Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e. None of these. 33. The de minimis fringe benefit: a. Exclusion applies only to property received by t b. Can be provided on a

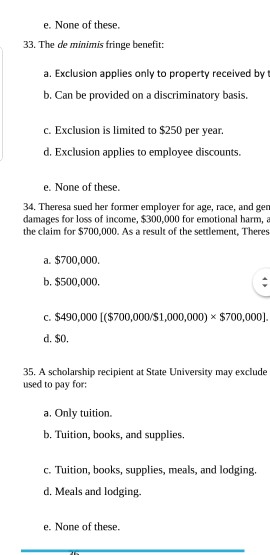

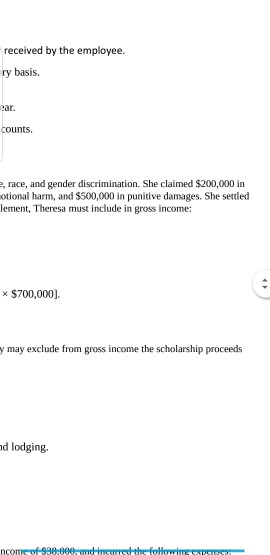

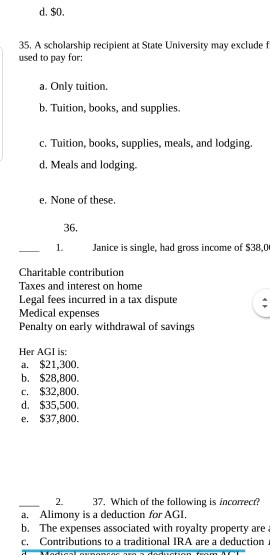

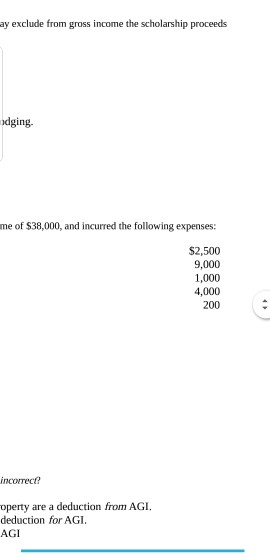

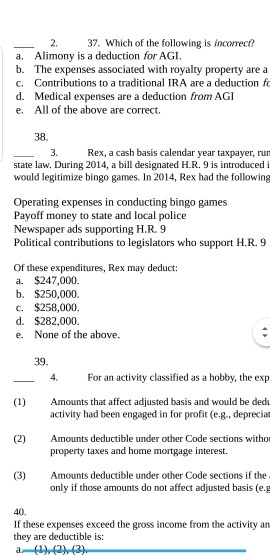

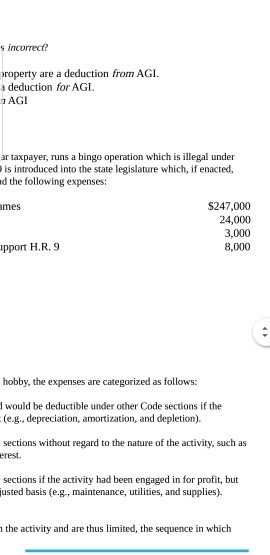

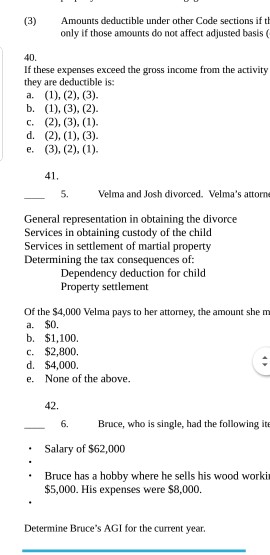

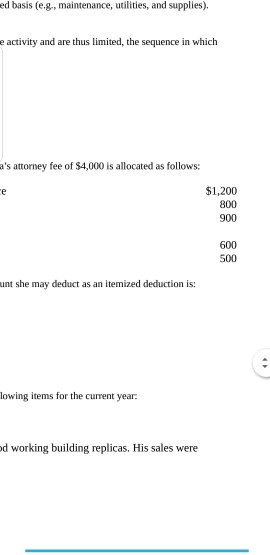

e. None of these. 33. The de minimis fringe benefit: a. Exclusion applies only to property received by t b. Can be provided on a discriminatory basis. c. Exclusion is limited to $250 per year. d. Exclusion applies to employee discounts. e. None of these. 34. Theresa sued her former employer for age, race, and gen damages for loss of income, $300,000 for emotional harm, a the claim for $700,000. As a result of the settlement, Theres a. $700,000. b. $500,000. c. $490,000 1($700,000 S1,000,000) x $700,000]. d. $0 35. A scholarship recipient at State University may exclude used to pay for: a. Only tuition. b. Tuition, books, and supplies. c. Tuition, books, supplies, meals, and lodging d. Meals and lodging. e. None of these. e. None of these. 33. The de minimis fringe benefit: a. Exclusion applies only to property received by t b. Can be provided on a discriminatory basis. c. Exclusion is limited to $250 per year. d. Exclusion applies to employee discounts. e. None of these. 34. Theresa sued her former employer for age, race, and gen damages for loss of income, $300,000 for emotional harm, a the claim for $700,000. As a result of the settlement, Theres a. $700,000. b. $500,000. c. $490,000 1($700,000 S1,000,000) x $700,000]. d. $0 35. A scholarship recipient at State University may exclude used to pay for: a. Only tuition. b. Tuition, books, and supplies. c. Tuition, books, supplies, meals, and lodging d. Meals and lodging. e. None of these

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started