Answered step by step

Verified Expert Solution

Question

1 Approved Answer

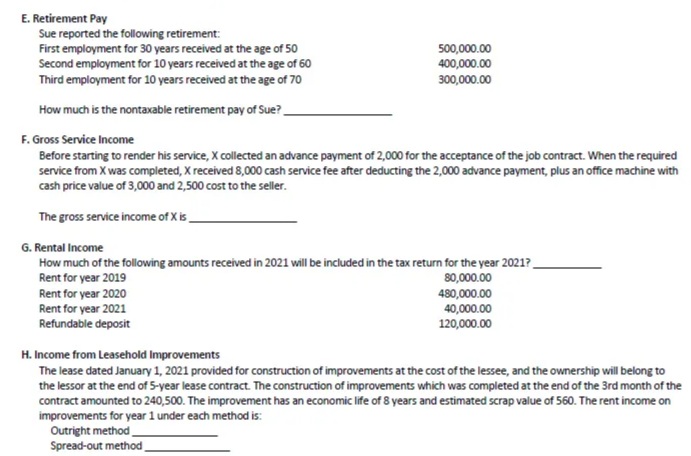

E. Retirement Pay Sue reported the following retirement: First employment for 30 years received at the age of 50 Second employment for 10 years

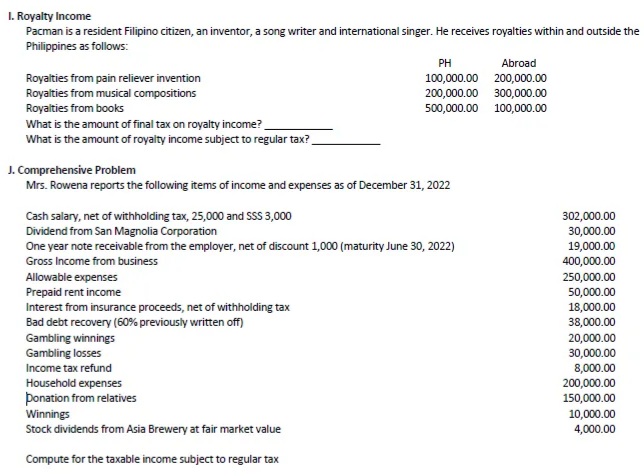

E. Retirement Pay Sue reported the following retirement: First employment for 30 years received at the age of 50 Second employment for 10 years received at the age of 60 Third employment for 10 years received at the age of 70 How much is the nontaxable retirement pay of Sue? F. Gross Service Income Before starting to render his service, X collected an advance payment of 2,000 for the acceptance of the job contract. When the required service from X was completed, X received 8,000 cash service fee after deducting the 2,000 advance payment, plus an office machine with cash price value of 3,000 and 2,500 cost to the seller. The gross service income of X is_ 500,000.00 400,000.00 300,000.00 G. Rental Income How much of the following amounts received in 2021 will be included in the tax return for the year 2021? Rent for year 2019 80,000.00 Rent for year 2020 Rent for year 2021 Refundable deposit 480,000.00 40,000.00 120,000.00 H. Income from Leasehold Improvements The lease dated January 1, 2021 provided for construction of improvements at the cost of the lessee, and the ownership will belong to the lessor at the end of 5-year lease contract. The construction of improvements which was completed at the end of the 3rd month of the contract amounted to 240,500. The improvement has an economic life of 8 years and estimated scrap value of 560. The rent income on improvements for year 1 under each method is: Outright method Spread-out method I. Royalty Income Pacman is a resident Filipino citizen, an inventor, a song writer and international singer. He receives royalties within and outside the Philippines as follows: Royalties from pain reliever invention Royalties from musical compositions Royalties from books What is the amount of final tax on royalty income? What is the amount of royalty income subject to regular tax? J. Comprehensive Problem Mrs. Rowena reports the following items of income and expenses as of December 31, 2022 PH Abroad 100,000.00 200,000.00 200,000.00 300,000.00 500,000.00 100,000.00 Cash salary, net of withholding tax, 25,000 and SSS 3,000 Dividend from San Magnolia Corporation One year note receivable from the employer, net of discount 1,000 (maturity June 30, 2022) Gross Income from business Allowable expenses Prepaid rent income Interest from insurance proceeds, net of withholding tax Bad debt recovery (60% previously written off) Gambling winnings Gambling losses Income tax refund Household expenses ponation from relatives Winnings Stock dividends from Asia Brewery at fair market value Compute for the taxable income subject to regular tax 302,000.00 30,000.00 19,000.00 400,000.00 250,000.00 50,000.00 18,000.00 38,000.00 20,000.00 30,000.00 8,000.00 200,000.00 150,000.00 10,000.00 4,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the taxable income subject to regular tax we need to determine the total gross income and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started