Answered step by step

Verified Expert Solution

Question

1 Approved Answer

E11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Linda's Luxury Travel

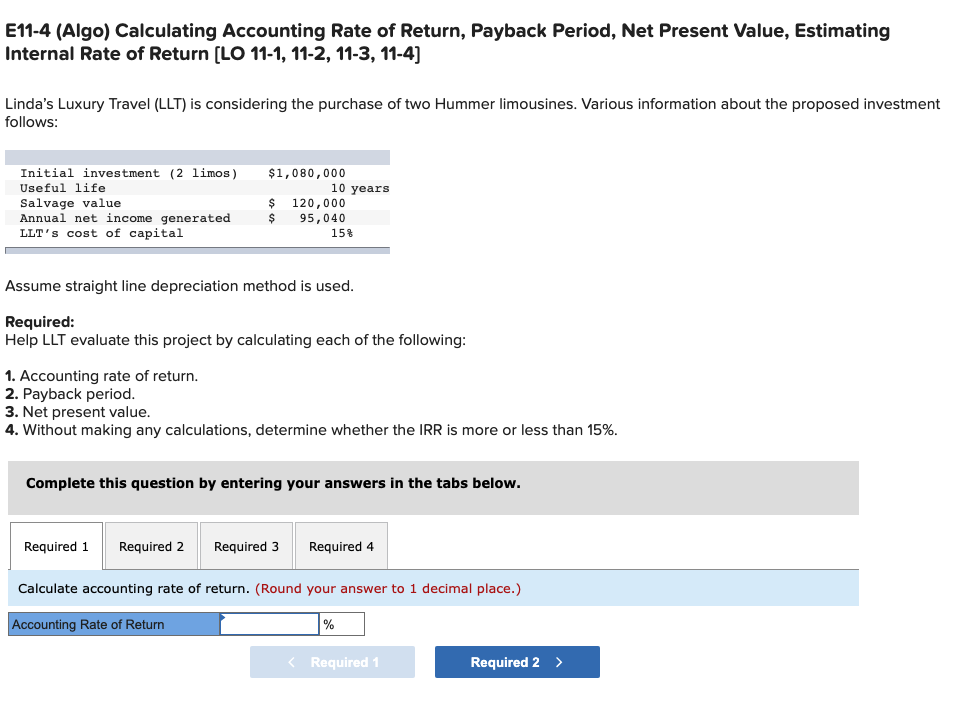

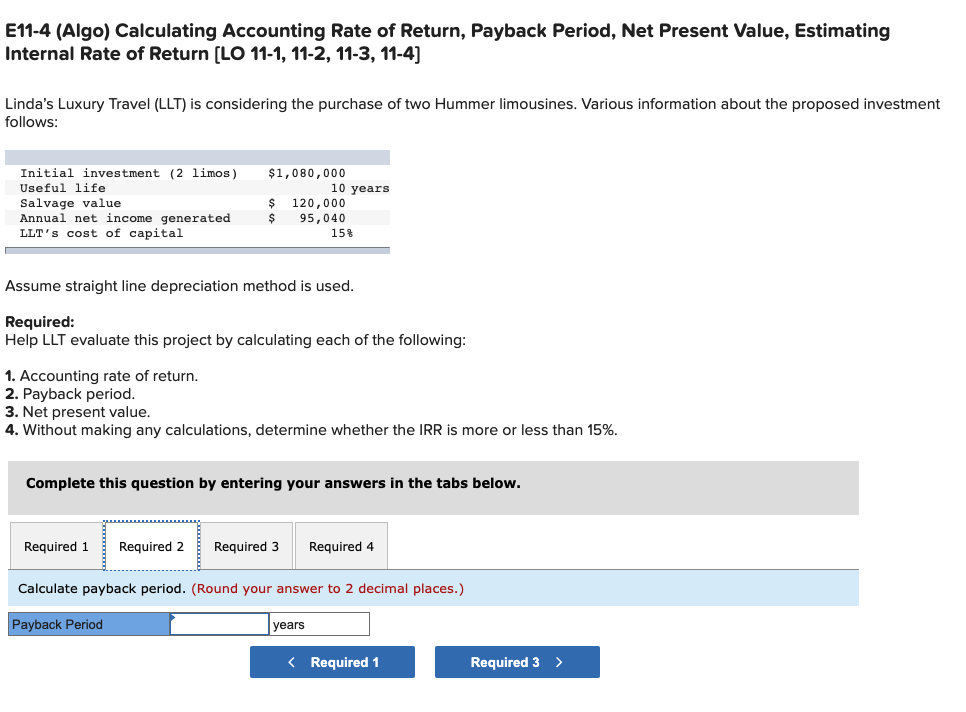

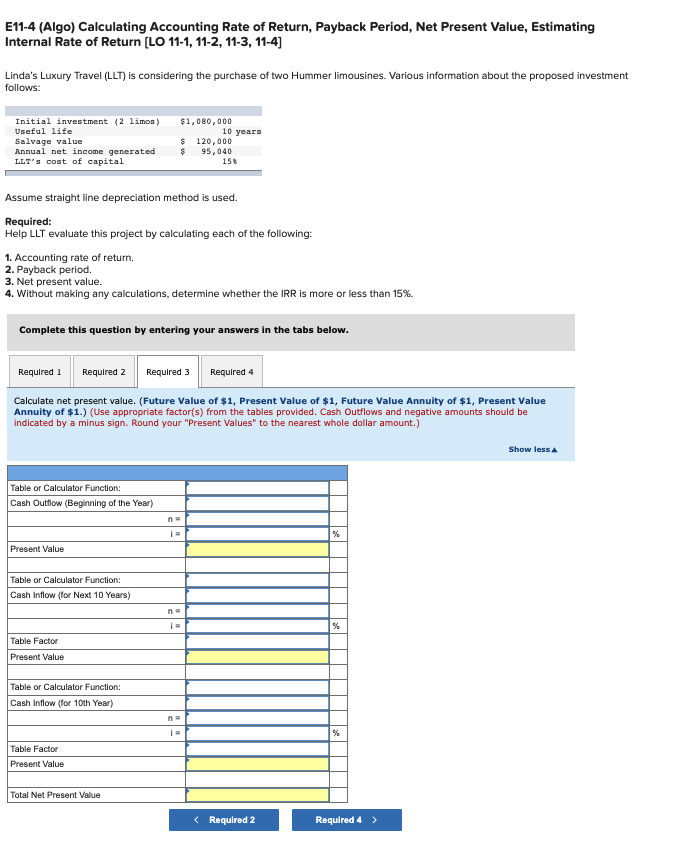

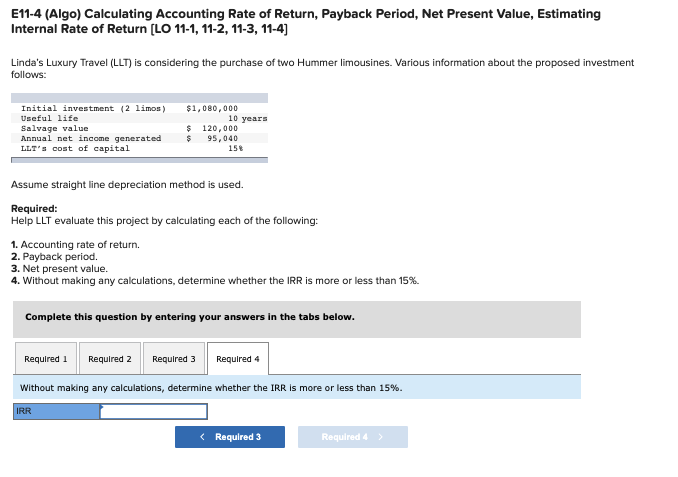

E11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Linda's Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investme follows: Assume straight line depreciation method is used. Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. 4. Without making any calculations, determine whether the IRR is more or less than 15%. Complete this question by entering your answers in the tabs below. Calculate accounting rate of return. (Round your answer to 1 decimal place.) E11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Linda's Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investme follows: Assume straight line depreciation method is used. Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. 4. Without making any calculations, determine whether the IRR is more or less than 15%. Complete this question by entering your answers in the tabs below. Calculate payback period. (Round your answer to 2 decimal places.) E11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Linda's Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Assume straight line depreciation method is used. Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. 4. Without making any calculations, determine whether the IRR is more or less than 15%. Complete this question by entering your answers in the tabs below. Calculate net present value. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Cash Outflows and negative amounts should be indicated by a minus sign. Round your "Present Values" to the nearest whole dollar amount.) E11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Linda's Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investmer follows: Assume straight line depreciation method is used. Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. 4. Without making any calculations, determine whether the IRR is more or less than 15%. Complete this question by entering your answers in the tabs below. Without making any calculations, determine whether the IRR is more or less than 15%

E11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Linda's Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investme follows: Assume straight line depreciation method is used. Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. 4. Without making any calculations, determine whether the IRR is more or less than 15%. Complete this question by entering your answers in the tabs below. Calculate accounting rate of return. (Round your answer to 1 decimal place.) E11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Linda's Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investme follows: Assume straight line depreciation method is used. Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. 4. Without making any calculations, determine whether the IRR is more or less than 15%. Complete this question by entering your answers in the tabs below. Calculate payback period. (Round your answer to 2 decimal places.) E11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Linda's Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Assume straight line depreciation method is used. Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. 4. Without making any calculations, determine whether the IRR is more or less than 15%. Complete this question by entering your answers in the tabs below. Calculate net present value. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Cash Outflows and negative amounts should be indicated by a minus sign. Round your "Present Values" to the nearest whole dollar amount.) E11-4 (Algo) Calculating Accounting Rate of Return, Payback Period, Net Present Value, Estimating Internal Rate of Return [LO 11-1, 11-2, 11-3, 11-4] Linda's Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investmer follows: Assume straight line depreciation method is used. Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. 4. Without making any calculations, determine whether the IRR is more or less than 15%. Complete this question by entering your answers in the tabs below. Without making any calculations, determine whether the IRR is more or less than 15%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started