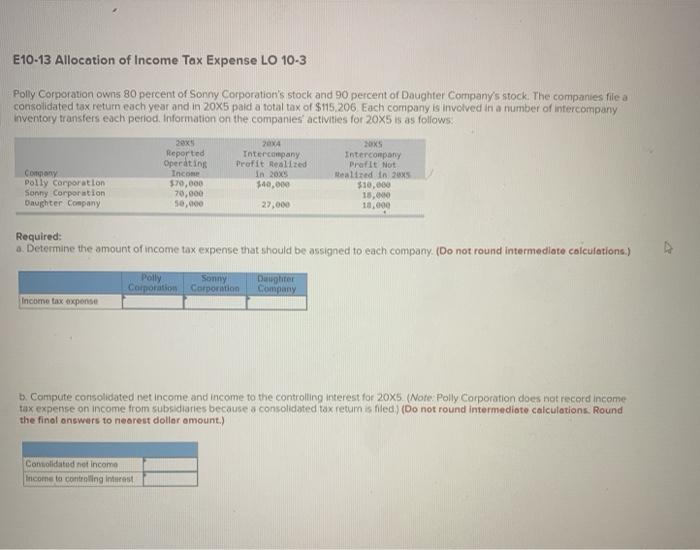

E10-13 Allocation of Income Tax Expense LO 10-3 Polly Corporation owns 80 percent of Sonny Corporation's stock and 90 percent of Daughter Company's stock. The companies file a consolidated tax return each year and in 20x5 paid a total tax of $115,206 Each company is involved in a number of intercompany Inventory transfers each period. Information on the companies' activities for 20x5 is as follows 20 204 205 Reported Intercompany Intercompany Operating Profit Realized Profit Not Conny Income In 20x5 Realized in 2005 Polly Corporation $70,000 140,000 $10.000 Sonny Corporation 70,000 15.00 Daughter Company 50,000 27,000 10,000 Required: a. Determine the amount of income tax expense that should be assigned to each company. (Do not round intermediate calculations.) Polly Sonny Corporation Corporation Dawiter Company Income tax exponse b. Compute consolidated net income and income to the controlling interest for 20x5 (Note Polly Corporation does not record income tax expense on income from subsidiaries because a consolidated tax return is filed) (Do not round intermediate calculations. Round the final answers to nearest dollar amount.) Consolidated not income Income to controlling interest E10-13 Allocation of Income Tax Expense LO 10-3 Polly Corporation owns 80 percent of Sonny Corporation's stock and 90 percent of Daughter Company's stock. The companies file a consolidated tax return each year and in 20x5 paid a total tax of $115,206 Each company is involved in a number of intercompany Inventory transfers each period. Information on the companies' activities for 20x5 is as follows 20 204 205 Reported Intercompany Intercompany Operating Profit Realized Profit Not Conny Income In 20x5 Realized in 2005 Polly Corporation $70,000 140,000 $10.000 Sonny Corporation 70,000 15.00 Daughter Company 50,000 27,000 10,000 Required: a. Determine the amount of income tax expense that should be assigned to each company. (Do not round intermediate calculations.) Polly Sonny Corporation Corporation Dawiter Company Income tax exponse b. Compute consolidated net income and income to the controlling interest for 20x5 (Note Polly Corporation does not record income tax expense on income from subsidiaries because a consolidated tax return is filed) (Do not round intermediate calculations. Round the final answers to nearest dollar amount.) Consolidated not income Income to controlling interest