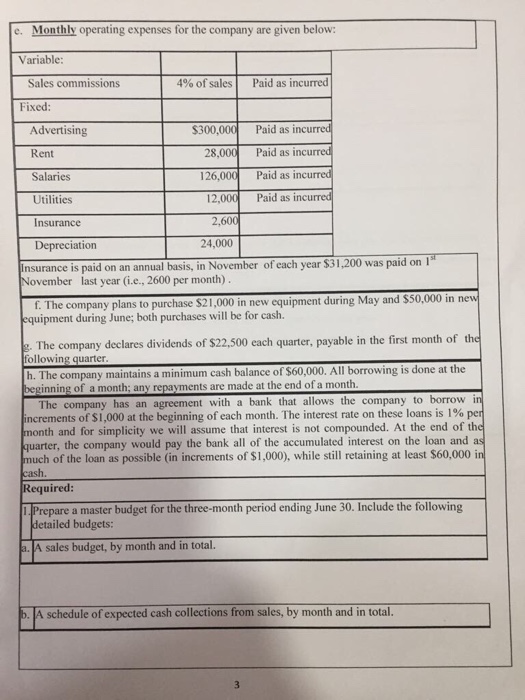

e. Monthly operating expenses for the company are given below: Insurance is paid on an annual basis, in November of each year $31, 200 was paid on 1^st November last year (i.e., 2600 per month). f. The company plans to purchase $21,000 in new equipment during May and $50,000 in new equipment during June; both purchases will be for cash. g. The company declares dividends of $22, 500 each quarter, payable in the first month of the following quarter. h. The company maintains a minimum cash balance of $60,000. All borrowing is done at the beginning of a month; any repayments are made at the end of a month. The company has an agreement with a bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. At the end of the quarter, the company would pay the bank all of the accumulated interest on the loan and as much of the loan as possible (in increments of $1,000), while still retaining at least $60,000 in cash. 1. Prepare a master budget for the three-month period ending June 30. Include the following detailed budgets: a. A sales budget, by month and in total. b. A schedule of expected cash collections from sales, by month and in total. e. Monthly operating expenses for the company are given below: Insurance is paid on an annual basis, in November of each year $31, 200 was paid on 1^st November last year (i.e., 2600 per month). f. The company plans to purchase $21,000 in new equipment during May and $50,000 in new equipment during June; both purchases will be for cash. g. The company declares dividends of $22, 500 each quarter, payable in the first month of the following quarter. h. The company maintains a minimum cash balance of $60,000. All borrowing is done at the beginning of a month; any repayments are made at the end of a month. The company has an agreement with a bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. At the end of the quarter, the company would pay the bank all of the accumulated interest on the loan and as much of the loan as possible (in increments of $1,000), while still retaining at least $60,000 in cash. 1. Prepare a master budget for the three-month period ending June 30. Include the following detailed budgets: a. A sales budget, by month and in total. b. A schedule of expected cash collections from sales, by month and in total