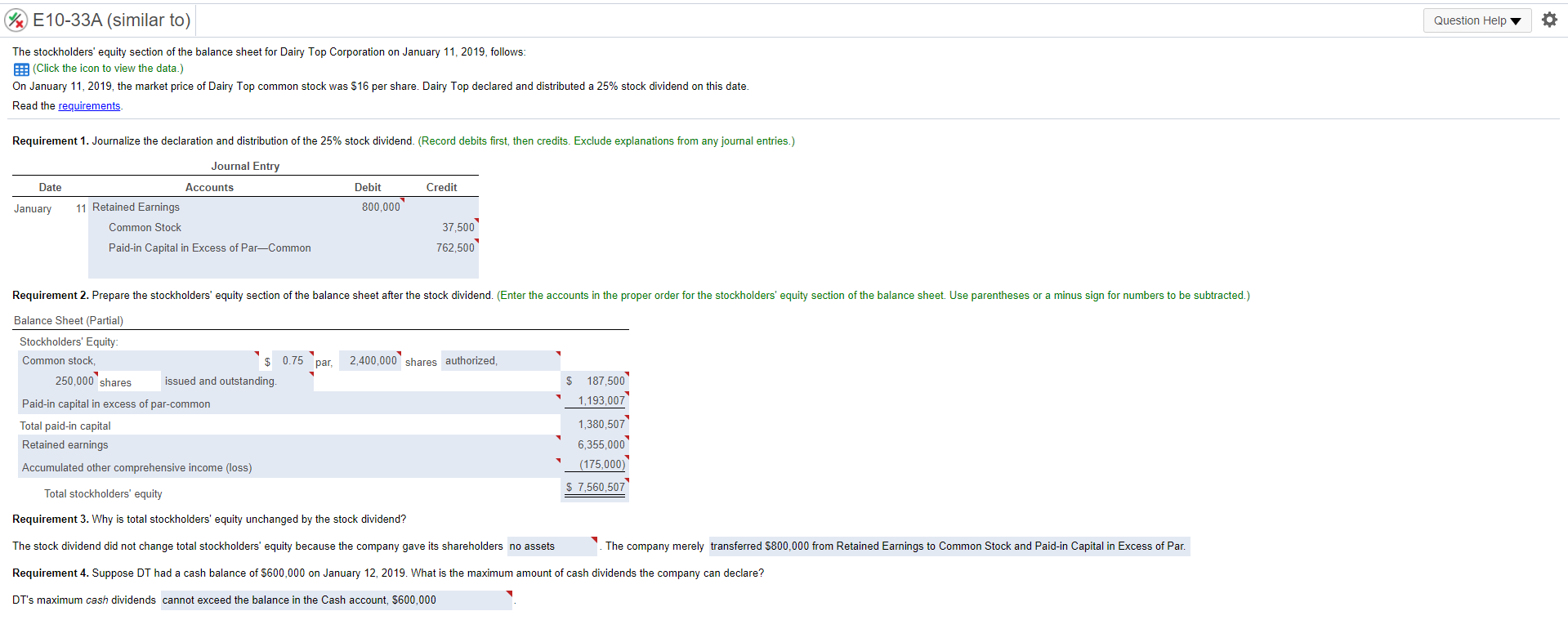

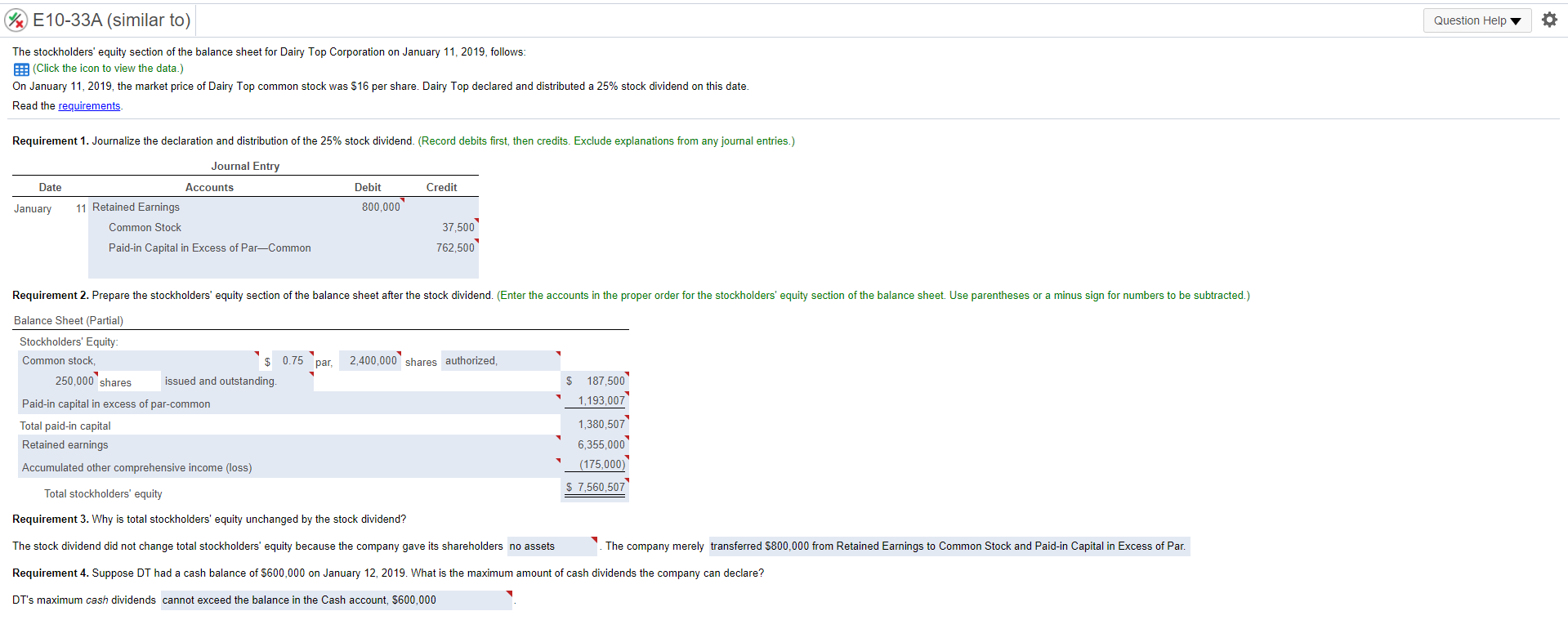

%E10-33A (similar to) Question Help The stockholders' equity section of the balance sheet for Dairy Top Corporation on January 11, 2019, follows: (Click the icon to view the data.) On January 11, 2019, the market price of Dairy Top common stock was $16 per share. Dairy Top declared and distributed a 25% stock dividend on this date. Read the requirements Requirement 1. Journalize the declaration and distribution of the 25% stock dividend. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Date Accounts Debit Credit January 800,000 11 Retained Earnings Common Stock Paid-in Capital in Excess of ParCommon 37,500 762.500 Requirement 2. Prepare the stockholders' equity section of the balance sheet after the stock dividend. (Enter the accounts in the proper order for the stockholders' equity section of the balance sheet. Use parentheses or a minus sign for numbers to be subtracted.) Balance Sheet (Partial) Stockholders' Equity Common stock, 2,400,000 shares authorized, $ 0.75 par issued and outstanding. 250,000 shares 187,500 1,193,007 Paid-in capital in excess of par-common Total paid-in capital Retained earnings Accumulated other comprehensive income (loss) 1,380,507 6,355,000 (175,000) $ 7,560,507 Total stockholders' equity Requirement 3. Why is total stockholders' equity unchanged by the stock dividend? The stock dividend did not change total stockholders' equity because the company gave its shareholders no assets . The company merely transferred $800,000 from Retained Earnings to Common Stock and Paid-in Capital in Excess of Par. Requirement 4. Suppose DT had cash balance of $600,000 on January 12, 2019. What is the maximum amount of cash dividends the company can declare? DT's maximum cash dividends cannot exceed the balance in the Cash account, $600,000 %E10-33A (similar to) Question Help The stockholders' equity section of the balance sheet for Dairy Top Corporation on January 11, 2019, follows: (Click the icon to view the data.) On January 11, 2019, the market price of Dairy Top common stock was $16 per share. Dairy Top declared and distributed a 25% stock dividend on this date. Read the requirements Requirement 1. Journalize the declaration and distribution of the 25% stock dividend. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Date Accounts Debit Credit January 800,000 11 Retained Earnings Common Stock Paid-in Capital in Excess of ParCommon 37,500 762.500 Requirement 2. Prepare the stockholders' equity section of the balance sheet after the stock dividend. (Enter the accounts in the proper order for the stockholders' equity section of the balance sheet. Use parentheses or a minus sign for numbers to be subtracted.) Balance Sheet (Partial) Stockholders' Equity Common stock, 2,400,000 shares authorized, $ 0.75 par issued and outstanding. 250,000 shares 187,500 1,193,007 Paid-in capital in excess of par-common Total paid-in capital Retained earnings Accumulated other comprehensive income (loss) 1,380,507 6,355,000 (175,000) $ 7,560,507 Total stockholders' equity Requirement 3. Why is total stockholders' equity unchanged by the stock dividend? The stock dividend did not change total stockholders' equity because the company gave its shareholders no assets . The company merely transferred $800,000 from Retained Earnings to Common Stock and Paid-in Capital in Excess of Par. Requirement 4. Suppose DT had cash balance of $600,000 on January 12, 2019. What is the maximum amount of cash dividends the company can declare? DT's maximum cash dividends cannot exceed the balance in the Cash account, $600,000