Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e) Using your answer from part b, compute the residual income of ETS. f) Compute the EVA and ETS. g) Why are the EVA and

e) Using your answer from part b, compute the residual income of ETS.

f) Compute the EVA and ETS.

g) Why are the EVA and RI levels different?

h) Based on the data given in the problem, discuss why ROI, EVA and RI may be inappropriate measures of performance for ETS.

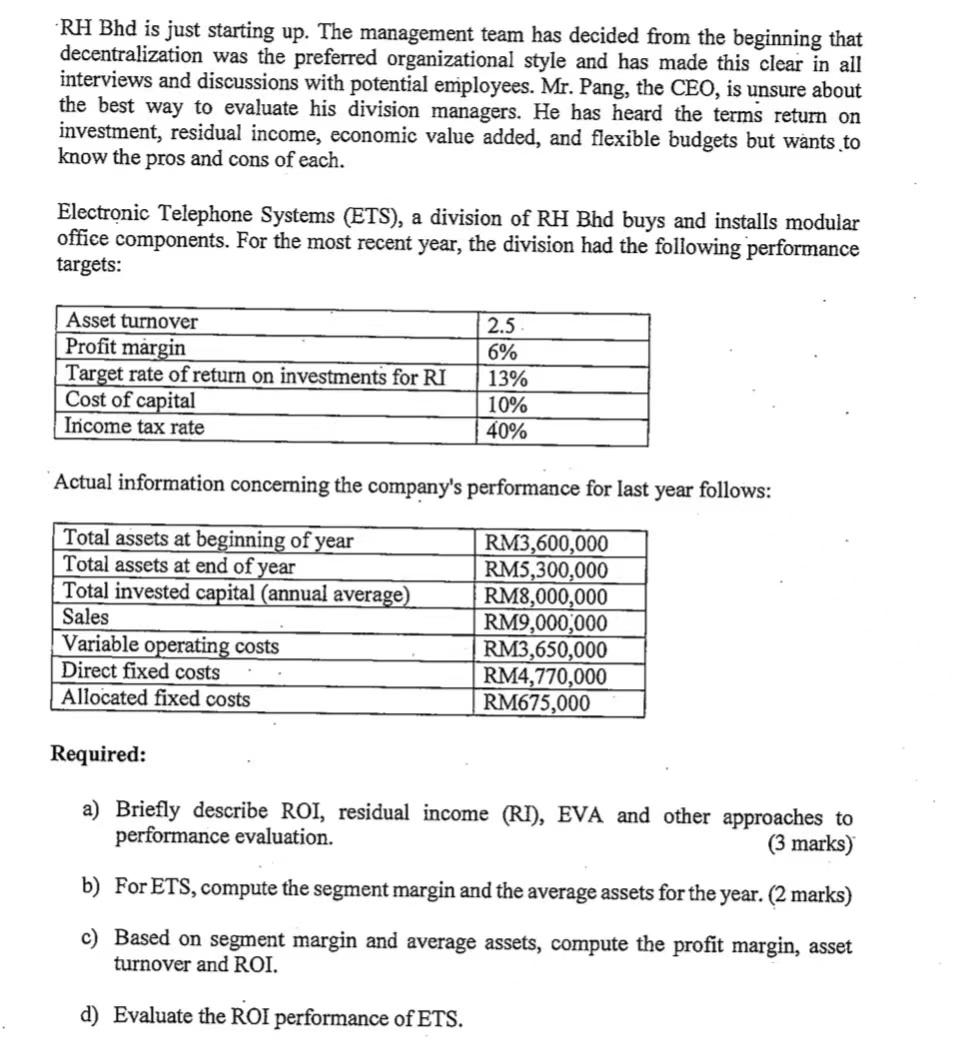

RH Bhd is just starting up. The management team has decided from the beginning that decentralization was the preferred organizational style and has made this clear in all interviews and discussions with potential employees. Mr. Pang, the CEO, is unsure about the best way to evaluate his division managers. He has heard the terms return on investment, residual income, economic value added, and flexible budgets but wants to know the pros and cons of each. Electronic Telephone Systems (ETS), a division of RH Bhd buys and installs modular office components. For the most recent year, the division had the following performance targets: Asset turnover Profit margin Target rate of return on investments for RI Cost of capital Income tax rate 2.5 6% 13% 10% 40% Actual information concerning the company's performance for last year follows: Total assets at beginning of year Total assets at end of year Total invested capital (annual average) Sales Variable operating costs Direct fixed costs Allocated fixed costs RM3,600,000 RM5,300,000 RM8,000,000 RM9,000,000 RM3,650,000 RM4,770,000 RM675,000 Required: a) Briefly describe ROI, residual income (RI), EVA and other approaches to performance evaluation. (3 marks) b) For ETS, compute the segment margin and the average assets for the year. (2 marks) c) Based on segment margin and average assets, compute the profit margin, asset turnover and ROI. d) Evaluate the ROI performance of ETSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started