Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bay Water Ceramics is a wholesaler and retailer of tiles and decorative stone. They sell to a range of hardware stores, building and landscape

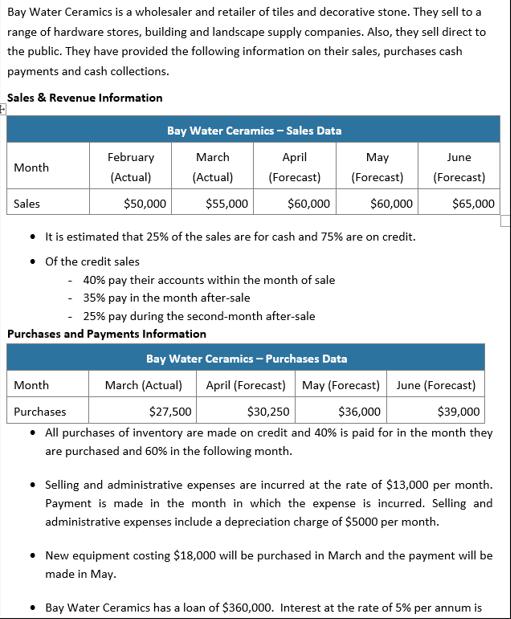

Bay Water Ceramics is a wholesaler and retailer of tiles and decorative stone. They sell to a range of hardware stores, building and landscape supply companies. Also, they sell direct to the public. They have provided the following information on their sales, purchases cash payments and cash collections. Sales & Revenue Information Month Sales February (Actual) $50,000 Bay Water Ceramics - Sales Data March April (Actual) (Forecast) $55,000 $60,000 40% pay their accounts within the month of sale 35% pay in the month after-sale 25% pay during the second-month after-sale Purchases and Payments Information May (Forecast) It is estimated that 25% of the sales are for cash and 75% are on credit. Of the credit sales - $60,000 June (Forecast) $65,000 Bay Water Ceramics - Purchases Data March (Actual) April (Forecast) May (Forecast) June (Forecast) Month Purchases $27,500 $30,250 $36,000 $39,000 All purchases of inventory are made on credit and 40% is paid for in the month they are purchased and 60% in the following month. Selling and administrative expenses are incurred at the rate of $13,000 per month. Payment is made in the month in which the expense is incurred. Selling and administrative expenses include a depreciation charge of $5000 per month. New equipment costing $18,000 will be purchased in March and the payment will be made in May. Bay Water Ceramics has a loan of $360,000. Interest at the rate of 5% per annum is Opening Bank Balance The balance of the bank account on 31 March is $10,500 Required: 1. Open the excel spreadsheet file FNSACC412_AE_Sk_1of3_SR_1of1.xlsx. Go to the worksheet called 'Bay Water Ceramics Cash Budget'. There is a partially completed template for a cash budget. Using this template, prepare a cash budget for Bay Water Ceramics for the period April to June. Ignore the effects of GST in this question. Your cash budget will need to include: a. Cash receipts budget b. Cash payments budget c. Total cash budget

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Cash Receipts Budget February March April May June Total Sales 50000 55000 60000 60000 65000 290000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started