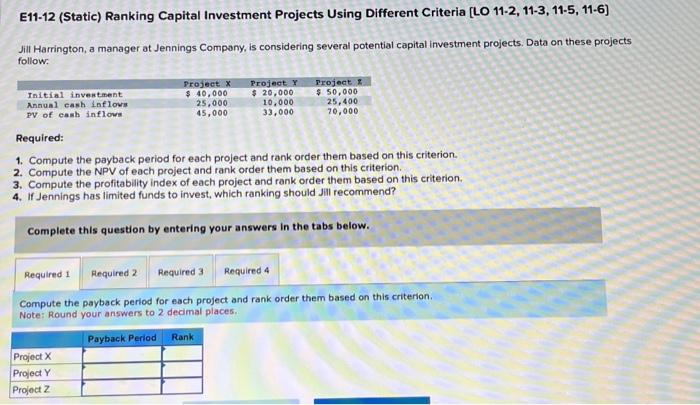

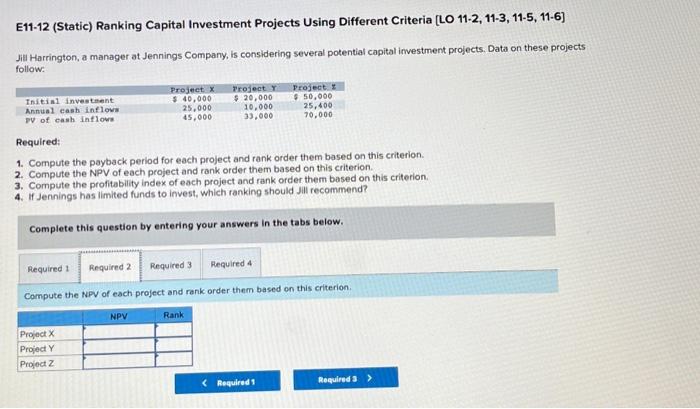

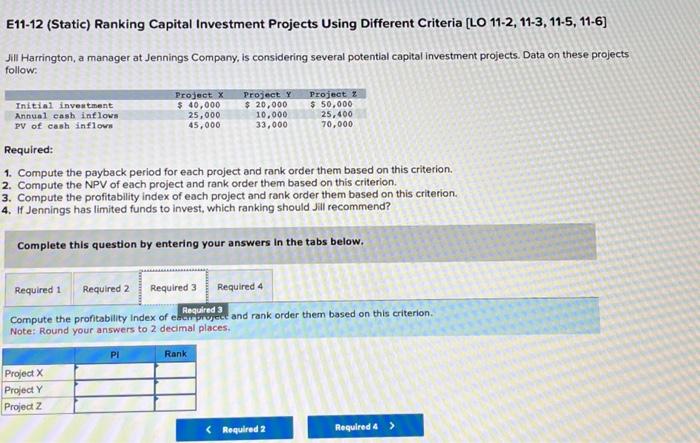

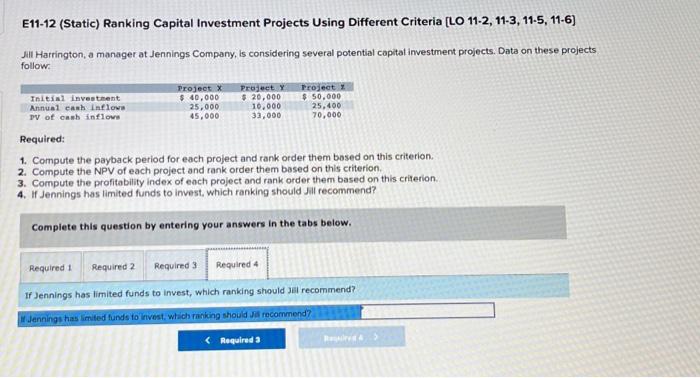

E11-12 (Static) Ranking Capital Investment Projects Using Different Criteria [LO 11-2, 11-3, 11-5, 11-6] Jill Harrington, a manager at Jennings Company, is considering several potential capital investment projects. Data on these projects follow: Required: 1. Compute the payback period for each project and rank order them based on this criterion. 2. Compute the NPV of each project and rank order them based on this criterion. 3. Compute the profitability index of each project and rank order them based on this criterion. 4. If Jernings has limited funds to invest, which ranking should Jill recommend? Complete this question by entering your answers in the tabs below. Compute the NPV of each project and rank order them based on this criterion. E11-12 (Static) Ranking Capital Investment Projects Using Different Criteria [LO 11-2, 11-3, 11-5, 11-6] Jill Harrington, a manager at Jennings Company, is considering several potential capitat investment projects. Data on these projects follow: Required: 1. Compute the payback period for each project and rank order them bosed on this criterion. 2. Compute the NPV of each project and rank order them based on this criterion. 3. Compute the profitability index of each project and rank order them based on this criterion. 4. If Jennings has limited funds to invest, which ranking should Jill recommend? Complete this question by entering your answers in the tabs below. If Jennings has limited funds to invest, which ranking should Jil recommend? II Jennings has limited funds to irvest, which rasking should Jff recornmend? E11-12 (Static) Ranking Capital Investment Projects Using Different Criteria [LO 11-2, 11-3, 11-5, 11-6] Jill Harrington, a manager at Jennings Company, is considering several potential capital investment projects. Data on these projects follow: Required: 1. Compute the payback period for each project and rank order them based on this criterion. 2. Compute the NPV of each project and rank order them based on this criterion. 3. Compute the profitability index of each project and rank order them based on this criterion. 4. If Jennings has limited funds to invest, which ranking should Jill recommend? Complete this question by entering your answers in the tabs below. Compute the payback period for each project and rank order them based on this criterion. Note: Round your answers to 2 decimal places. E11-12 (Static) Ranking Capital Investment Projects Using Different Criteria [LO 11-2, 11-3, 11-5, 11-6] Jill Harrington, a manager at Jennings Company, is considering several potential capital investment projects. Data on these projects follow: Required: 1. Compute the payback period for each project and rank order them based on this criterion. 2. Compute the NPV of each project and rank order them based on this criterion. 3. Compute the profitability index of each project and rank order them based on this criterion. 4. If Jennings has limited funds to invest, which ranking should Jill recommend? Complete this question by entering your answers in the tabs below. Compute the profitability index of eatopirted 3 and rank order them based on this criterion. Note: Round your answers to 2 decimal places