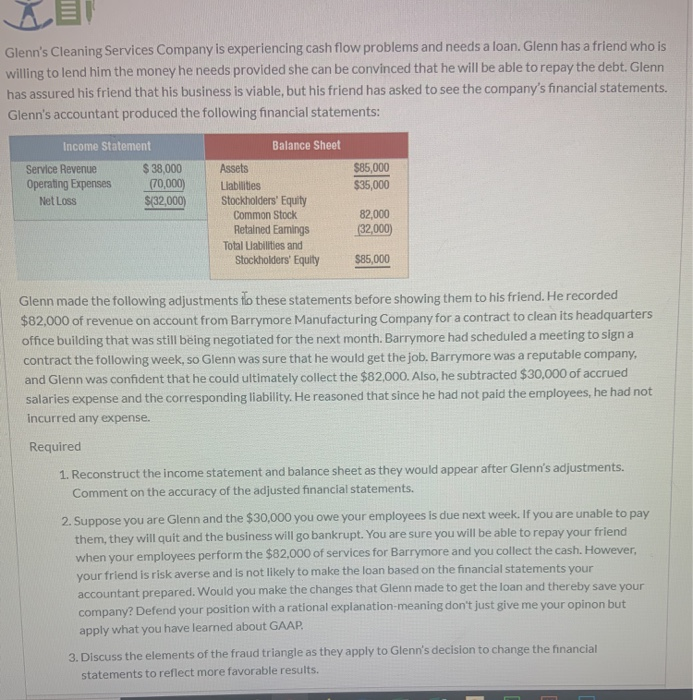

E Glenn's Cleaning Services Company is experiencing cash flow problems and needs a loan. Glenn has a friend who is willing to lend him the money he needs provided she can be convinced that he will be able to repay the debt. Glenn has assured his friend that his business is viable, but his friend has asked to see the company's financial statements. Glenn's accountant produced the following financial statements: Income Statement Service Revenue $ 38,000 Operating Expenses (70,000) Net Loss $(32,000) $85,000 $35,000 Balance Sheet Assets Liabilities Stockholders' Equity Common Stock Retained Eamings Total Liabilities and Stockholders' Equity 82,000 32,000 $85,000 Glenn made the following adjustments to these statements before showing them to his friend. He recorded $82,000 of revenue on account from Barrymore Manufacturing Company for a contract to clean its headquarters office building that was still being negotiated for the next month. Barrymore had scheduled a meeting to sign a contract the following week, so Glenn was sure that he would get the job. Barrymore was a reputable company, and Glenn was confident that he could ultimately collect the $82,000. Also, he subtracted $30,000 of accrued salaries expense and the corresponding liability. He reasoned that since he had not paid the employees, he had not incurred any expense. Required 1. Reconstruct the income statement and balance sheet as they would appear after Glenn's adjustments. Comment on the accuracy of the adjusted financial statements. 2. Suppose you are Glenn and the $30,000 you owe your employees is due next week. If you are unable to pay them, they will quit and the business will go bankrupt. You are sure you will be able to repay your friend when your employees perform the $82,000 of services for Barrymore and you collect the cash. However, your friend is risk averse and is not likely to make the loan based on the financial statements your accountant prepared. Would you make the changes that Glenn made to get the loan and thereby save your company? Defend your position with a rational explanation meaning don't just give me your opinon but apply what you have learned about GAAP. 3. Discuss the elements of the fraud triangle as they apply to Glenn's decision to change the financial statements to reflect more favorable results