Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) Two sisters, Mary and Jane, jointly purchased an apartment using their own savings. The apartment was rented out, but because the rental rate

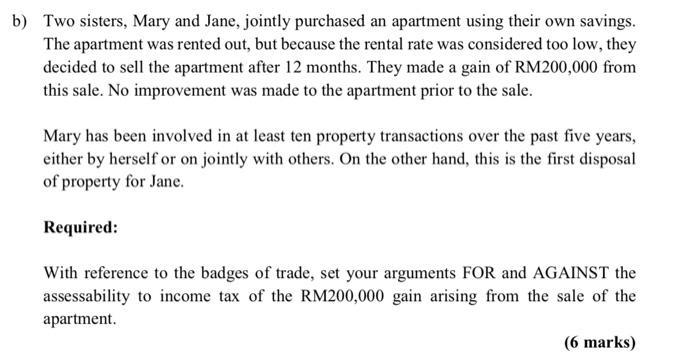

b) Two sisters, Mary and Jane, jointly purchased an apartment using their own savings. The apartment was rented out, but because the rental rate was considered too low, they decided to sell the apartment after 12 months. They made a gain of RM200,000 from this sale. No improvement was made to the apartment prior to the sale. Mary has been involved in at least ten property transactions over the past five years, either by herself or on jointly with others. On the other hand, this is the first disposal of property for Jane. Required: With reference to the badges of trade, set your arguments FOR and AGAINST the assessability to income tax of the RM200,000 gain arising from the sale of the apartment. (6 marks)

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

It is pertinent to note in the question that Mary has been a part of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started