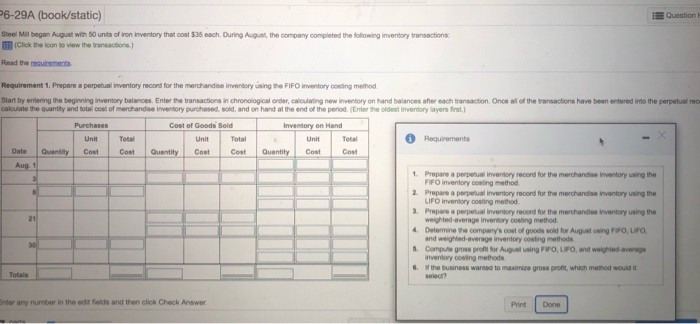

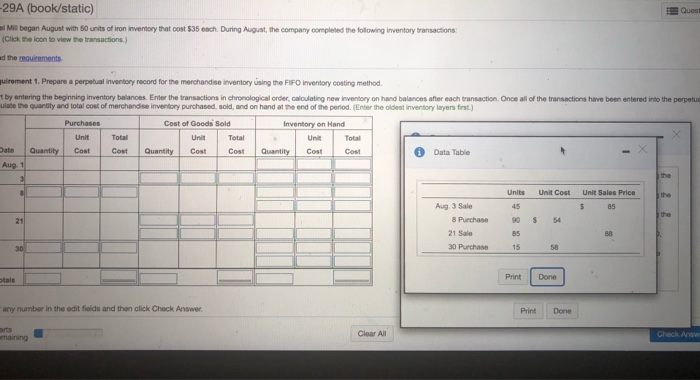

E Question P6-29A (book/static) Steel Mal began August with 50 units of iron inventory that cost $35 each. During August the company completed the following inventory transactions Click the icon to view the transactions.) Read the requirements Requirement 1. Prepare a perpetual inventory record for the merchandise inventory using the FIFO inventory costing method Start by entering the beginning inventory balances. Enter the transactions in chronological order, conting new invertory on hand balances her each transaction. Once all of the transactions have been entered into the perpetual rec calculate the quantity and total cost of merchandise inventory purchased sold, and on hand at the end of the period. Enter the oldest inventory layers frst.) Purchases Cost of Goods Sold Total Cost Requirements Unit Cost inventory on Hand Unit Quantity Cost Cost Total Cost Date Quantity Cost Quantity 1. Prepare a perpetual inventory record for the merchandise inventory using the FIFO inventory costing method 2. Prepare a perpetual inventory record for the merchandise inventory using the LIFO inventory costing method 3. Prepare a perpetual inventory record for the merchandise inventory using the weighted average inventory sing method 4. Determine the company's cost of goods sold for Augusting FIFO, UFO, and weighted average inventory coating methods 8. Computa gross profit for August using FIFO, UFO, and weighted average inventory cosing methods G. W the business wanted to maxim gross profit, which method would it Wol Totals Enter any number in the edit fields and then click Check Answer Prin [Done] -29A (book/static) Mil began August with 50 units of iron inventory that cost $35 each. During August, the company completed the following inventory transactions: (Click the loon to view the transactions.) ad the requirements quirement 1. Prepare a perpetual inventory record for the merchandise inventory using the FIFO inventory costing method t by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetu ulate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period (Enter the oldest inventory layers first.) Cost of Goods Sold Inventory on Hand Unit Total Cost Unit Cost Total Cost Date Quantity Cost Quantity Quantity Cost * Data Table Aug 1 Units 45 90 Aug 3 Sale 8Purchase 21 Sale Unit Cost S $ 54 Unit Sales Price as 30 Purchase 15 58 tals Print Done any number in the edit folds and then click Check Answer. Print Done maining Check AS