Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John Little who is single is a new client of yours that has come to you with several tax issues with which he needs

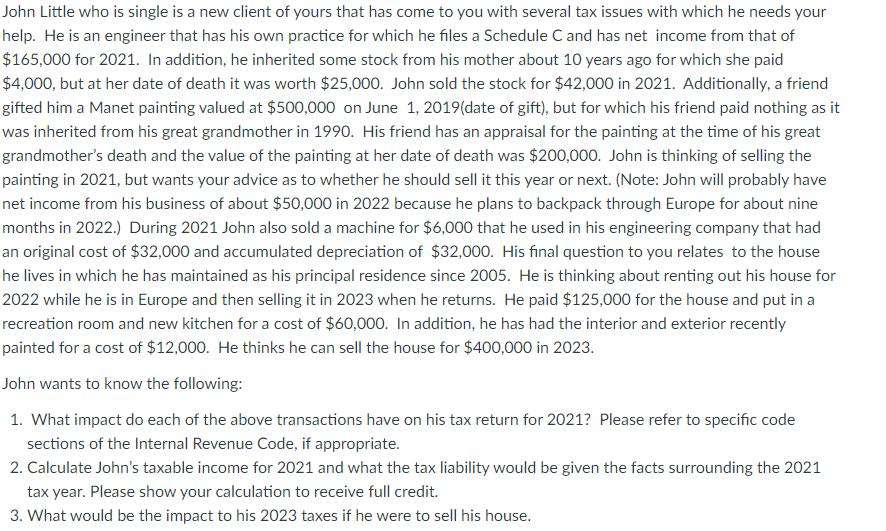

John Little who is single is a new client of yours that has come to you with several tax issues with which he needs your help. He is an engineer that has his own practice for which he files a Schedule C and has net income from that of $165,000 for 2021. In addition, he inherited some stock from his mother about 10 years ago for which she paid $4,000, but at her date of death it was worth $25,000. John sold the stock for $42,000 in 2021. Additionally, a friend gifted him a Manet painting valued at $500,000 on June 1, 2019 (date of gift), but for which his friend paid nothing as it was inherited from his great grandmother in 1990. His friend has an appraisal for the painting at the time of his great grandmother's death and the value of the painting at her date of death was $200,000. John is thinking of selling the painting in 2021, but wants your advice as to whether he should sell it this year or next. (Note: John will probably have net income from his business of about $50,000 in 2022 because he plans to backpack through Europe for about nine months in 2022.) During 2021 John also sold a machine for $6,000 that he used in his engineering company that had an original cost of $32,000 and accumulated depreciation of $32,000. His final question to you relates to the house he lives in which he has maintained as his principal residence since 2005. He is thinking about renting out his house for 2022 while he is in Europe and then selling it in 2023 when he returns. He paid $125,000 for the house and put in a recreation room and new kitchen for a cost of $60,000. In addition, he has had the interior and exterior recently painted for a cost of $12,000. He thinks he can sell the house for $400,000 in 2023. John wants to know the following: 1. What impact do each of the above transactions have on his tax return for 2021? Please refer to specific code sections of the Internal Revenue Code, if appropriate. 2. Calculate John's taxable income for 2021 and what the tax liability would be given the facts surrounding the 2021 tax year. Please show your calculation to receive full credit. 3. What would be the impact to his 2023 taxes if he were to sell his house.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer to question 1 a Impact of transactions on tax return 2021 b Answer to question b Scheule C In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started