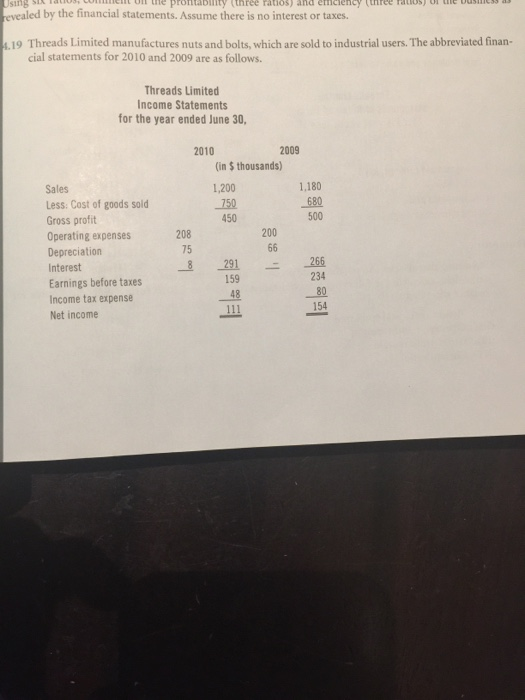

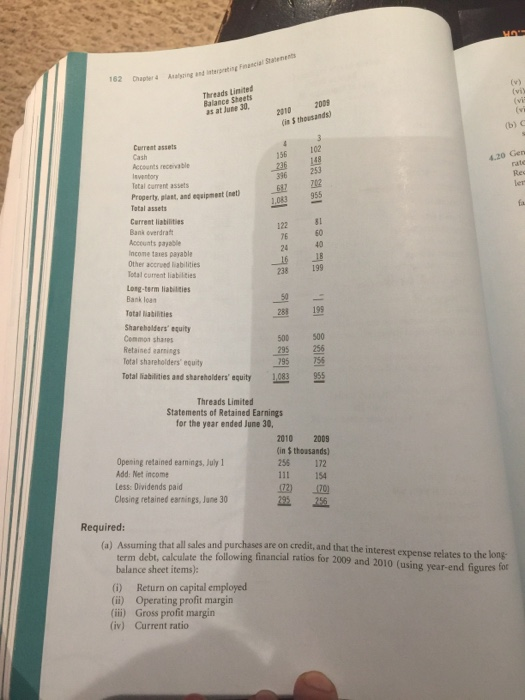

e Uus J Using Slots Con Un tie pronably three ratios) and criciency (ATCL HIUS) UI revealed by the financial statements. Assume there is no interest or taxes. 1.19 Threads Limited manufactures nuts and bolts, which are sold to industrial users. The abbreviated finan- cial statements for 2010 and 2009 are as follows. Threads Limited Income Statements for the year ended June 30, 2010 2009 (in $thousands) 1,200 1,180 750 680 450 500 200 Sales Less: Cost of goods sold Gross profit Operating expenses Depreciation Interest Earnings before taxes Income tax expense Net income anica 52 D (vi) Threads Limited Balance Sheets as at lune 30 2009 thousands) 102 1.20 Gen 251 Res F Current assets Cash Accounts receivable Inventory Total current assets Property, plant and equipment (net Tatal assets Current liabilities Bank overdraft Accounts payable Income tres payable Other accrued liabilities Total current liabilities Long-term liabilities Bank loan Totalities Shareholders' quity Cosmon shares Retained earnings Total shareholders' equity Total abilities and shareholders' equity 13899181 8818181 1,083 Threads Limited Statements of Retained Earnings for the year ended June 30, 2010 2009 in thousands) Opening retained earnings, July 1 256 172 Add: Net income 111 154 Less: Dividends paid Closing retained earnings, June 30 256 12) Required: Assumine that all sales and purchases are on credit, and that the interest expense relates to the long- term debt calculate the following financial ratios for 2009 and 2010 (using year-end figures for balance sheet items): 6) Return on capital employed (ii) Operating profit margin (iii) Gross profit margin (iv) Current ratio 3 SIZES 300109 9NIINNOSOV Chapter 4 Analyzing and Interpreting Financial Statements 163 (v) Acid test ratio (vi) Collection period for receivables (vii) Payment period for payables (viii) Inventory turnover period. (b) Comment on the performance of Threads Limited from the viewpoint of a business considering supplying a substantial amount of goods to Threads Limited on usual credit terms. 4.20 Genesis Ltd. was incorporated in 2007 and has grown rapidly over the past three years. The rapid rate of growth has created problems for the business that management has found difficult to deal wi Recently, a firm of management consultants has been asked to help the company overcome these prob. lems. In a preliminary report to management, the management consultants state: "Most of the difficulties faced by the business are symptoms of an underlying problem of overtrading." The most recent financial statements of the business are set out below. Genesis Ltd. Balance Sheet as at October 31, 2010 (in $ thousands) 104 Current assets Accounts receivable Inventory Total current assets