Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The stockholders' equity section of the balance sheet for Dairy Place Corporation on January 12, 2019, follows: E (Click the icon to view the

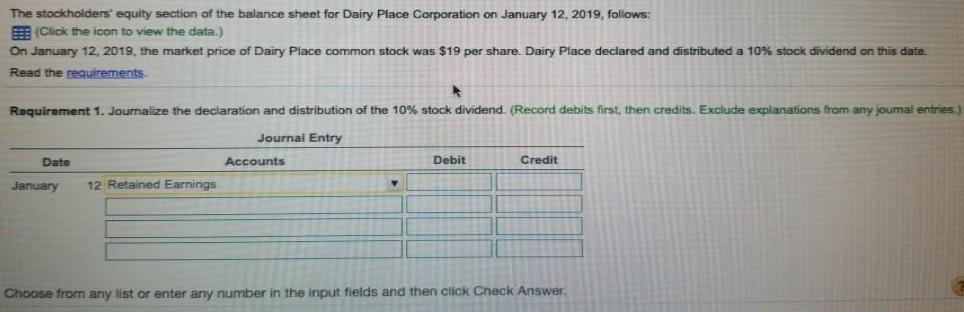

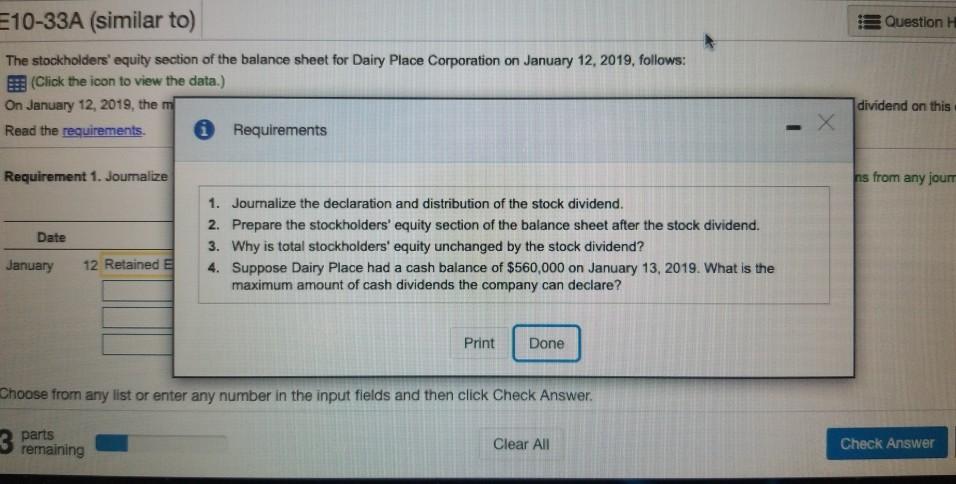

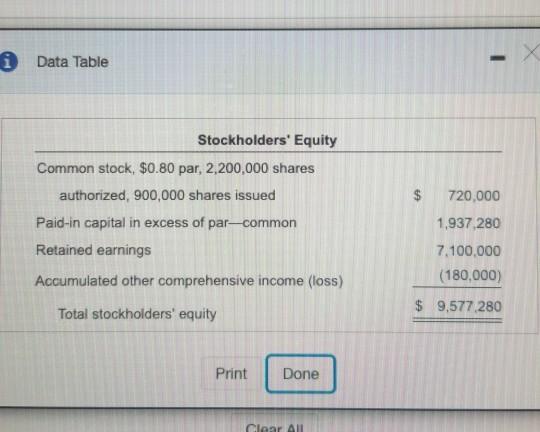

The stockholders' equity section of the balance sheet for Dairy Place Corporation on January 12, 2019, follows: E (Click the icon to view the data.) On January 12, 2019, the market price of Dairy Place common stock was $19 per share. Dairy Place declared and distributed a 10% stock dividend on this date. Read the requirements Requirement 1. Jounalize the deciaration and distribution of the 10% stock dividend. (Record debits first, then credits. Exclude expianations from any jourmal entries.) Journal Entry Date Accounts Debit Credit January 12 Retained Earnings Choose from any list or enter any number in the input fields and then click Check Answer. E10-33A (similar to) Question H The stockholders' equity section of the balance sheet for Dairy Place Corporation on January 12, 2019, follows: E (Click the icon to view the data.) On January 12, 2019, the m dividend on this Read the requirements. Requirements Requirement 1. Joumalize ns from any jourm 1. Journalize the declaration and distribution of the stock dividend. 2. Prepare the stockholders' equity section of the balance sheet after the stock dividend. 3. Why is total stockholders' equity unchanged by the stock dividend? Date January 12 Retained E 4. Suppose Dairy Place had a cash balance of $560,000 on January 13, 2019. What is the maximum amount of cash dividends the company can declare? Print Done Choose from any list or enter any number in the input fields and then click Check Answer. 3 parts remaining Clear All Check Answer i Data Table Stockholders' Equity Common stock, $0.80 par, 2,200,000 shares authorized, 900,000 shares issued 720,000 Paid-in capital in excess of par-common 1,937,280 Retained earnings 7,100,000 Accumulated other comprehensive income (loss) (180,000) $ 9,577 280 Total stockholders' equity Print Done Clear All %24

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Requiremnt 1 Dairy Place Corporation Date Accoutn Tittle Debit Credit 12Jan Retained Earning 900000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started