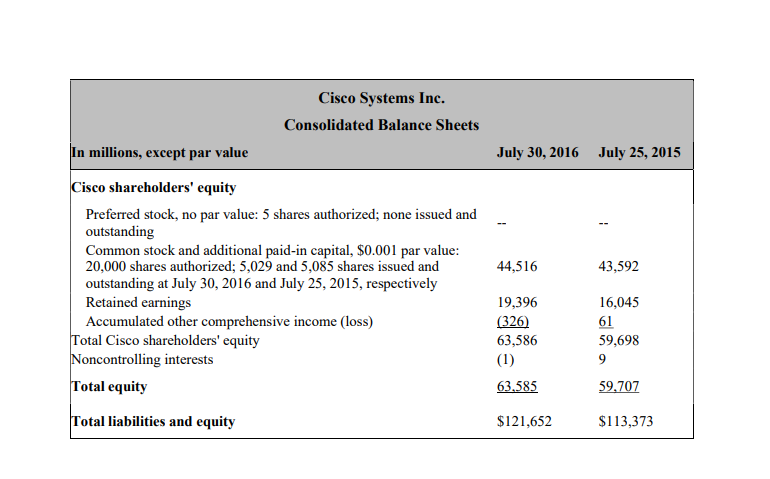

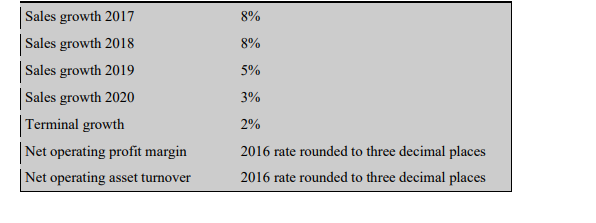

Following are the income statement and balance sheet for Cisco Systems for the year ended July 30, 2016. \begin{tabular}{|ll|} \hline Sales growth 2017 & 8% \\ Sales growth 2018 & 8% \\ Sales growth 2019 & 5% \\ Sales growth 2020 & 3% \\ Terminal growth & 2% \\ Net operating profit margin & 2016 rate rounded to three decimal places \\ Net operating asset turnover & 2016 rate rounded to three decimal places \\ \hline \end{tabular}

Following are the income statement and balance sheet for Cisco Systems for the year ended July 30, 2016. \begin{tabular}{|ll|} \hline Sales growth 2017 & 8% \\ Sales growth 2018 & 8% \\ Sales growth 2019 & 5% \\ Sales growth 2020 & 3% \\ Terminal growth & 2% \\ Net operating profit margin & 2016 rate rounded to three decimal places \\ Net operating asset turnover & 2016 rate rounded to three decimal places \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started