Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E . Your client has decided that the risk of the bond portfolio is acceptable and wishes to leave it as it is . Now

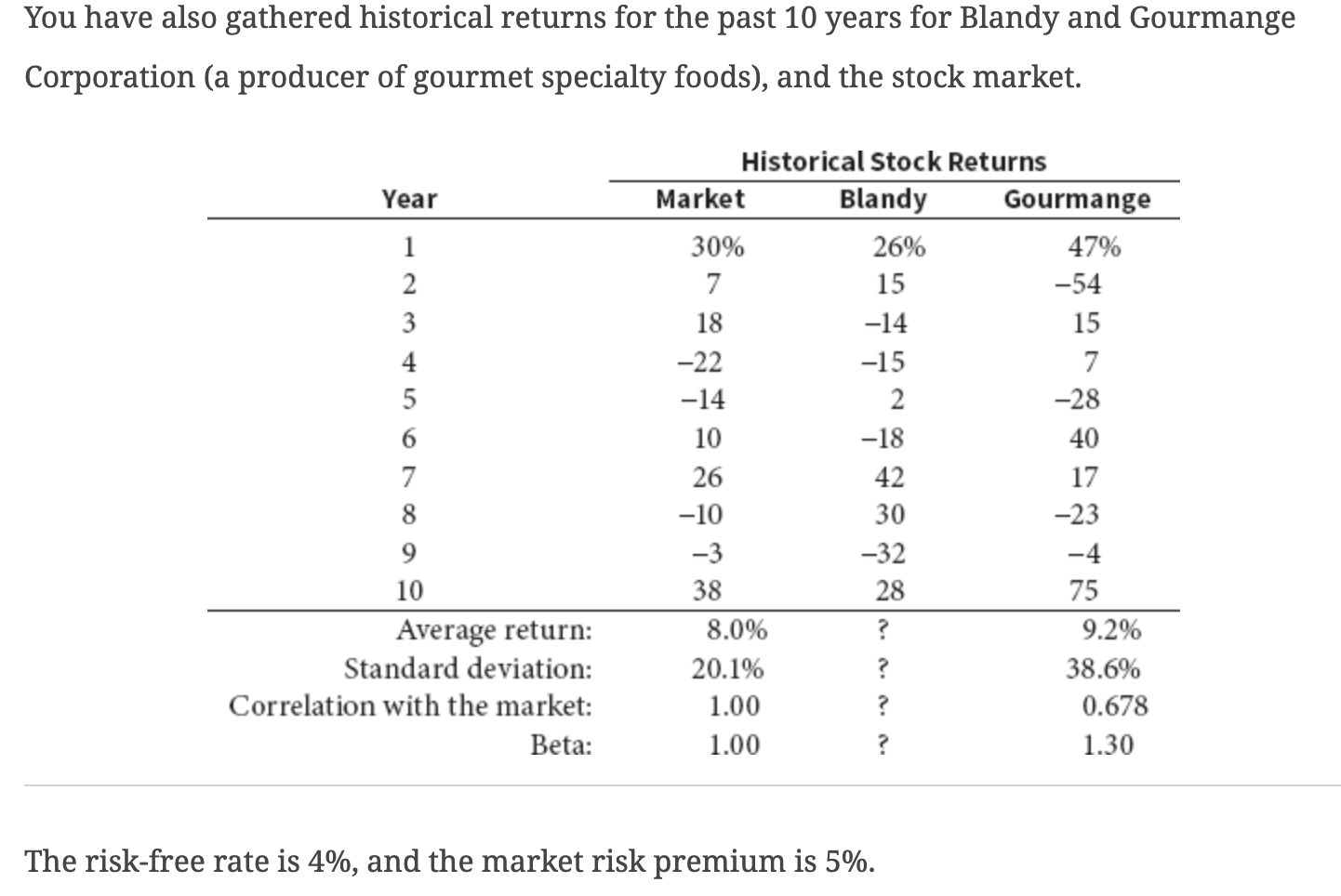

E Your client has decided that the risk of the bond portfolio is acceptable and wishes to leave it as it is Now your client has asked you to use historical returns to estimate the standard deviation of Blandys stock returns. Note: Many analysts use to years of monthly returns to estimate risk, and many use weeks of weekly returns; some even use a year or less of daily returns. For the sake of simplicity, use Blandys annual returns.

F Your client is shocked at how much risk Blandy stock has and would like to reduce the level of risk. You suggest that the client sell of the Blandy stock and create a portfolio with Blandy stock and in the highrisk Gourmange stock. How do you suppose the client will react to replacing some of the Blandy stock with highrisk stock? Show the client what the proposed portfolio return would have been in each year of the sample. Then calculate the average return and standard deviation using the portfolios annual returns. How does the risk of this twostock portfolio compare with the risk of the individual stocks if they were held in isolation?

G Explain correlation to your client. Calculate the estimated correlation between Blandy and Gourmange. Does this explain why the portfolio standard deviation was less than Blandys standard deviation?

H Suppose an investor starts with a portfolio consisting of one randomly selected stock. As more and more randomly selected sANSAHJDCWE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started