Answered step by step

Verified Expert Solution

Question

1 Approved Answer

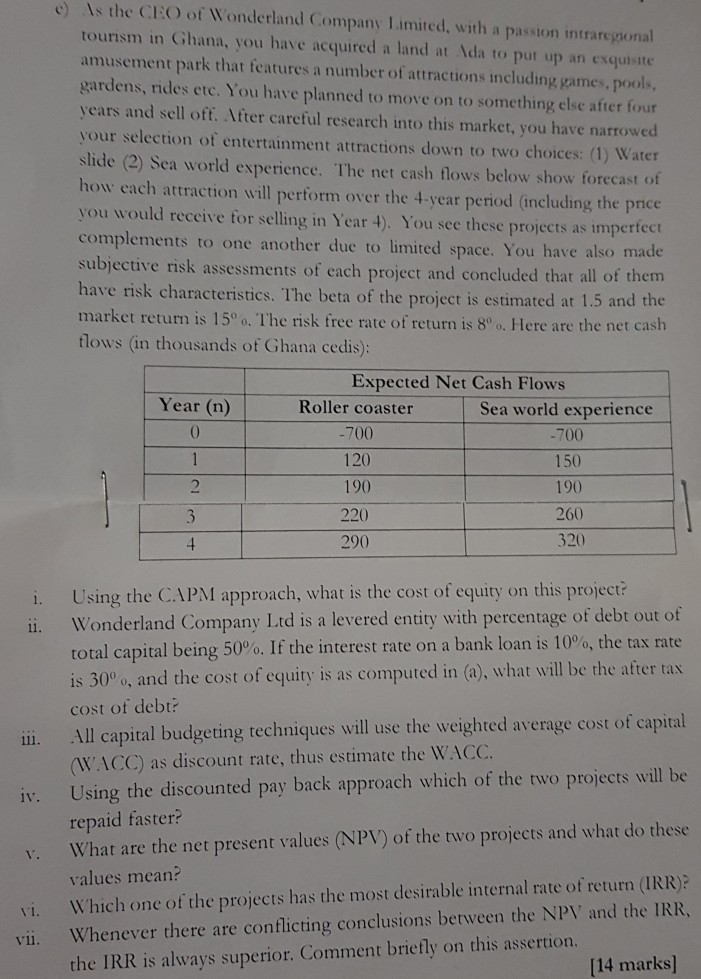

e) Is the CEO of Wonderland Company Limited, with a passion intraregional tourism in Ghana, you have acquired a land at da to put up

e) Is the CEO of Wonderland Company Limited, with a passion intraregional tourism in Ghana, you have acquired a land at \da to put up an exquisite amusement park that features a number of attractions including games, pools, gardens, rides etc. You have planned to move on to something else after four years and sell off. Ifter careful research into this market, you have narrowed your selection of entertainment attractions down to two choices: (1) Water slide (2) Sea world experience. The net cash flows below show forecast of how each attraction will perform over the 4-year period (including the price you would receive for selling in Year 1). You see these projects as imperfect complements to one another due to limited space. You have also made subjective risk assessments of each project and concluded that all of them have risk characteristics. The beta of the project is estimated at 1.5 and the market return is 15o. The risk free rate of return is 8. Here are the net cash flows (in thousands of Ghana cedis): Expected Net Cash Flows Year (n) Roller coaster Sea world experience 0 -700 -700 120 150 2 190 190 3 220 260 290 320 4 ii. 111. iv. Using the CAPM approach, what is the cost of equity on this project? Wonderland Company Ltd is a levered entity with percentage of debt out of total capital being 50%. If the interest rate on a bank loan is 10%, the tax rate is 30, and the cost of equity is as computed in (a), what will be the after tax cost of debt? All capital budgeting techniques will use the weighted average cost of capital (WACC) as discount rate, thus estimate the WACC. Using the discounted pay back approach which of the two projects will be repaid faster? What are the net present values (NPV) of the two projects and what do these values mean? Which one of the projects has the most desirable internal rate of return (IRR)? Whenever there are conflicting conclusions between the NPV and the IRR. the IRR is always superior. Comment briefly on this assertion [14 marks] VI. V11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started