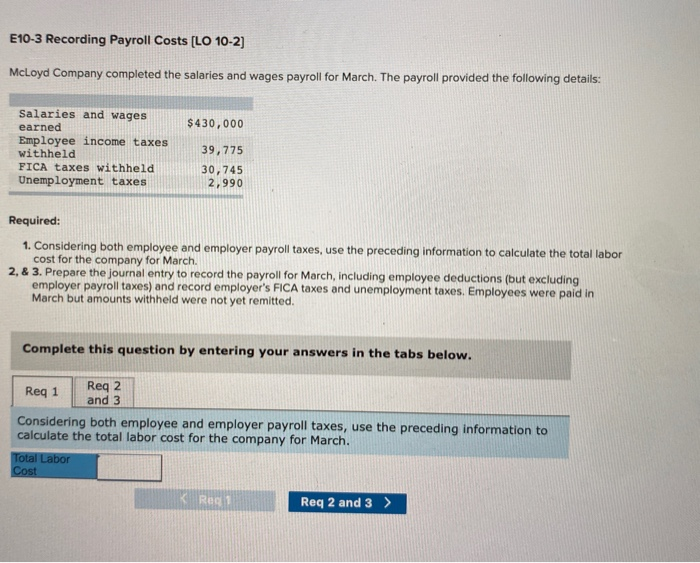

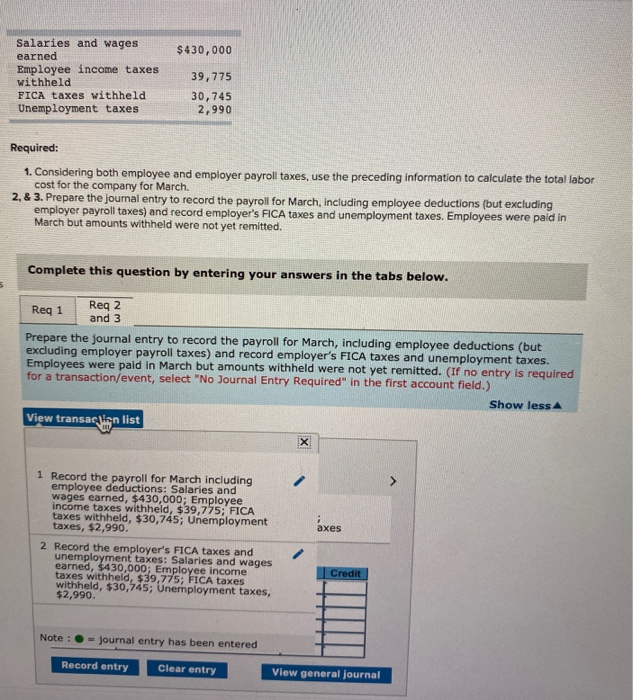

E10-3 Recording Payroll Costs [LO 10-2] McLoyd Company completed the salaries and wages payroll for March. The payroll provided the following details: $430,000 Salaries and wages earned Employee income taxes withheld FICA taxes withheld Unemployment taxes 39,775 30,745 2,990 Required: 1. Considering both employee and employer payroll taxes, use the preceding information to calculate the total labor cost for the company for March 2. & 3. Prepare the journal entry to record the payroll for March, including employee deductions (but excluding employer payroll taxes) and record employer's FICA taxes and unemployment taxes. Employees were paid in March but amounts withheld were not yet remitted. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Considering both employee and employer payroll taxes, use the preceding information to calculate the total labor cost for the company for March. Total Labor Cost POD Req 2 and 3 > $430,000 Salaries and wages earned Employee income taxes withheld FICA taxes withheld Unemployment taxes 39,775 30,745 2,990 Required: 1. Considering both employee and employer payroll taxes, use the preceding information to calculate the total labor cost for the company for March 2. & 3. Prepare the journal entry to record the payroll for March, including employee deductions (but excluding employer payroll taxes) and record employer's FICA taxes and unemployment taxes. Employees were paid in March but amounts withheld were not yet remitted. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Prepare the journal entry to record the payroll for March, including employee deductions (but excluding employer payroll taxes) and record employer's FICA taxes and unemployment taxes. Employees were paid in March but amounts withheld were not yet remitted. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Show less View transaclian list 1 Record the payroll for March including employee deductions: Salaries and wages earned, $430,000; Employee income taxes withheld, $39,775; FICA taxes withheld, $30,745; Unemployment taxes, $2,990. axes 2 Record the employer's FICA taxes and unemployment taxes: Salaries and wages earned, $430,000; Employee income taxes withheld, $39,775; FICA taxes withheld, $30,745; Unemployment taxes, $2,990. Credit Note : - journal entry has been entered Record entry Clear entry View general Journal