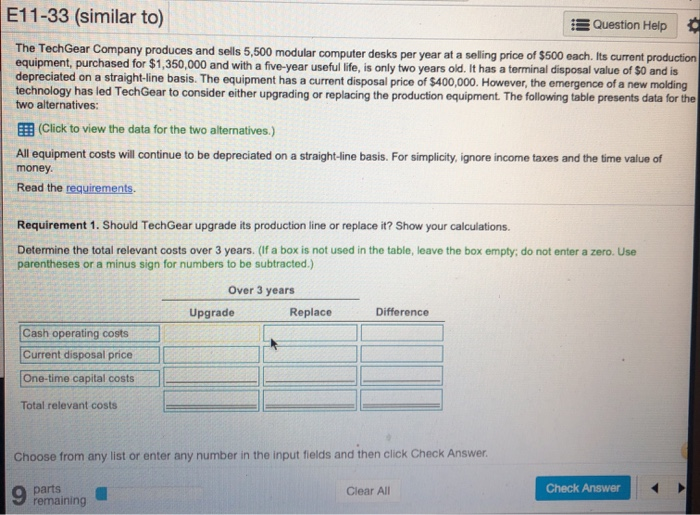

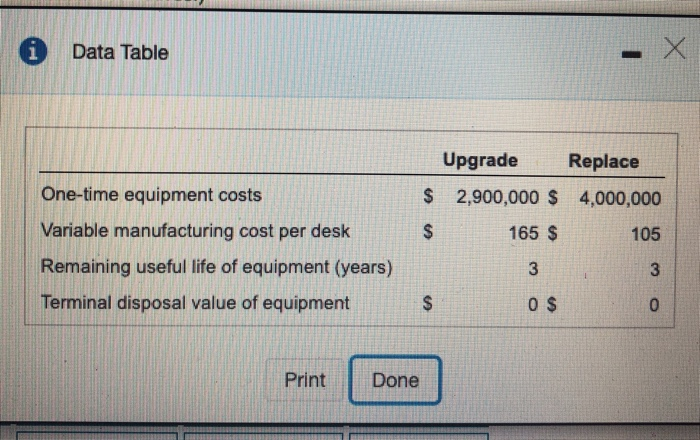

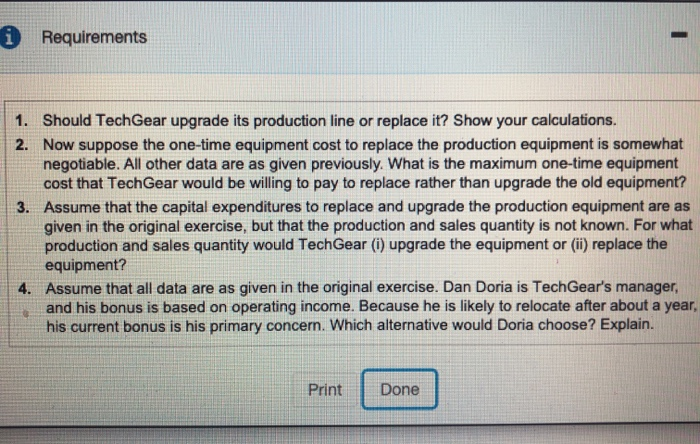

E11-33 (similar to) Question Help The TechGear Company produces and sells 5,500 modular computer desks per year at a selling price of $500 each. Its current production equipment, purchased for $1,350,000 and with a five-year useful life. is only two years old. It has a terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price of $400,000. However, the emergence of a new molding technology has led TechGear to consider either upgrading or replacing the production equipment. The following table presents data for the two alternatives: (Click to view the data for the two alternatives.) All equipment costs will continue to be depreciated on a straight-line basis. For simplicity, ignore income taxes and the time value of money. Read the requirements. Requirement 1. Should TechGear upgrade its production line or replace it? Show your calculations. Determine the total relevant costs over 3 years. (If a box is not used in the table, leave the box empty: do not enter a zero. Use parentheses or a minus sign for numbers to be subtracted.) Over 3 years Upgrade Replace Difference Cash operating costs Current disposal price AS One-time capital costs Total relevant costs Choose from any list or enter any number in the input fields and then click Check Answer. Check Answer O Clear All parts remaining i Data Table Upgrade Replace $ 2,900,000 $ 4,000,000 $ 165 $ 105 One-time equipment costs Variable manufacturing cost per desk Remaining useful life of equipment (years) Terminal disposal value of equipment 0 $ Print Done i Requirements 1. Should TechGear upgrade its production line or replace it? Show your calculations. 2. Now suppose the one-time equipment cost to replace the production equipment is somewhat negotiable. All other data are as given previously. What is the maximum one-time equipment cost that TechGear would be willing to pay to replace rather than upgrade the old equipment? 3. Assume that the capital expenditures to replace and upgrade the production equipment are as given in the original exercise, but that the production and sales quantity is not known. For what production and sales quantity would TechGear (i) upgrade the equipment or (ii) replace the equipment? Assume that all data are as given in the original exercise. Dan Doria is TechGear's manager, and his bonus is based on operating income. Because he is likely to relocate after about a year, his current bonus is his primary concern. Which alternative would Doria choose? Explain. Print Done