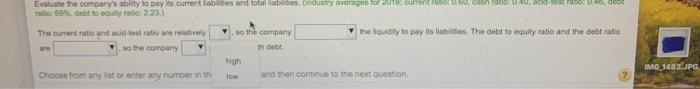

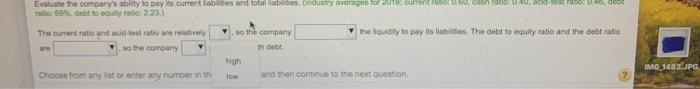

e. The current ratio and acid test ratio are relatively (high/low) so the company (appears to have/ does not have) The liquidy to pay its liabilities. The debt to equity ratio in the debt ratio are ( at average levels/extremely low/relatively high) so the company (is/is not) overloaded with debt.

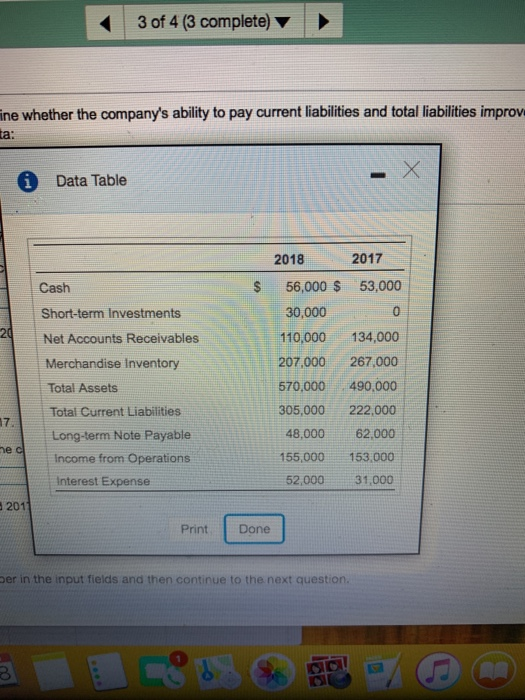

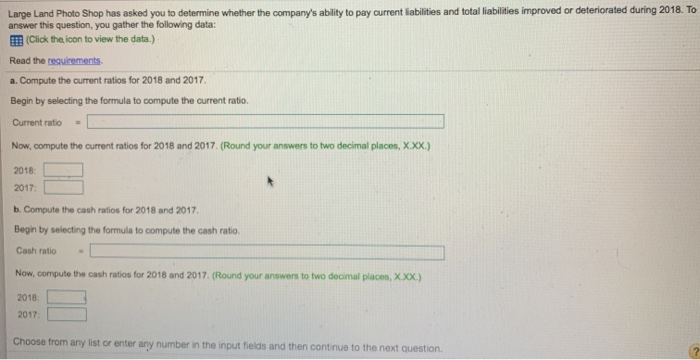

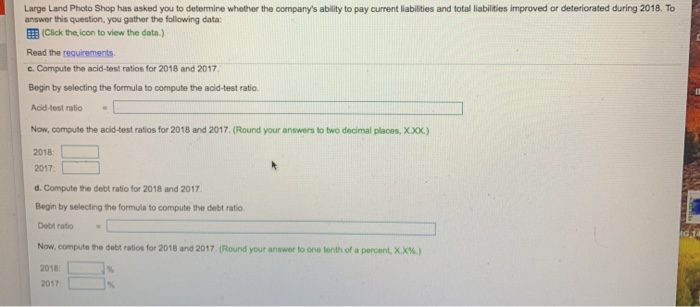

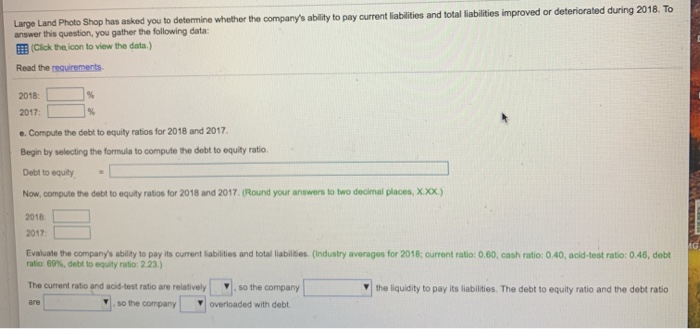

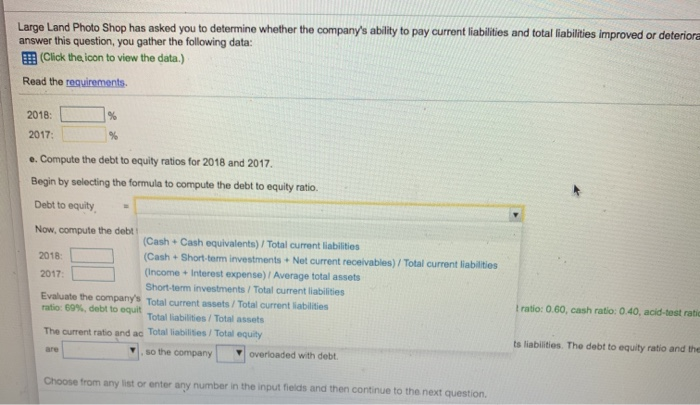

Large Land Photo Shop has asked you to determine whether the company's ability to pay current iabilities and total liabilities improved or deteriorated during 2018. To answer this question, you gather the following data: (Click the iocon to view the data.) reauirements Read the a. Compute the curent ratios for 2018 and 2017. Begin by selecting the formula to compute the current ratio. Current ratio Now, compute the current ratios for 2018 and 2017. (Round your answers to two decimal places, X.XX.) 2018 2017 b. Compute the cash ratios for 2018 and 2017 Begin by selecting the formula to compute the cash ratio. Cash ratio Now, compute the cash ratios for 2018 and 2017. (Round your answers to two decimal places, X.XX) 2018: 2017 Choose from any list or enter any number in the input fields and then continue to the next question Large Land Photo Shop has asked you to determine whether the company's ability to pay current liabilities and total liabilities improved or deteriorated during 2018. To answer this question, you gather the following data: EEB (Click the icon to view the data.) Read the requirements c. Compute the acid-test ratios for 2018 and 2017. Begin by selecting the formula too compute the acid-test ratio. Acid-test ratio Now, compute the acid-test ratios for 2018 and 2017. (Round your answers to two decimal places, XXX.) 2018: 2017 d. Compute the debt ratio for 2018 and 2017 Begin by selecting the formula to compute the debt ratio Debt ratio G 14 Now, compute the debt ratios for 2018 and 2017 (Round your answer to one tenth of a percent, X.X %) 2018 % % 2017 Large Land Photo Shop has asked you to determine whether the company's ability to pay current liabilities and total liabilities improved or deteriorated during 2018. To answer this question, you gather the following data (Click the icon to view the data.) Read the requirements. % 2018: % 2017 e. Compute the debt to equity ratios for 2018 and 2017. Begin by selecting the formula to compute the debt to equity ratio. Debt to equity Now, compute the debt to equity ratios for 2018 and 2017. (Round your answers to two decimal places, X.XX.) 2018 2017 Evaluate the company's ability to pay its current labilities and total liabilties. (Industry averages for 2018; current ratio: 0.60, cash ratio: 0.40, acid-test ratio: 0.46, debt ratio: 69% , debt to equity ratio: 2.23.) The current ratio and acid-test ratio are relatively so the company the liquidity to pay its liabilities. The debt to equity ratio and the debt ratio are so the company overloaded with debt. Large Land Photo Shop has asked you to determine whether the company's ability to pay current liabilities and total liabilities improved or deteriora answer this question, you gather the following data: (Click the icon to view the data.) Read the requirements. 2018: % 2017 % e. Compute the debt to equity ratios for 2018 and 2017, Begin by selecting the formula to compute the debt to equity ratio. Debt to equity Now, compute the debt (Cash+ Cash equivalents) / Total current liabilities (Cash+ Short-term investments + Net current receivables)/Total current liabilities 2018: (Income + Interest expense)/ Average total assets 2017 Short-term investments/Total current liabilities Evaluate the company's Total current assets/Total current iabilities ratio: 69 %, debt to equit Total liabilities/Total assets t ratio: 0.60, cash ratio: 0.40, acid-test rati The current ratio and ac Total liabilities/ Total equity ts liabilities. The debt to equity ratio and the so the company overloaded with debt. are Choose from any list or enter any number in the input fields and then continue to the next question. 3 of 4 (3 complete) ine whether the company's ability to pay current liabilities and total liabilities improv ta: i Data Table 2017 2018 56,000 $ 53,000 Cash 30,000 Short-term Investments 20 134,000 110,000 Net Accounts Receivables 207,000 267,000 Merchandise Inventory 490,000 570,000 Total Assets 305,000 222,000 Total Current Liabilities 17 48,000 62,000 Long-term Note Payable e c 155,000 153,000 Income from Operations 52,000 31,000 Interest Expense 2011 Print Done per in the input fields and then continue to the next

e. The current ratio and acid test ratio are relatively (high/low) so the company (appears to have/ does not have) The liquidy to pay its liabilities. The debt to equity ratio in the debt ratio are ( at average levels/extremely low/relatively high) so the company (is/is not) overloaded with debt.

e. The current ratio and acid test ratio are relatively (high/low) so the company (appears to have/ does not have) The liquidy to pay its liabilities. The debt to equity ratio in the debt ratio are ( at average levels/extremely low/relatively high) so the company (is/is not) overloaded with debt.