Answered step by step

Verified Expert Solution

Question

1 Approved Answer

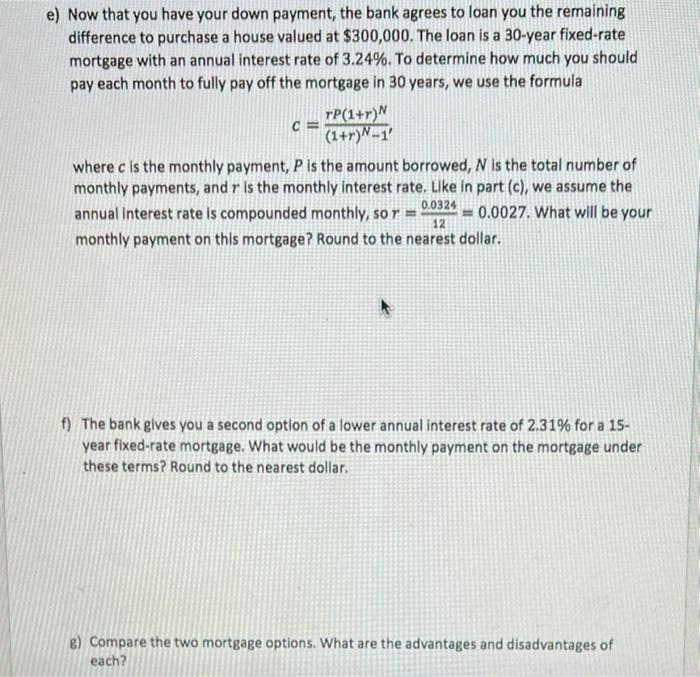

e) Now that you have your down payment, the bank agrees to loan you the remaining difference to purchase a house valued at $300,000.

e) Now that you have your down payment, the bank agrees to loan you the remaining difference to purchase a house valued at $300,000. The loan is a 30-year fixed-rate mortgage with an annual interest rate of 3.24%. To determine how much you should pay each month to fully pay off the mortgage in 30 years, we use the formula C= TP(1+r) (1+r)N-1 where c is the monthly payment, P is the amount borrowed, N is the total number of monthly payments, and r is the monthly interest rate. Like in part (c), we assume the annual Interest rate is compounded monthly, so r = =0.0027. What will be your 0.0324 12 monthly payment on this mortgage? Round to the nearest dollar. f) The bank gives you a second option of a lower annual interest rate of 2.31% for a 15- year fixed-rate mortgage. What would be the monthly payment on the mortgage under these terms? Round to the nearest dollar. g) Compare the two mortgage options. What are the advantages and disadvantages of each?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started