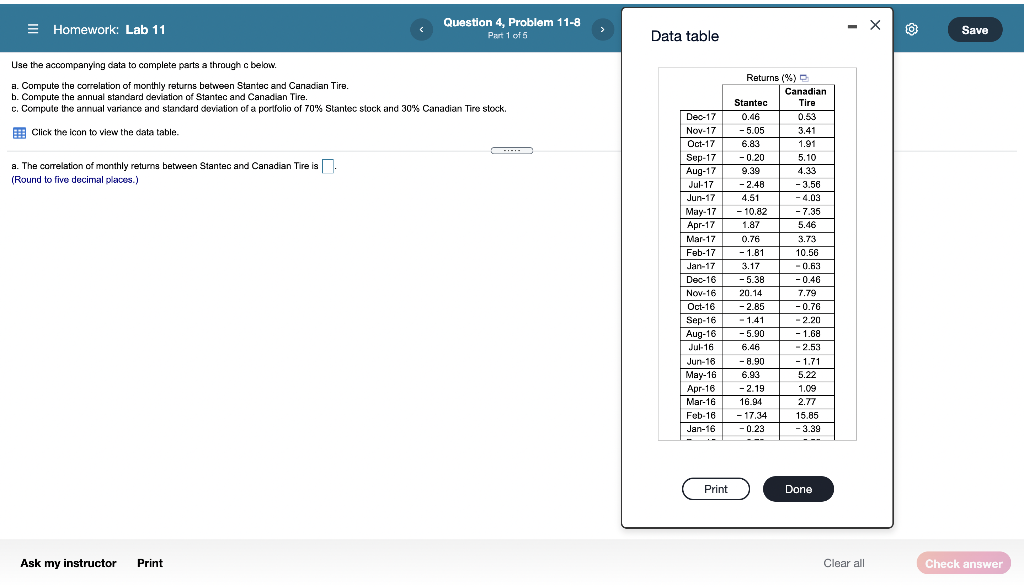

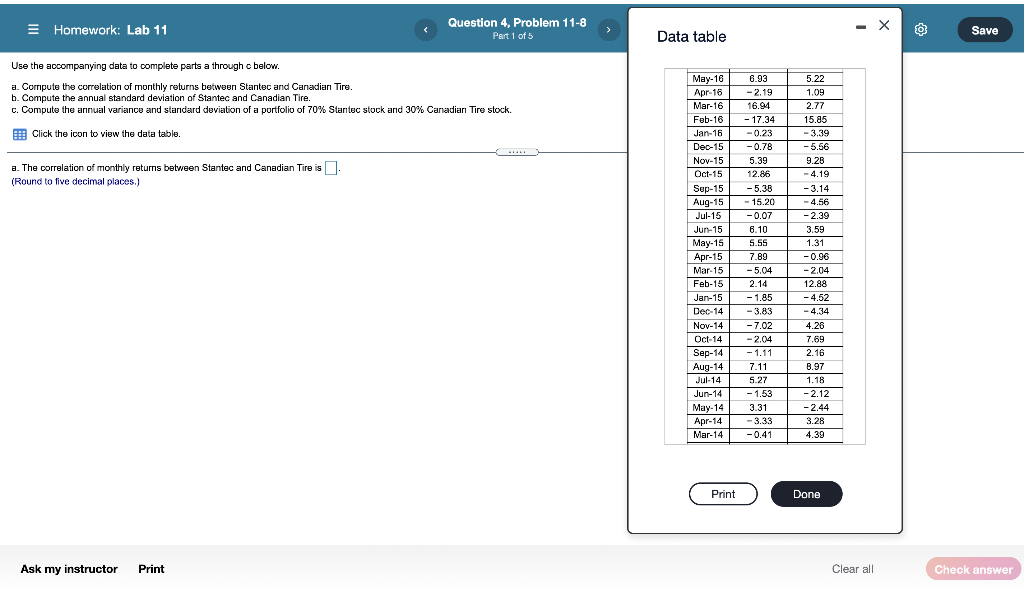

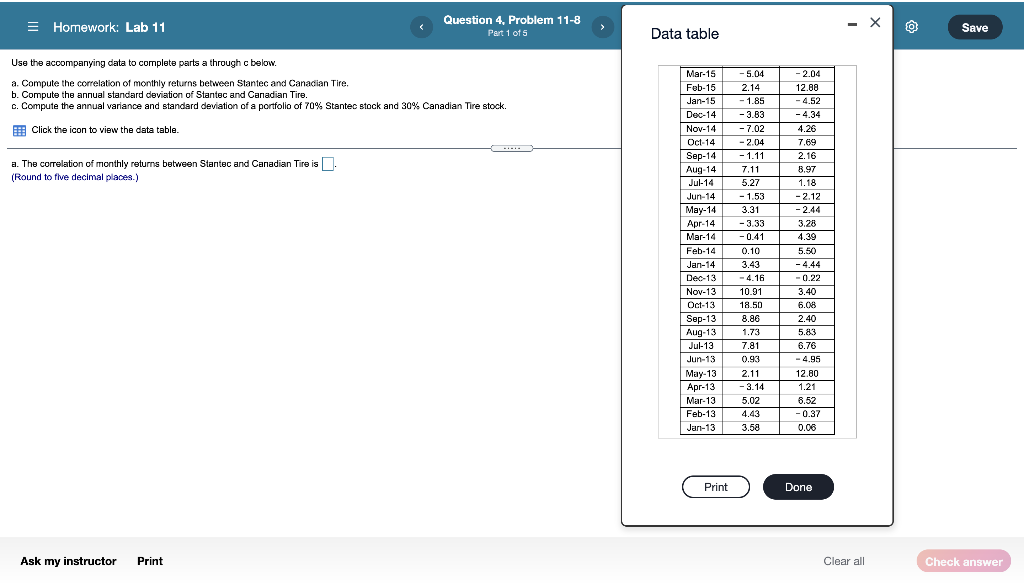

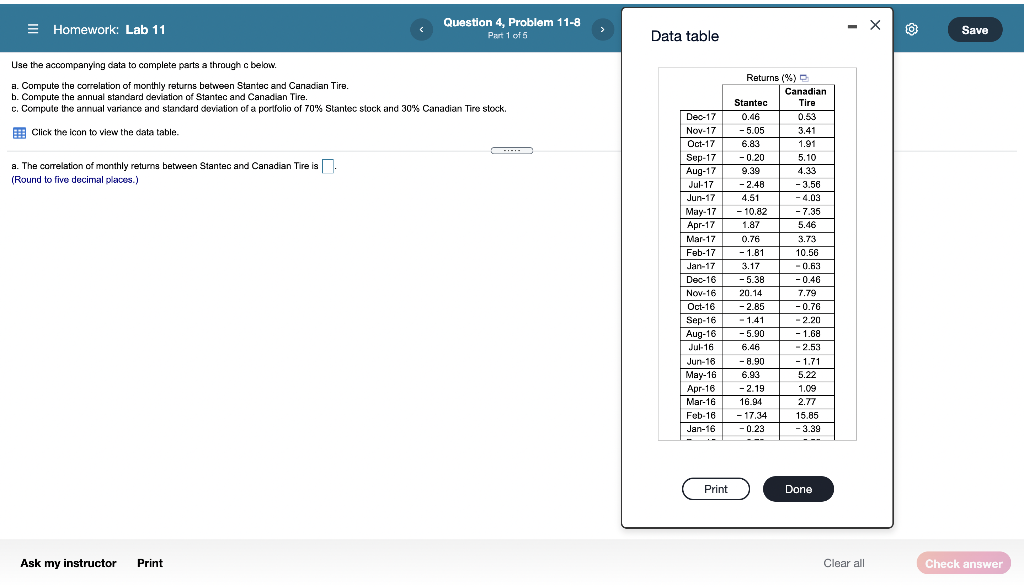

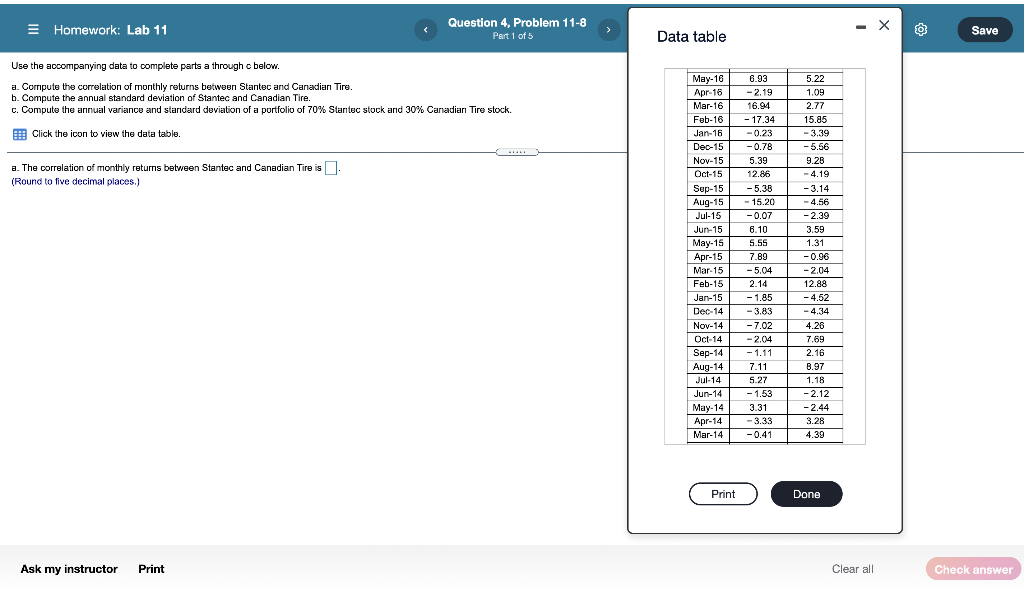

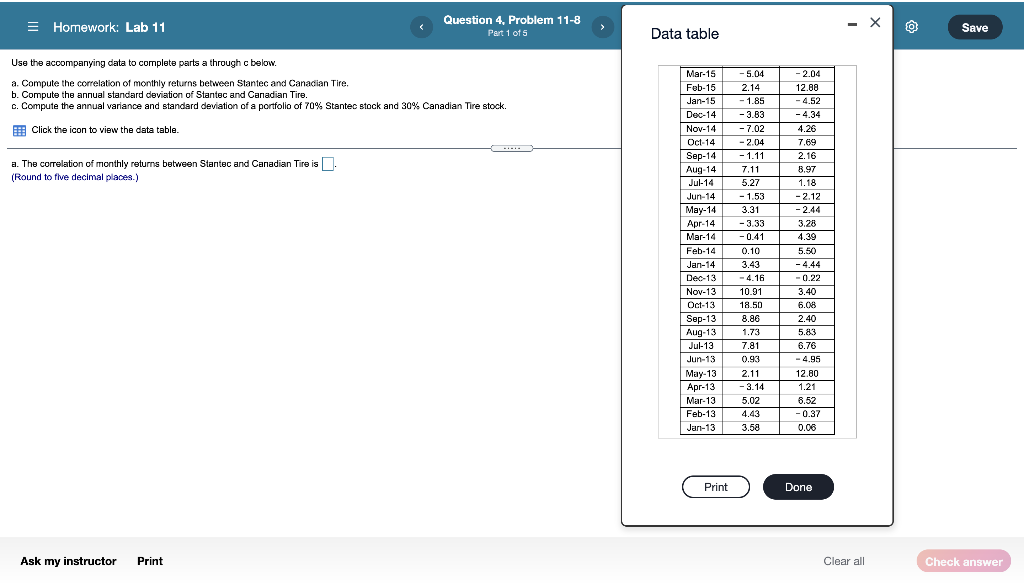

E Homework: Lab 11 Question 4, Problem 11-8 Part 1 of 5 1 X Data table Save Use the accompanying data to complete parts a through c below. a. Compute the correlation of monthly returns between Stantec and Canadian Tire. b. Compute the annual standard deviation of Stantec and Canadian Tire. c. Compute the annual variance and standard deviation of a portfolio of 70% Stanloc stock and 30% Canadian Tire stock. Click the icon to view the data table. - a. The correlation of monthly returns between Stantec and Canadian Tire is. ( (Round to five decimal places.) Dec-17 Nov-17 Oct-17 Sep-17 Aug-17 Jul-17 Jun-17 May-17 Apr-17 Mar-17 Feb-17 Jan-17 Dec-16 Nov-16 Oct-16 Sep-16 Aug-16 Jul-16 Jun-18 May-16 Apr-16 Mar-16 Feb-16 Jan-16 Returns (%) Canadian Stantec Tire 0.46 0.53 -5.05 3.41 6.83 1.91 -0.20 5.10 9.39 4.33 -2.48 -3.56 4.51 -4.03 - 10.82 - 7.35 1.87 5.46 0.76 3.73 - 1.81 10.56 3.17 -0.62 -5.38 -0.46 20.14 7.79 -2.85 -0.76 -1.41 - 2.20 -5.90 -1.68 6.46 -2.53 - 8.90 - 1.71 6.93 5.22 -2.19 1.09 16.94 - 17.34 15.85 -0.23 - 3.39 2.77 Print Done Ask my instructor Print Clear all Check answer Homework: Lab 11 Question 4. Problem 11-8 Part 1 of 5 - X Save Data table Use the accompanying data to complete parts a through c below. a. Compute the correlation of monthly returns between Stantec and Canadian Tirs. b. Compute the annual standard deviation of Stantec and Canadian Tire. c. Compute the annual variance and standard deviation of a portfolio of 70% Startec stock and 30% Canadian Tire stock. Click the icon to view the data table. a. The correlation of monthly returns between Stantec and Canadian Tire is (Round to five decimal places.) May-16 Apr-16 Mar-16 Feb-16 Jan-16 Dec-15 Nov-15 Oct-15 - Sep-15 Aug-15 Jul-15 - Jun-15 May-15 Apr-15 Mar 15 Feb-15 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Jul 14 Jun-14 May-14 Apr-14 Mar-14 6.93 -2.19 16.94 - 17.34 -0.23 -0.78 5.39 12.86 -5.38 - 15.20 -0.07 6.10 5.55 7.89 - 5.04 2.14 -1.85 -3.83 -7.02 -2.04 - 1.11 7.11 5.27 -1.53 3.31 -3.33 -0.41 5.22 1.09 2.77 15.85 -3.39 -5.56 9.28 -4.19 -3.14 -4.56 -2.39 3.59 1.31 -0.96 -2.04 12.88 -4.52 -4.34 4.26 7.69 2.16 8.97 1.18 -2.12 -2.44 3.28 4.39 HH Print Done Ask my instructor Print Clear all Check answer E Homework: Lab 11 Question 4. Problem 11-8 Part 1 of 5 Save Data table Use the accompanying data to complete parts a through c below. a. Compute the correlation of monthly returns between Stantec and Canadian Tire. b. Compute the annual standard deviation of Stantec and Canadian Tire, C. Compute the annual variance and standard deviation of a portfolio of 70% Stantec stock and 30% Canadian Tire stock. -2.04 12.88 -4.52 -4.34 Click the icon to view the data table. a. The correlation of monthly returns between Stantec and Canadian Tire is O. (Round to five decimal places.) Mar-15 Feb-15 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Jul-14 Jun-14 May-14 Apr-14 Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 May-13 Apr-13 Mar-13 Feb-13 Jan-13 - 5.04 2.14 -1.85 -3.83 - 7.02 -2.04 - 1.11 7.11 5.27 -1.53 3.31 -3.33 -0.41 0.10 3.43 -4.16 10.91 18.50 8.86 1.73 7.81 0.93 7.69 2.16 8.97 1.18 - 2.12 -2.44 3.28 4.39 5.50 -4.44 -0.22 3.40 6.08 2.40 5.83 6.76 -4.95 12.80 1.21 2.11 -3.14 5.02 4.43 3.58 6.52 -0.37 0.06 ( Print Done Ask my instructor Print Clear all Check