Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E11-17 Determining the Effect of a Stock Repurchase on EPS and ROE E11-17 (Algo) Determining the Effect of a Stock Repurchase on EPS and ROE

E11-17 Determining the Effect of a Stock Repurchase on EPS and ROE

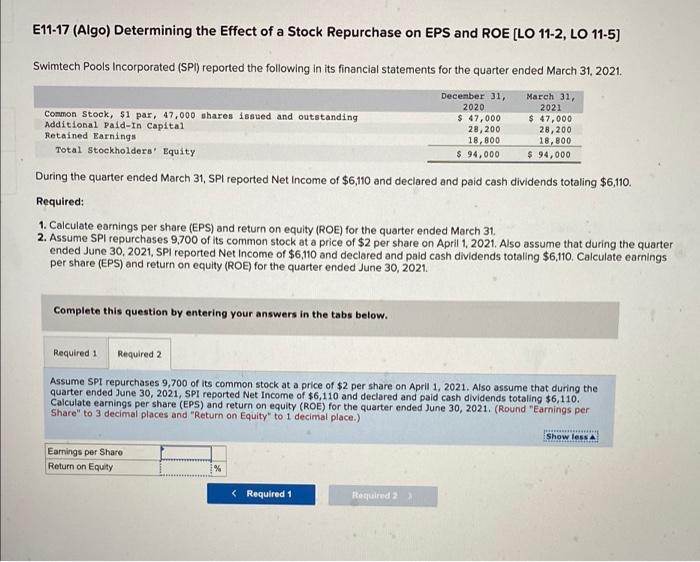

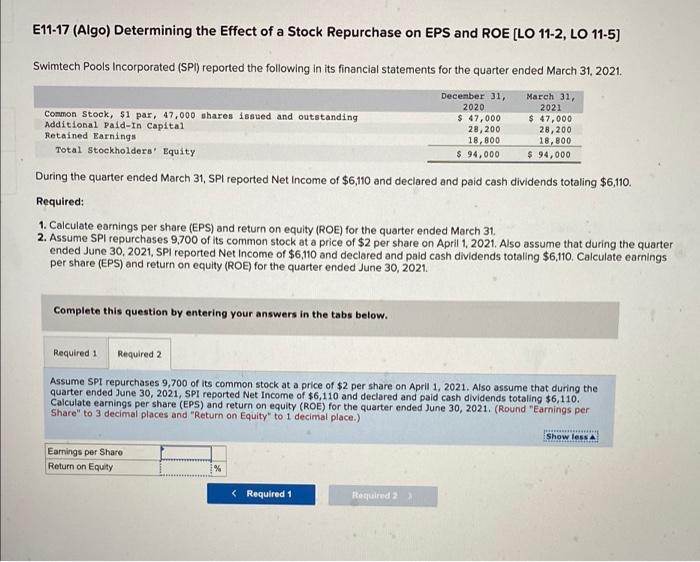

E11-17 (Algo) Determining the Effect of a Stock Repurchase on EPS and ROE [LO 11-2, LO 11-5] Swimtech Pools Incorporated (SPI) reported the following in its financial statements for the quarter ended March 31, 2021. Common Stock, $1 par, 47,000 shares issued and outstanding December 31, 2020 $ 47,000 28,200 18,800 March 31, 2021 $ 47,000 28,200 18,800 Additional Paid-In Capital Retained Earnings Total Stockholders' Equity $ 94,000 $ 94,000 During the quarter ended March 31, SPI reported Net Income of $6,110 and declared and paid cash dividends totaling $6,110. Required: 1. Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended March 31. 2. Assume SPI repurchases 9,700 of its common stock at a price of $2 per share on April 1, 2021. Also assume that during the quarter ended June 30, 2021, SPI reported Net Income of $6,110 and declared and paid cash dividends totaling $6,110. Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended June 30, 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume SPI repurchases 9,700 of its common stock at a price of $2 per share on April 1, 2021. Also assume that during the quarter ended June 30, 2021, SPI reported Net Income of $6,110 and declared and paid cash dividends totaling $6,110. Calculate earnings per share (EPS) and return on equity (ROE) for the quarter ended June 30, 2021. (Round "Earnings per Share" to 3 decimal places and "Return on Equity" to 1 decimal place.) HARVE Show less A Earnings per Share Return on Equity %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started