Answered step by step

Verified Expert Solution

Question

1 Approved Answer

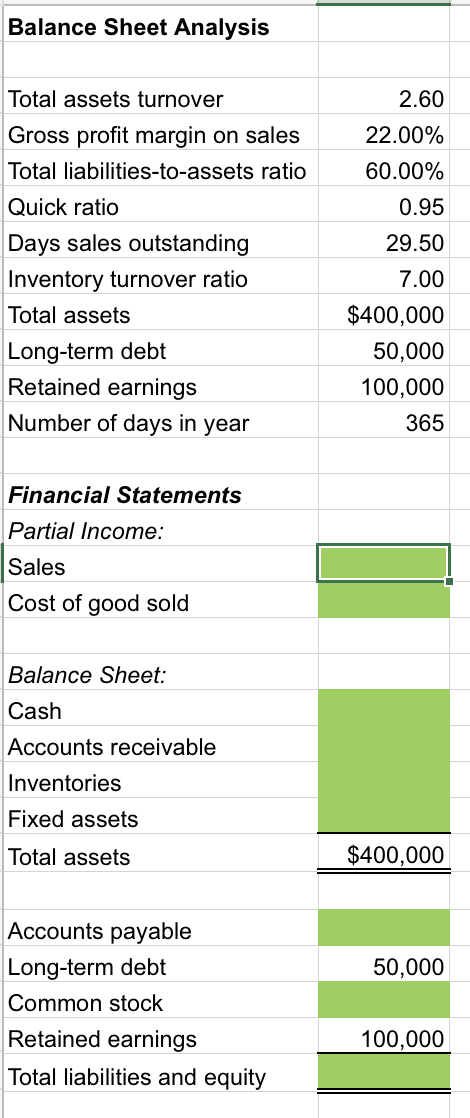

e. Perform a common size analysis. begin{tabular}{|l|r|} hline Balance Sheet Analysis & hline Total assets turnover & 2.60 hline Gross profit margin on

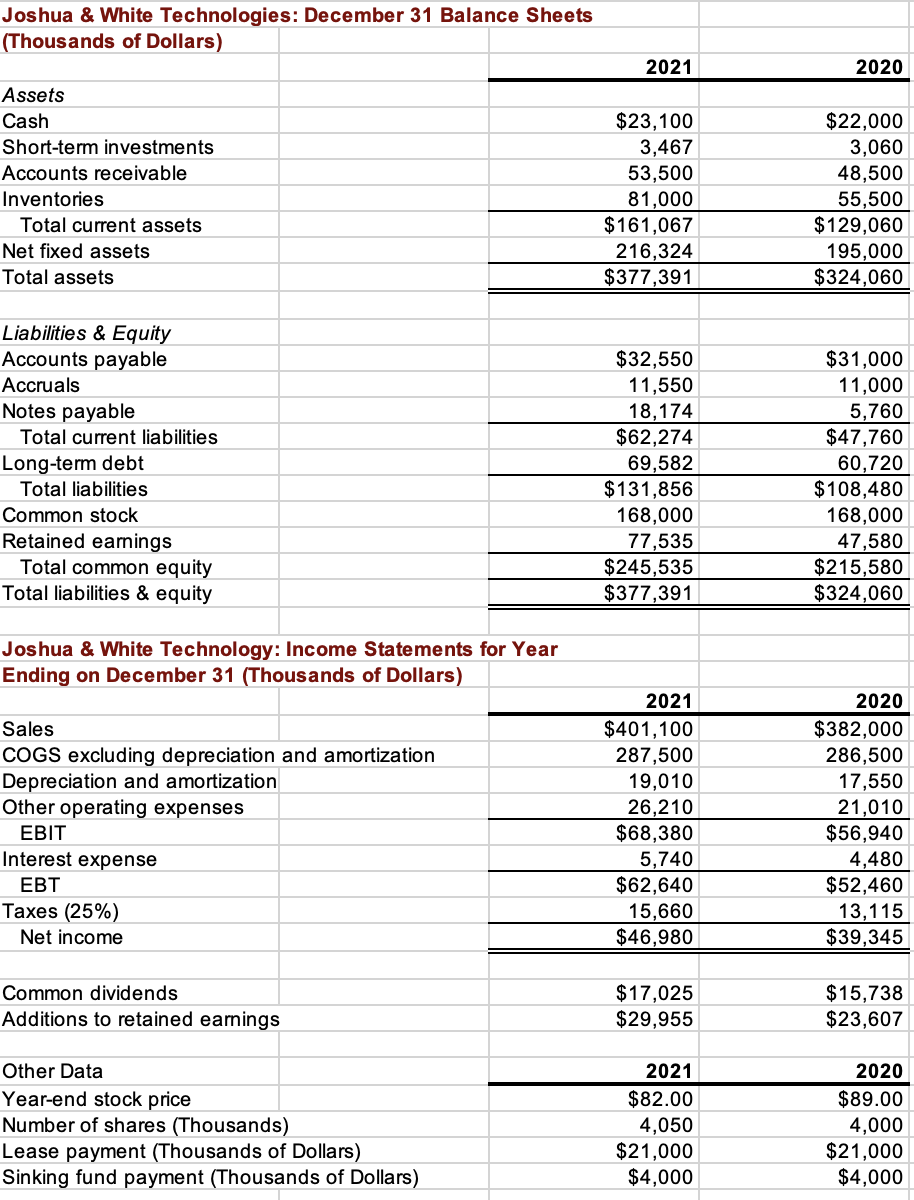

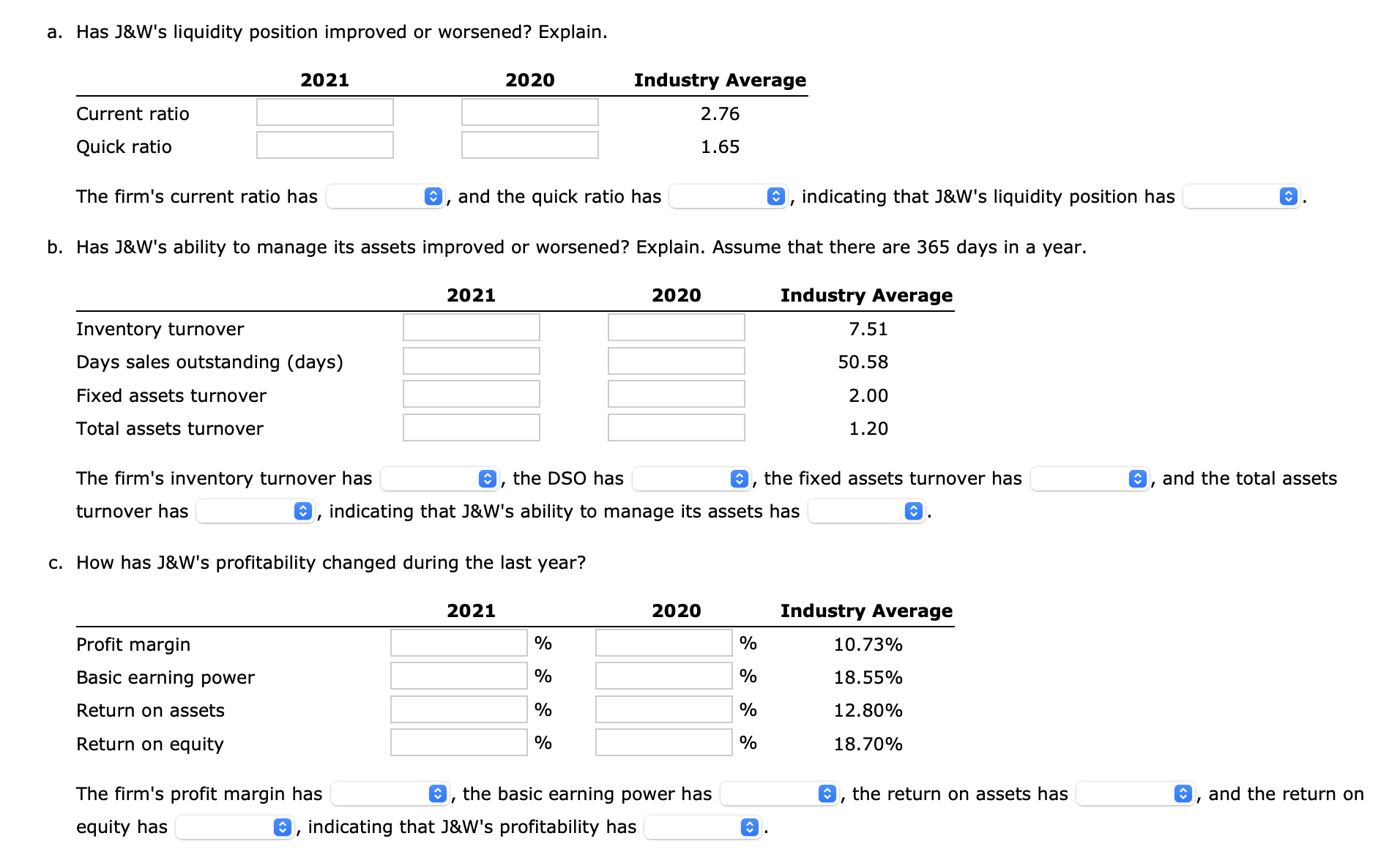

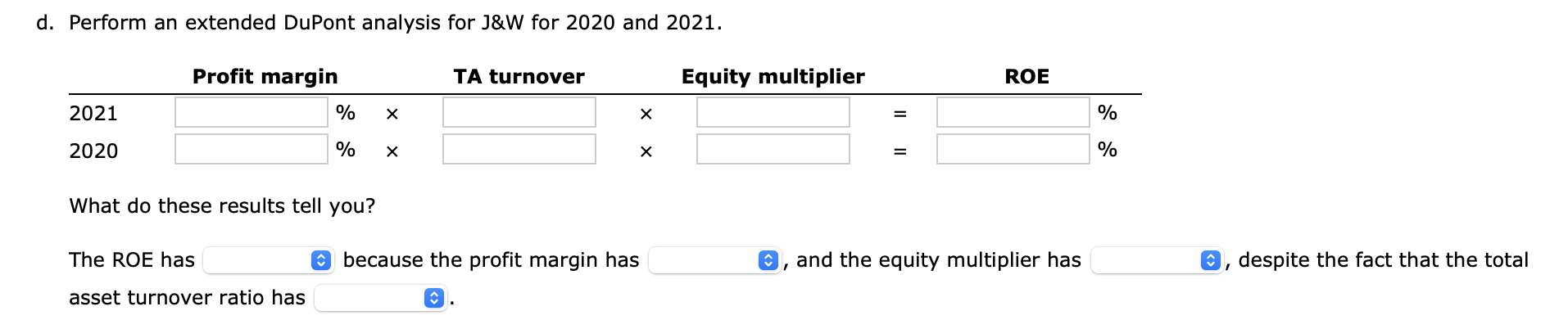

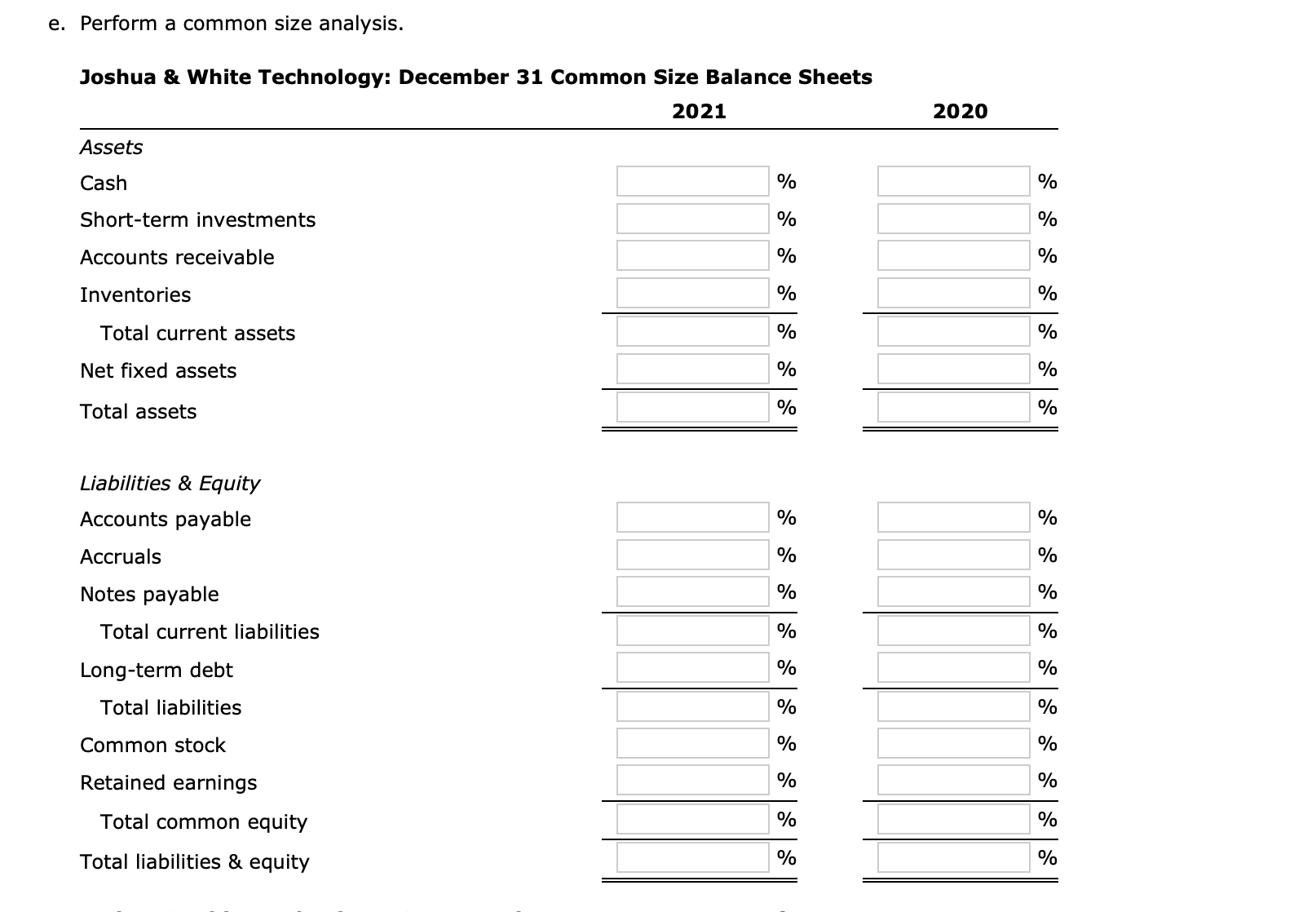

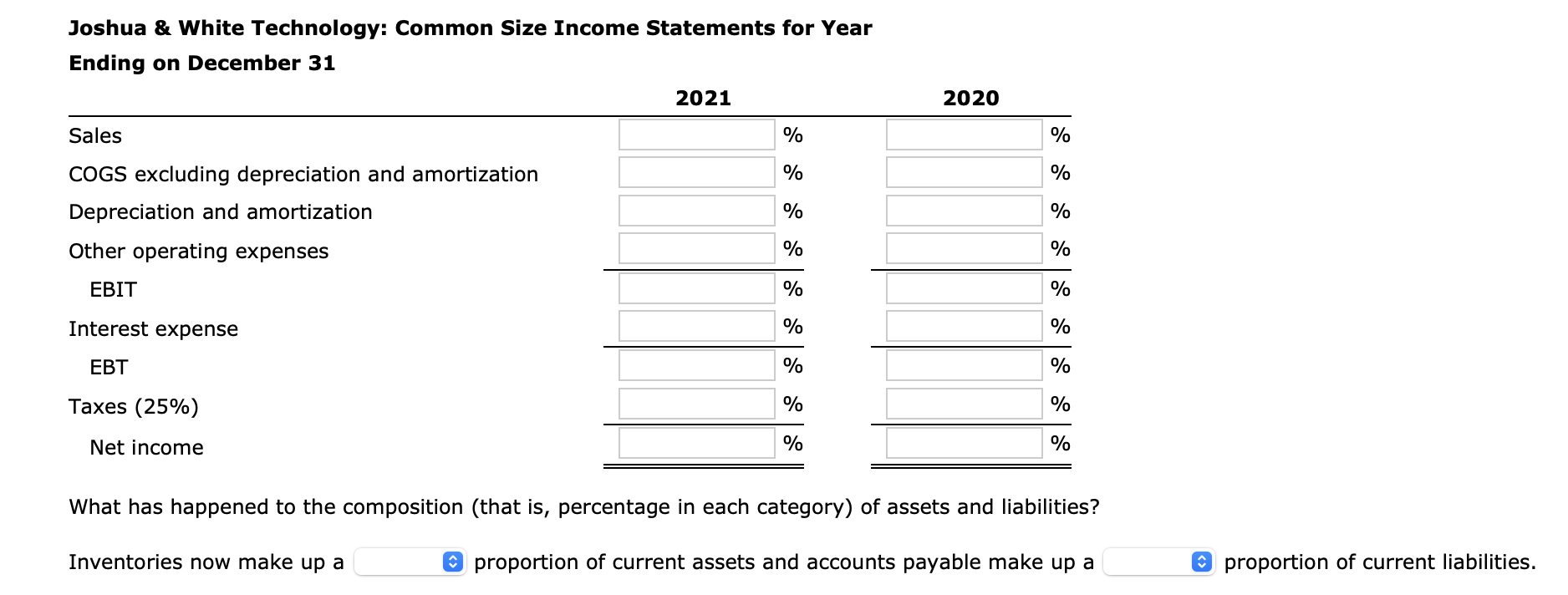

e. Perform a common size analysis. \begin{tabular}{|l|r|} \hline Balance Sheet Analysis & \\ \hline Total assets turnover & 2.60 \\ \hline Gross profit margin on sales & 22.00% \\ \hline Total liabilities-to-assets ratio & 60.00% \\ \hline Quick ratio & 0.95 \\ \hline Days sales outstanding & 29.50 \\ \hline Inventory turnover ratio & 7.00 \\ \hline Total assets & $400,000 \\ \hline Long-term debt & 50,000 \\ \hline Retained earnings & 100,000 \\ \hline Number of days in year & 365 \\ \hline & \\ \hline Financial Statements & \\ \hline Partial Income: & \\ \hline Sales & \\ \hline Cost of good sold & \\ \hline & \\ \hline Balance Sheet: & \\ \hline Cash & \\ \hline Accounts receivable & \\ \hline Inventories & \\ \hline Fixed assets & \\ \hline Total assets & \\ \hline Accounts payable & \\ \hline Long-term debt & \\ \hline Common stock & \\ \hline Retained earnings & \\ \hline Total liabilities and equity & \\ \hline \hline & \\ \hline \end{tabular} d. Perform an extended DuPont analysis for J\&W for 2020 and 2021. What do these results tell you? The ROE has because the profit margin has , and the equity multiplier has despite the fact that the total asset turnover ratio has Joshua \& White Technology: Common Size Income Statements for Year Ending on December 31 What has happened to the composition (that is, percentage in each category) of assets and liabilities? Inventories now make up a proportion of current assets and accounts payable make up a proportion of current liabilities. a. Has J\&W's liquidity position improved or worsened? Explain. The firm's current ratio has , and the quick ratio has , indicating that J\&W's liquidity position has b. Has J\&W's ability to manage its assets improved or worsened? Explain. Assume that there are 365 days in a year. The firm's inventory turnover has the DSO has the fixed assets turnover has and the total assets turnover has , indicating that J\&W's ability to manage its assets has c. How has J\&W's profitability changed during the last year? The firm's profit margin has the basic earning power has , the return on assets has , and the return on equity has , indicating that J\&W's profitability has

e. Perform a common size analysis. \begin{tabular}{|l|r|} \hline Balance Sheet Analysis & \\ \hline Total assets turnover & 2.60 \\ \hline Gross profit margin on sales & 22.00% \\ \hline Total liabilities-to-assets ratio & 60.00% \\ \hline Quick ratio & 0.95 \\ \hline Days sales outstanding & 29.50 \\ \hline Inventory turnover ratio & 7.00 \\ \hline Total assets & $400,000 \\ \hline Long-term debt & 50,000 \\ \hline Retained earnings & 100,000 \\ \hline Number of days in year & 365 \\ \hline & \\ \hline Financial Statements & \\ \hline Partial Income: & \\ \hline Sales & \\ \hline Cost of good sold & \\ \hline & \\ \hline Balance Sheet: & \\ \hline Cash & \\ \hline Accounts receivable & \\ \hline Inventories & \\ \hline Fixed assets & \\ \hline Total assets & \\ \hline Accounts payable & \\ \hline Long-term debt & \\ \hline Common stock & \\ \hline Retained earnings & \\ \hline Total liabilities and equity & \\ \hline \hline & \\ \hline \end{tabular} d. Perform an extended DuPont analysis for J\&W for 2020 and 2021. What do these results tell you? The ROE has because the profit margin has , and the equity multiplier has despite the fact that the total asset turnover ratio has Joshua \& White Technology: Common Size Income Statements for Year Ending on December 31 What has happened to the composition (that is, percentage in each category) of assets and liabilities? Inventories now make up a proportion of current assets and accounts payable make up a proportion of current liabilities. a. Has J\&W's liquidity position improved or worsened? Explain. The firm's current ratio has , and the quick ratio has , indicating that J\&W's liquidity position has b. Has J\&W's ability to manage its assets improved or worsened? Explain. Assume that there are 365 days in a year. The firm's inventory turnover has the DSO has the fixed assets turnover has and the total assets turnover has , indicating that J\&W's ability to manage its assets has c. How has J\&W's profitability changed during the last year? The firm's profit margin has the basic earning power has , the return on assets has , and the return on equity has , indicating that J\&W's profitability has Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started